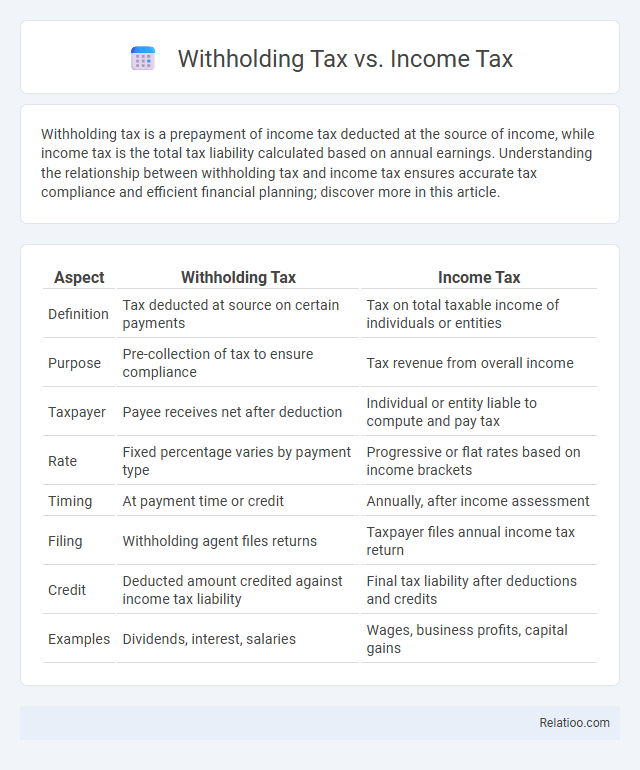

Withholding tax is a prepayment of income tax deducted at the source of income, while income tax is the total tax liability calculated based on annual earnings. Understanding the relationship between withholding tax and income tax ensures accurate tax compliance and efficient financial planning; discover more in this article.

Table of Comparison

| Aspect | Withholding Tax | Income Tax |

|---|---|---|

| Definition | Tax deducted at source on certain payments | Tax on total taxable income of individuals or entities |

| Purpose | Pre-collection of tax to ensure compliance | Tax revenue from overall income |

| Taxpayer | Payee receives net after deduction | Individual or entity liable to compute and pay tax |

| Rate | Fixed percentage varies by payment type | Progressive or flat rates based on income brackets |

| Timing | At payment time or credit | Annually, after income assessment |

| Filing | Withholding agent files returns | Taxpayer files annual income tax return |

| Credit | Deducted amount credited against income tax liability | Final tax liability after deductions and credits |

| Examples | Dividends, interest, salaries | Wages, business profits, capital gains |

Introduction to Withholding Tax and Income Tax

Withholding tax is a government-mandated deduction from an employee's paycheck, collected at the source to prepay income tax obligations and ensure steady revenue flow. Income tax is the total tax levied on an individual's or entity's earnings, assessed annually based on total income, including wages, dividends, and business profits. Withholding simplifies tax compliance by legally requiring employers or payers to deduct and remit taxes directly to tax authorities, reducing the risk of underpayment.

Definition of Withholding Tax

Withholding tax is a government-required deduction from an employee's salary or certain payments made to non-residents, collected at the source before the income reaches the recipient. Income tax is the total tax imposed on an individual's or entity's earnings, calculated annually based on gross income after deductions and credits. Withholding refers broadly to the act of deducting tax or other amounts at the point of payment, ensuring compliance and timely tax collection.

Definition of Income Tax

Income tax is a mandatory financial charge imposed by governments on individuals and entities based on their earnings, including wages, salaries, and business profits. Withholding tax refers to the portion of income tax withheld at the source by employers or payers before the income reaches the recipient, ensuring timely tax collection. While withholding is the method of tax deduction, income tax represents the actual liability calculated on total income earned within a tax period.

Key Differences Between Withholding Tax and Income Tax

Withholding tax is a prepayment collected at the source of income, typically by employers or financial institutions, to ensure timely tax collection, whereas income tax is the actual tax liability calculated on the taxpayer's total earnings during the fiscal year. Key differences include the timing of payment-- with withholding tax being deducted upfront and income tax being settled after filing returns-- and the obligation for employers to remit withholding taxes on behalf of employees while individuals directly pay income tax based on their tax brackets. Withholding tax serves as a mechanism to prevent tax evasion through advance collection, whereas income tax determines the final amount owed or refunded after accounting for all deductions and credits.

How Withholding Tax Works

Withholding tax is a mechanism where a portion of your income is deducted at the source by the payer before you receive the payment, ensuring tax compliance and helping to prevent tax evasion. This tax is typically applied to wages, dividends, interest, and royalties, and is credited against your total income tax liability when you file your return. Unlike general income tax, which is calculated on your total annual earnings, withholding tax provides an advance payment system to streamline tax collection.

How Income Tax Is Calculated

Income tax is calculated based on your taxable income, which includes wages, salaries, and other earnings minus allowable deductions and exemptions. Withholding tax is a prepayment of income tax that is automatically deducted from your paycheck or payments to ensure you meet your tax obligations throughout the year. While withholding is a method of collecting income tax, income tax itself is the actual amount owed to the government after considering your total taxable income and applicable tax rates.

Applicability: Who Pays Withholding Tax vs. Income Tax

Withholding tax applies primarily to payments made to non-resident individuals or entities, where the payer deducts tax at the source before remitting the remainder to the payee, targeting cross-border transactions and specific income types like dividends or royalties. Income tax is paid directly by individuals or businesses on their total taxable income, including earnings from employment, self-employment, or investments, and is usually filed annually with tax authorities. Understanding the difference helps you manage your tax obligations efficiently, ensuring proper compliance whether you are the payer responsible for withholding or the recipient liable for income tax payments.

Impact on Individuals and Businesses

Withholding tax directly affects cash flow for both individuals and businesses by pre-collecting tax on wages or payments, reducing immediate income but easing annual tax liabilities. Income tax imposes a broader financial obligation based on total earnings, influencing financial planning and compliance responsibilities for taxpayers. Distinguishing withholding from income tax is crucial for accurate tax filing and optimizing tax management strategies, minimizing penalties and maximizing refunds.

Reporting and Compliance Requirements

Withholding tax requires employers to deduct a portion of an employee's income at the source and remit it to the tax authorities, ensuring real-time compliance with tax laws. Income tax is the total tax liability you owe based on annual earnings, which must be reported accurately on your tax return, reflecting all income sources and deductions. Withholding focuses on timely reporting and remittance obligations, while income tax demands comprehensive annual filings and potential additional payments or refunds based on the difference between withheld amounts and actual tax owed.

Conclusion: Choosing the Right Tax Approach

Selecting the appropriate tax approach depends on the specific financial context and regulatory requirements governing income and payments. Withholding tax ensures pre-collection on certain payments, reducing the risk of tax evasion, whereas income tax represents the comprehensive tax liability assessed on total earnings. Understanding the distinctions between withholding tax mechanisms and overall income tax obligations enables more efficient tax planning and compliance.

Infographic: Withholding Tax vs Income Tax

relatioo.com

relatioo.com