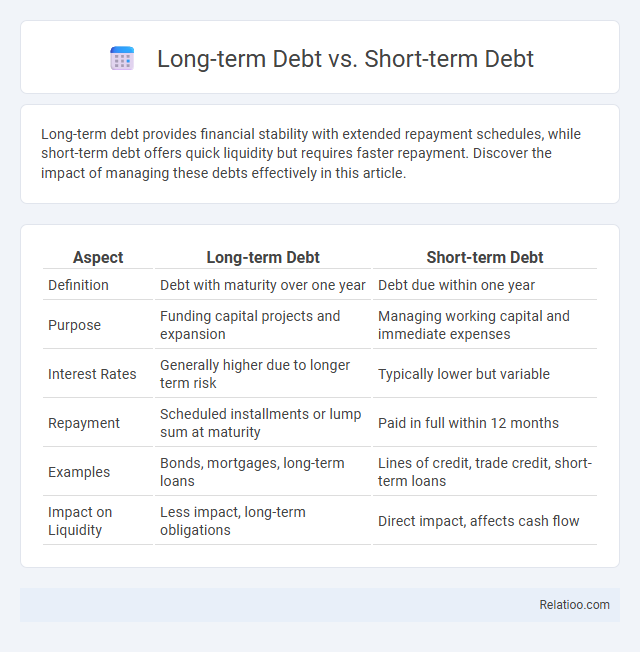

Long-term debt provides financial stability with extended repayment schedules, while short-term debt offers quick liquidity but requires faster repayment. Discover the impact of managing these debts effectively in this article.

Table of Comparison

| Aspect | Long-term Debt | Short-term Debt |

|---|---|---|

| Definition | Debt with maturity over one year | Debt due within one year |

| Purpose | Funding capital projects and expansion | Managing working capital and immediate expenses |

| Interest Rates | Generally higher due to longer term risk | Typically lower but variable |

| Repayment | Scheduled installments or lump sum at maturity | Paid in full within 12 months |

| Examples | Bonds, mortgages, long-term loans | Lines of credit, trade credit, short-term loans |

| Impact on Liquidity | Less impact, long-term obligations | Direct impact, affects cash flow |

Understanding Long-term Debt and Short-term Debt

Long-term debt refers to financial obligations with maturities exceeding one year, often used for significant investments such as property or infrastructure, providing businesses with extended time frames for repayment and typically featuring fixed or variable interest rates. Short-term debt consists of liabilities due within one year, including accounts payable and short-term loans, primarily utilized for managing working capital and addressing immediate financial needs. Understanding the distinctions between long-term and short-term debt is crucial for effective financial planning, liquidity management, and aligning debt structure with a company's operational and strategic goals.

Key Differences Between Long-term and Short-term Debt

Long-term debt typically involves borrowing with repayment terms exceeding one year, often used for capital investments, while short-term debt must be repaid within a year and is generally utilized for managing operational expenses. Interest rates on short-term debt are usually lower but may fluctuate more rapidly, whereas long-term debt offers fixed or predictable rates, providing stability in financial planning. Your choice between long-term and short-term debt hinges on your business's cash flow, funding needs, and risk tolerance, balancing flexibility against cost and repayment obligations.

Advantages of Long-term Debt

Long-term debt offers businesses the advantage of stable financing with fixed interest rates, allowing you to plan budgets more effectively without the pressure of imminent repayment. This type of debt improves cash flow management by spreading out payments over several years, reducing the risk of liquidity issues compared to short-term debt. Companies leveraging long-term debt often benefit from higher creditworthiness and the ability to invest in large-scale growth initiatives.

Benefits of Short-term Debt

Short-term debt offers greater flexibility for managing immediate cash flow needs due to its quick repayment cycle, often within one year, reducing long-term financial burden. It typically incurs lower interest costs compared to long-term debt, providing cost-effective financing for operational expenses or inventory purchases. Businesses benefit from short-term debt's ability to quickly adapt to market fluctuations without the risk of prolonged obligations tied to long-term debt structures.

Risks and Drawbacks of Long-term Debt

Long-term debt carries higher interest costs over time and increases the risk of financial inflexibility due to prolonged repayment commitments. Unlike short-term debt, it exposes companies to potential market interest rate fluctuations and refinancing risks at maturity. Excessive long-term debt can lead to decreased credit ratings and restrictive covenants that limit strategic business options.

Potential Downsides of Short-term Debt

Short-term debt often carries higher interest rates and can strain your cash flow due to frequent repayment schedules, increasing the risk of default if revenues fluctuate. Unlike long-term debt, short-term obligations lack flexible repayment terms, which may force rushed refinancing or asset liquidation under unfavorable conditions. Understanding these potential downsides is crucial for managing your overall debt strategy effectively.

Impact on Financial Statements

Long-term debt impacts the balance sheet by increasing liabilities and often leads to higher interest expenses reported on the income statement over multiple periods, improving liquidity ratios due to extended repayment terms. Short-term debt affects current liabilities, reducing working capital and potentially increasing interest expenses in the near term, which may constrain cash flow reflected on the cash flow statement. Overall debt influences leverage ratios like debt-to-equity, affects solvency assessments, and determines the interest coverage ratio, impacting investors' and creditors' evaluation of financial health.

How Businesses Choose Between Long-term and Short-term Debt

Businesses choose between long-term debt and short-term debt based on factors such as interest rates, cash flow stability, and the purpose of the financing. Long-term debt offers fixed interest rates and repayment schedules ideal for funding major capital investments, while short-term debt provides flexibility for managing working capital and operational expenses. Companies evaluate their financial health, market conditions, and risk tolerance to optimize debt structure and balance liquidity with growth opportunities.

Factors to Consider When Selecting Debt Type

When selecting between long-term debt, short-term debt, and general debt options, consider factors such as interest rates, repayment terms, and your business's cash flow stability. Long-term debt often offers lower monthly payments and fixed rates, ideal for large investments, while short-term debt suits immediate financing needs with typically higher rates but quicker payoffs. Understanding your financial goals and ability to manage repayment schedules ensures that your chosen debt type aligns with your company's growth and liquidity requirements.

Long-term vs Short-term Debt: Which is Right for Your Business?

Long-term debt offers your business the advantage of lower monthly payments and extended repayment periods, ideal for financing large investments and stabilizing cash flow over time. Short-term debt provides quick access to funds with faster repayment, suitable for managing immediate expenses or seasonal fluctuations. Choosing between long-term and short-term debt depends on your business's financial goals, cash flow stability, and the nature of your funding needs.

Infographic: Long-term Debt vs Short-term Debt

relatioo.com

relatioo.com