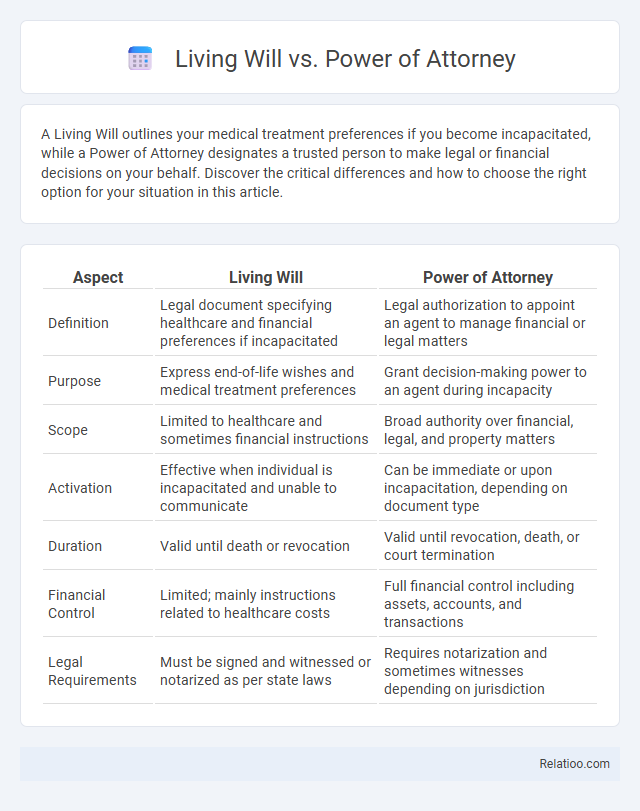

A Living Will outlines your medical treatment preferences if you become incapacitated, while a Power of Attorney designates a trusted person to make legal or financial decisions on your behalf. Discover the critical differences and how to choose the right option for your situation in this article.

Table of Comparison

| Aspect | Living Will | Power of Attorney |

|---|---|---|

| Definition | Legal document specifying healthcare and financial preferences if incapacitated | Legal authorization to appoint an agent to manage financial or legal matters |

| Purpose | Express end-of-life wishes and medical treatment preferences | Grant decision-making power to an agent during incapacity |

| Scope | Limited to healthcare and sometimes financial instructions | Broad authority over financial, legal, and property matters |

| Activation | Effective when individual is incapacitated and unable to communicate | Can be immediate or upon incapacitation, depending on document type |

| Duration | Valid until death or revocation | Valid until revocation, death, or court termination |

| Financial Control | Limited; mainly instructions related to healthcare costs | Full financial control including assets, accounts, and transactions |

| Legal Requirements | Must be signed and witnessed or notarized as per state laws | Requires notarization and sometimes witnesses depending on jurisdiction |

Understanding the Basics: Living Will vs Power of Attorney

A Living Will is a legal document that specifies an individual's preferences for medical treatment in case they become incapacitated, primarily guiding healthcare decisions. Power of Attorney (POA) appoints a trusted person to make legal or financial decisions on behalf of the individual when they are unable to do so. Understanding the distinction between a Living Will and Power of Attorney is crucial: the Living Will directs healthcare choices, while a POA grants authority for broader decision-making, including financial and legal matters.

Legal Definitions and Key Distinctions

A Living Will is a legal document outlining Your healthcare preferences if You become incapacitated, while a Power of Attorney designates an agent to make financial or medical decisions on Your behalf. The key distinction lies in scope: a Living Will specifically addresses end-of-life medical treatments, whereas a Power of Attorney grants broader decision-making authority. Understanding these legal definitions ensures clarity in managing Your future healthcare and financial affairs.

Scope of Authority: What Each Document Covers

Living Will primarily covers your healthcare preferences, specifying medical treatments you want or refuse if you become incapacitated. Power of Attorney grants authority to an agent to make financial or legal decisions on your behalf, extending beyond medical care. Your Living Will and Power of Attorney together ensure comprehensive management of health and financial matters during incapacitation.

When to Use a Living Will

A Living Will should be used when an individual wants to specify their medical treatment preferences in situations where they are unable to communicate, such as terminal illness or unconsciousness. Unlike a Power of Attorney, which designates a person to make decisions on your behalf, a Living Will directly outlines your healthcare wishes. It is critical to establish a Living Will early to ensure your end-of-life care aligns with your values and reduces uncertainty for family members.

When to Use a Power of Attorney

You should use a Power of Attorney when you need someone to make financial or medical decisions on your behalf if you become incapacitated. Unlike a Living Will, which only outlines your healthcare preferences, a Power of Attorney grants broader authority to manage your affairs. This legal document ensures your designated agent can act immediately or upon incapacity, providing essential control over your well-being and assets.

Decision-Making Powers: Medical and Financial

Living Will outlines your preferences for medical treatment and end-of-life care, ensuring healthcare providers follow your wishes when you cannot communicate. Power of Attorney grants a trusted individual the authority to make financial decisions on your behalf, including managing assets and paying bills. Your decision-making powers are divided: the Living Will controls medical choices, while the Power of Attorney governs financial matters.

Appointing Agents and Representatives

Appointing agents in a Living Will involves designating individuals who make healthcare decisions when you cannot communicate your wishes. Power of Attorney allows you to appoint a trusted representative to handle financial, legal, or medical decisions on your behalf. Your choice of representative in these documents should reflect someone reliable who understands your values and preferences.

Legal Requirements and Validity

Living Will and Power of Attorney differ in legal requirements and validity, where a Living Will specifically outlines your medical treatment preferences if you become incapacitated, requiring notarization or witnesses depending on state laws. Power of Attorney grants your designated agent authority to make broader financial or healthcare decisions on your behalf and must comply with state-specific signing and witnessing protocols for validity. Understanding these distinctions ensures your legal documents are properly executed to reflect your healthcare and financial wishes accurately.

Benefits of Having Both Documents

Having both a Living Will and Power of Attorney ensures comprehensive healthcare planning by clearly outlining your medical treatment preferences while designating a trusted person to make decisions when you're unable to communicate. These documents work together to provide legally binding instructions and decision-making authority, preventing confusion and disputes among family members during critical moments. Your combined use guarantees that your healthcare wishes are respected and managed effectively, providing peace of mind for you and your loved ones.

Frequently Asked Questions: Living Will and Power of Attorney

A Living Will outlines specific medical treatments and end-of-life care preferences, while a Power of Attorney appoints a trusted individual to manage healthcare or financial decisions when one becomes incapacitated. Frequently asked questions about Living Wills often concern their legal validity and how clearly they guide medical professionals in emergencies. Common queries about Power of Attorney focus on choosing the right agent, the scope of authority granted, and how to revoke or update the document.

Infographic: Living Will vs Power of Attorney

relatioo.com

relatioo.com