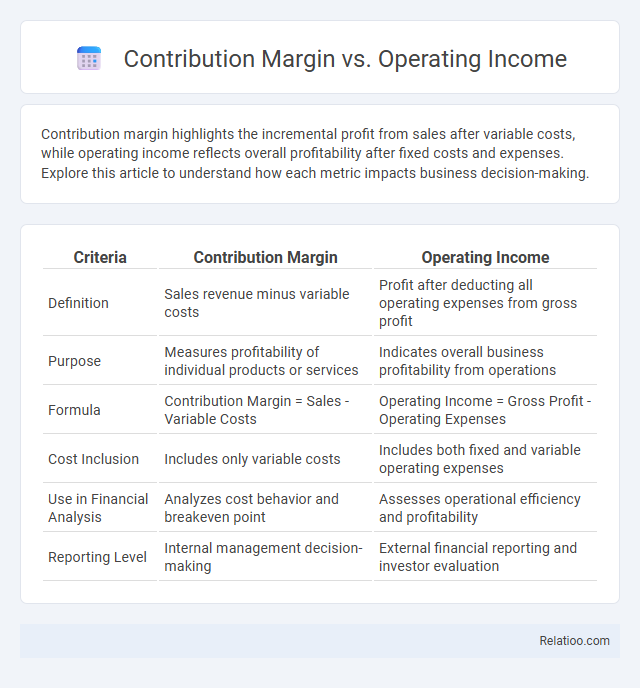

Contribution margin highlights the incremental profit from sales after variable costs, while operating income reflects overall profitability after fixed costs and expenses. Explore this article to understand how each metric impacts business decision-making.

Table of Comparison

| Criteria | Contribution Margin | Operating Income |

|---|---|---|

| Definition | Sales revenue minus variable costs | Profit after deducting all operating expenses from gross profit |

| Purpose | Measures profitability of individual products or services | Indicates overall business profitability from operations |

| Formula | Contribution Margin = Sales - Variable Costs | Operating Income = Gross Profit - Operating Expenses |

| Cost Inclusion | Includes only variable costs | Includes both fixed and variable operating expenses |

| Use in Financial Analysis | Analyzes cost behavior and breakeven point | Assesses operational efficiency and profitability |

| Reporting Level | Internal management decision-making | External financial reporting and investor evaluation |

Understanding Contribution Margin

Contribution margin represents the amount remaining from sales revenue after variable costs are deducted, serving as a crucial indicator of how much revenue contributes to covering fixed costs and generating profit. Unlike operating income, which accounts for all expenses including fixed costs and provides a net profit figure, contribution margin focuses specifically on the relationship between variable costs and sales revenue. Understanding contribution margin helps businesses make informed decisions about pricing, product focus, and cost control to optimize profitability.

Defining Operating Income

Operating Income represents the profit generated from core business operations after deducting operating expenses such as wages, rent, and cost of goods sold, but before interest and taxes. Contribution Margin shows the selling price per unit minus the variable costs per unit, highlighting how much revenue contributes to fixed costs and profit. Understanding Operating Income helps you analyze how efficiently your business is managing expenses beyond just covering variable costs.

Key Differences Between Contribution Margin and Operating Income

Contribution margin represents the portion of sales revenue remaining after variable costs are deducted, highlighting how much revenue contributes to covering fixed costs and generating profit. Operating income accounts for total revenues minus both variable and fixed operating expenses, reflecting the company's overall profitability from core operations. Your understanding of contribution margin helps analyze cost behavior and pricing decisions, while operating income provides insight into overall operational efficiency and financial performance.

Calculating Contribution Margin

Calculating Contribution Margin involves subtracting variable costs directly tied to production from total sales revenue, providing a clear measure of profitability per unit before fixed costs. Contribution Margin helps determine how much revenue contributes to covering fixed expenses and generating operating income. Understanding this metric is essential for assessing cost behavior and making informed pricing, budgeting, and decision-making strategies in business operations.

Calculating Operating Income

Operating Income is calculated by subtracting total operating expenses, including selling, general, and administrative costs, from the Contribution Margin, which represents sales revenue minus variable costs. The Contribution Margin highlights how much revenue contributes to fixed costs and profits before operating expenses are deducted. Understanding this relationship clarifies profitability by distinguishing between variable cost coverage and the remaining income after fixed operating expenses.

Importance of Contribution Margin in Decision Making

Contribution margin provides critical insight into how much revenue remains after variable costs, directly impacting profitability assessments and pricing strategies. Understanding the contribution margin helps you evaluate the financial viability of products or services by isolating the portion of sales contributing to fixed costs and net income. Operating income incorporates fixed costs and offers a broader profitability view, but contribution margin is essential for short-term decision-making and cost control.

Role of Operating Income in Financial Analysis

Operating income plays a crucial role in financial analysis by measuring a company's profitability from core business operations before interest and taxes, offering a clear indicator of operational efficiency. Contribution margin highlights the incremental profit per unit, essential for understanding product-level profitability and breakeven analysis, whereas operating income aggregates overall business profitability, facilitating strategic decision-making. Analysts rely on operating income to assess sustainable earnings potential and compare profitability across periods or competitors, independent of financing and tax structures.

Impact of Fixed and Variable Costs

Contribution margin represents the revenue remaining after deducting variable costs, highlighting how much is available to cover fixed costs and contribute to profit. Operating income accounts for both fixed and variable costs, showing the actual profitability after all operating expenses. Your understanding of fixed and variable costs directly influences how you analyze these metrics to optimize pricing, cost control, and overall financial performance.

Practical Examples: Contribution Margin vs Operating Income

Contribution margin represents the amount remaining from sales revenue after variable costs, used to cover fixed costs and generate profit, while operating income reflects the profit left after deducting both variable and fixed operating expenses. For example, if a company sells a product for $100 with variable costs of $60, the contribution margin is $40; after subtracting fixed costs like $25, the operating income is $15. Understanding these differences helps managers make pricing, production, and cost control decisions more effectively.

Choosing the Right Metric for Business Strategy

Choosing the right metric for business strategy hinges on understanding the distinct roles of contribution margin, operating income, and contribution. Contribution margin highlights the profitability per unit by subtracting variable costs from sales, aiding pricing and product mix decisions. Operating income provides a comprehensive profitability measure after fixed costs, crucial for assessing overall business health and long-term strategic planning.

Infographic: Contribution Margin vs Operating Income

relatioo.com

relatioo.com