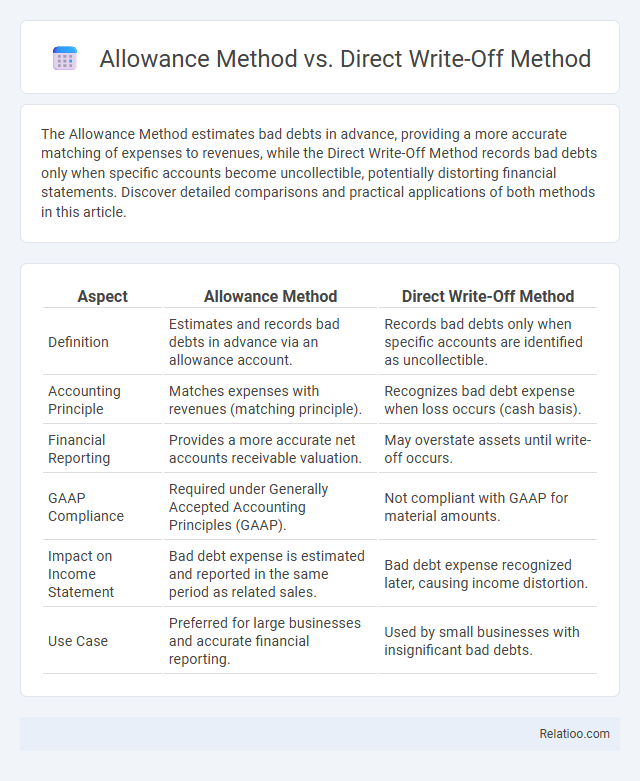

The Allowance Method estimates bad debts in advance, providing a more accurate matching of expenses to revenues, while the Direct Write-Off Method records bad debts only when specific accounts become uncollectible, potentially distorting financial statements. Discover detailed comparisons and practical applications of both methods in this article.

Table of Comparison

| Aspect | Allowance Method | Direct Write-Off Method |

|---|---|---|

| Definition | Estimates and records bad debts in advance via an allowance account. | Records bad debts only when specific accounts are identified as uncollectible. |

| Accounting Principle | Matches expenses with revenues (matching principle). | Recognizes bad debt expense when loss occurs (cash basis). |

| Financial Reporting | Provides a more accurate net accounts receivable valuation. | May overstate assets until write-off occurs. |

| GAAP Compliance | Required under Generally Accepted Accounting Principles (GAAP). | Not compliant with GAAP for material amounts. |

| Impact on Income Statement | Bad debt expense is estimated and reported in the same period as related sales. | Bad debt expense recognized later, causing income distortion. |

| Use Case | Preferred for large businesses and accurate financial reporting. | Used by small businesses with insignificant bad debts. |

Introduction to Bad Debt Accounting Methods

Bad debt accounting methods include the Allowance Method, Direct Write-Off Method, and their variations, each addressing uncollectible receivables differently to maintain accurate financial records. The Allowance Method estimates doubtful accounts in advance using an allowance for bad debts, ensuring expenses align with revenues in the same period. Your choice between methods impacts balance sheet accuracy and income statement timing, influencing financial analysis and reporting compliance.

Overview of the Allowance Method

The Allowance Method estimates uncollectible accounts by creating a contra-asset account called Allowance for Doubtful Accounts, which matches bad debt expenses to the same period as the related sales. This method enhances the accuracy of financial statements by adhering to the matching principle and providing a realistic view of net receivables. Your company benefits from improved financial reporting and more reliable credit risk management compared to the Direct Write-Off Method.

Overview of the Direct Write-Off Method

The Direct Write-Off Method records bad debt expense only when specific accounts are deemed uncollectible, directly reducing accounts receivable without estimating future losses. Unlike the Allowance Method, it does not create a reserve account, potentially distorting net income and violating the matching principle in financial statements. Your business may find the Direct Write-Off Method simpler but less accurate for reflecting the true financial position during periods of significant uncollectible accounts.

Key Differences Between Allowance and Direct Write-Off Methods

The Allowance Method estimates doubtful accounts at the end of each period, matching bad debt expenses to the same period as sales, ensuring compliance with GAAP and accurate financial reporting. In contrast, the Direct Write-Off Method recognizes bad debt expense only when specific accounts are deemed uncollectible, often leading to timing mismatches and less accurate financial statements. The key difference lies in the timing and approach: the Allowance Method proactively anticipates credit losses, while the Direct Write-Off Method reacts to actual defaults.

GAAP Compliance: Allowance vs Direct Write-Off

The Allowance Method aligns with GAAP compliance by estimating and matching bad debt expenses to the same period as related sales, using an allowance for doubtful accounts to present accurate net receivables. The Direct Write-Off Method violates GAAP principles because it records bad debts only when accounts become uncollectible, resulting in mismatched expense recognition and overstated assets. Your financial statements maintain GAAP adherence and realistic valuation of receivables by adopting the Allowance Method over Direct Write-Off.

Impact on Financial Statements

The Allowance Method estimates and records bad debt expenses in the same period as related sales, ensuring a more accurate representation of accounts receivable and net income on financial statements. The Direct Write-Off Method recognizes bad debts only when specific accounts become uncollectible, potentially overstating assets and income in earlier periods, thus affecting financial statement reliability. You benefit from the Allowance Method's compliance with GAAP, providing clearer insight into true financial performance and healthier balance sheets.

Tax Implications of Each Method

The Allowance Method estimates uncollectible accounts before tax reporting, enabling businesses to match bad debt expenses with revenues, which aligns with Generally Accepted Accounting Principles (GAAP) and defers tax deductions until write-offs occur. The Direct Write-Off Method recognizes bad debts only when they are deemed uncollectible, often resulting in immediate tax deductions but potential mismatches between income and expense timing, typically disallowed under GAAP for financial reporting but accepted for tax purposes. Understanding the tax implications of each method helps you optimize your tax liability and comply with relevant accounting standards.

Advantages of the Allowance Method

The Allowance Method provides a more accurate matching of bad debt expenses with related revenues by estimating uncollectible accounts in the same period as the sales. It enhances financial statement reliability through the creation of an allowance for doubtful accounts, which reduces accounts receivable to net realizable value. Compared to the Direct Write-Off Method, it complies with GAAP and improves the predictability of bad debt expense.

Advantages of the Direct Write-Off Method

The Direct Write-Off Method offers the advantage of simplicity and clear-cut accounting by recognizing bad debt expense only when specific accounts are deemed uncollectible, eliminating the need for estimates. This method improves accuracy for small businesses or entities with negligible bad debts, as it reflects actual losses without impacting income prematurely. It also provides straightforward bookkeeping and compliance, making it easier to track and justify write-offs for tax purposes.

Choosing the Best Method for Your Business

Choosing the best method for your business depends on the size, complexity, and accuracy requirements of your accounts receivable. The Allowance Method estimates bad debts in advance, matching expenses to revenues for more accurate financial reporting, while the Direct Write-Off Method records bad debts only when accounts become uncollectible, which may distort profit margins. Your decision should weigh the benefits of timely expense recognition under the Allowance Method against the simplicity of the Direct Write-Off Method, considering compliance with accounting standards like GAAP or IFRS.

Infographic: Allowance Method vs Direct Write-Off Method

relatioo.com

relatioo.com