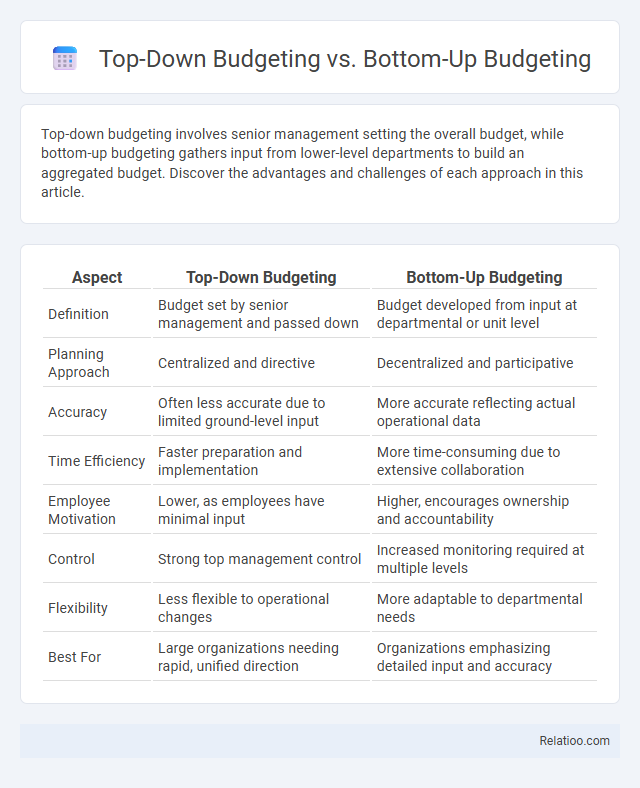

Top-down budgeting involves senior management setting the overall budget, while bottom-up budgeting gathers input from lower-level departments to build an aggregated budget. Discover the advantages and challenges of each approach in this article.

Table of Comparison

| Aspect | Top-Down Budgeting | Bottom-Up Budgeting |

|---|---|---|

| Definition | Budget set by senior management and passed down | Budget developed from input at departmental or unit level |

| Planning Approach | Centralized and directive | Decentralized and participative |

| Accuracy | Often less accurate due to limited ground-level input | More accurate reflecting actual operational data |

| Time Efficiency | Faster preparation and implementation | More time-consuming due to extensive collaboration |

| Employee Motivation | Lower, as employees have minimal input | Higher, encourages ownership and accountability |

| Control | Strong top management control | Increased monitoring required at multiple levels |

| Flexibility | Less flexible to operational changes | More adaptable to departmental needs |

| Best For | Large organizations needing rapid, unified direction | Organizations emphasizing detailed input and accuracy |

Introduction to Budgeting Approaches

Top-down budgeting involves senior management setting overall budget targets, which are then allocated to departments, ensuring alignment with strategic goals and streamlined decision-making. Bottom-up budgeting requires individual departments or units to create their own budgets based on detailed operational needs, fostering accuracy and employee engagement in resource planning. Choosing between these approaches depends on organizational structure, culture, and the need for either centralized control or detailed input from operational levels.

What is Top-Down Budgeting?

Top-Down Budgeting is a financial planning approach where senior management sets the overall budget targets and allocates resources to various departments. This method emphasizes strategic alignment and quicker decision-making by providing clear financial constraints from the top. It contrasts with Bottom-Up Budgeting, where individual departments propose budgets that are then consolidated and approved by management.

What is Bottom-Up Budgeting?

Bottom-Up Budgeting is a financial planning approach where individual departments or units create their own budget estimates, which are then aggregated to form the overall organizational budget. This method encourages participation and accuracy as it reflects the detailed insights and needs from operational levels. Compared to Top-Down Budgeting, which originates from senior management directives, Bottom-Up Budgeting provides a more granular and realistic view of resource requirements, enhancing commitment and accountability within the company.

Key Differences Between Top-Down and Bottom-Up Budgeting

Top-down budgeting involves senior management setting the overall budget, which is then allocated downward to departments, ensuring alignment with organizational goals but potentially overlooking ground-level insights. In contrast, bottom-up budgeting gathers input from various departments and teams, fostering detailed and realistic financial plans while requiring more time and coordination for accuracy. The key difference lies in the decision-making process: top-down is driven by executives, emphasizing control and strategic direction, whereas bottom-up emphasizes employee participation and detailed operational data.

Advantages of Top-Down Budgeting

Top-Down Budgeting offers advantages such as streamlined decision-making and faster budget approval by involving senior management in setting financial targets, which aligns the budget closely with strategic goals. It facilitates clear communication of priorities and ensures resource allocation supports company-wide objectives, reducing the risk of budget discrepancies. This method also enhances control over spending and promotes accountability at higher organizational levels.

Advantages of Bottom-Up Budgeting

Bottom-Up Budgeting empowers your team by involving employees at all levels in the budget creation process, leading to more accurate and realistic projections. This approach enhances ownership and accountability, resulting in higher motivation and improved resource allocation aligned with actual operational needs. In contrast to Top-Down Budgeting, Bottom-Up Budgeting reduces the risk of unrealistic targets by leveraging frontline insights and promoting transparency throughout the organization.

Limitations of Top-Down Budgeting

Top-down budgeting often faces limitations due to its top-heavy approach, which can lead to unrealistic targets as it may ignore input from lower-level employees who have detailed operational knowledge. This method risks reduced employee motivation and engagement because budgets are imposed without participative feedback, potentially causing misalignment with actual needs. In contrast, bottom-up budgeting incorporates valuable insights from various departments, improving accuracy but requiring more time and coordination.

Limitations of Bottom-Up Budgeting

Bottom-up budgeting often faces limitations such as time-consuming processes and the risk of overestimating expenses due to department managers aiming for larger budgets. It may also lead to misalignment with overall strategic goals since individual units focus on their specific needs rather than the organization's priorities. In contrast, top-down budgeting offers more control but can lack detailed insights, making it essential to balance both approaches for effective financial planning.

Choosing the Right Budgeting Approach for Your Organization

Top-down budgeting streamlines decision-making by setting financial targets from senior management, ensuring alignment with strategic goals but may overlook departmental insights. Bottom-up budgeting fosters accuracy and employee engagement by aggregating detailed input from various departments, though it can be time-consuming and complex. Choosing the right budgeting approach depends on organizational size, culture, and the need for control versus flexibility, with hybrid models often providing a balanced solution for diverse business needs.

Conclusion: Top-Down vs Bottom-Up Budgeting

Top-Down budgeting streamlines decision-making by setting financial targets at the executive level, ensuring alignment with strategic goals but sometimes overlooking operational nuances. Bottom-Up budgeting empowers your teams to contribute detailed insights, fostering accuracy and ownership while potentially requiring more time and coordination. Choosing between these methods depends on your organization's size, culture, and need for control versus participation in the budgeting process.

Infographic: Top-Down Budgeting vs Bottom-Up Budgeting

relatioo.com

relatioo.com