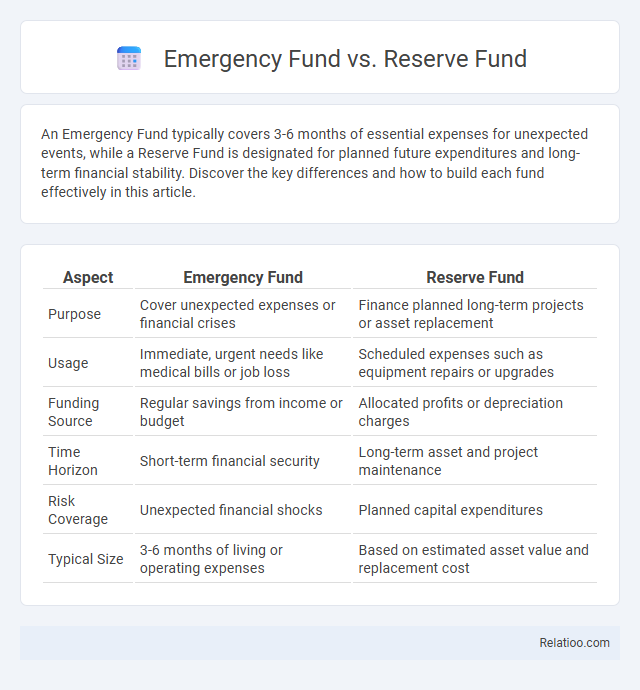

An Emergency Fund typically covers 3-6 months of essential expenses for unexpected events, while a Reserve Fund is designated for planned future expenditures and long-term financial stability. Discover the key differences and how to build each fund effectively in this article.

Table of Comparison

| Aspect | Emergency Fund | Reserve Fund |

|---|---|---|

| Purpose | Cover unexpected expenses or financial crises | Finance planned long-term projects or asset replacement |

| Usage | Immediate, urgent needs like medical bills or job loss | Scheduled expenses such as equipment repairs or upgrades |

| Funding Source | Regular savings from income or budget | Allocated profits or depreciation charges |

| Time Horizon | Short-term financial security | Long-term asset and project maintenance |

| Risk Coverage | Unexpected financial shocks | Planned capital expenditures |

| Typical Size | 3-6 months of living or operating expenses | Based on estimated asset value and replacement cost |

Understanding Emergency Funds: Definition and Purpose

An emergency fund is a financial safety net designed to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss, ensuring your financial stability during crises. Unlike a reserve fund, which is often set aside for planned maintenance or future investments, an emergency fund is specifically meant for unforeseen and urgent needs. Building your emergency fund to cover three to six months of living expenses is crucial to protect your financial well-being in times of uncertainty.

What Is a Reserve Fund? Key Differences Explained

A Reserve Fund is a designated savings account allocated for long-term capital expenses or unexpected major repairs, commonly used by organizations or housing associations. Unlike an Emergency Fund, which covers immediate personal financial crises like job loss or medical emergencies, a Reserve Fund targets planned, substantial expenditures such as roof replacement or infrastructure upgrades. Key differences include purpose, time horizon, and accessibility, where Emergency Funds prioritize liquidity for short-term emergencies, while Reserve Funds are structured for sustainability and future large-scale needs.

Emergency vs Reserve Fund: Core Objectives

An Emergency Fund primarily aims to provide immediate financial support during unforeseen personal crises such as job loss, medical emergencies, or urgent home repairs, ensuring liquidity and quick access to cash. In contrast, a Reserve Fund is designed to cover long-term, planned financial obligations or organizational needs, such as major capital expenditures or business continuity during prolonged downturns. Understanding these core objectives highlights that Emergency Funds prioritize short-term, rapid-response financial security, while Reserve Funds focus on sustaining operations and long-term stability.

When to Use Each Fund: Typical Scenarios

Emergency funds are used for unexpected, urgent expenses like medical emergencies or sudden job loss, ensuring financial stability during crises. Reserve funds are set aside for planned but irregular expenses such as major repairs, equipment replacement, or business contingencies, helping maintain operational continuity. Contingency funds cover unforeseen risks and liabilities not addressed by emergency or reserve funds, providing a financial buffer for rare, high-impact events.

How Much Should You Save in Each Fund?

Emergency funds typically require saving three to six months' worth of essential living expenses to cover unexpected financial setbacks like job loss or medical emergencies. Reserve funds are designed for specific, planned expenses such as home repairs or car maintenance, often recommended to hold around 5-10% of your annual budget depending on asset value and expected costs. Your savings strategy should prioritize building a fully-funded emergency fund before allocating money to reserve funds to ensure financial stability during unforeseen events.

Accessibility and Liquidity: Emergency vs Reserve Funds

Emergency funds are highly liquid and easily accessible, typically held in savings accounts or money market funds to cover unexpected expenses immediately. Reserve funds, while still accessible, may be invested in slightly less liquid assets such as short-term bonds or fixed deposits, balancing accessibility with potential returns. Emergency funds prioritize instant liquidity for urgent needs, whereas reserve funds focus on availability with moderate liquidity to support ongoing operational costs or planned contingencies.

Funding Sources: Building Both Funds Strategically

Emergency funds and reserve funds serve distinct purposes but require strategic funding sources to build effectively. You can grow your emergency fund through consistent savings from your paycheck, small windfalls, or dedicated budget categories, ensuring quick access for unexpected expenses. Reserve funds often rely on business profits, refinancing options, or allocated capital budgets to support long-term financial stability and planned contingencies.

Common Mistakes in Managing Financial Reserves

Common mistakes in managing financial reserves include confusing an emergency fund with a reserve fund, leading to inadequate savings for unexpected expenses versus planned future costs. Many people underfund their emergency fund, which should ideally cover three to six months of essential living expenses, causing financial strain during crises. You must clearly differentiate the purpose of each fund to ensure proper allocation and financial security.

Integrating Emergency and Reserve Funds Into Your Financial Plan

Integrating emergency and reserve funds into your financial plan ensures comprehensive financial security by covering both unexpected expenses and planned large purchases. An emergency fund typically holds 3-6 months' worth of living expenses to address sudden financial hardships like job loss or medical emergencies, while a reserve fund is allocated for anticipated but irregular costs such as home repairs or major car maintenance. Strategically managing both funds enhances liquidity and reduces the need for high-interest debt, promoting long-term financial stability.

Tips for Maintaining and Growing Your Safety Nets

Regularly contribute a fixed percentage of your income to build both your emergency and reserve funds, ensuring they cover at least three to six months of essential expenses. Keep these funds in high-yield, easily accessible accounts like money market or savings accounts to maximize growth while preserving liquidity. Periodically review and adjust contributions according to life changes and inflation to maintain the effectiveness of your financial safety nets.

Infographic: Emergency Fund vs Reserve Fund

relatioo.com

relatioo.com