Tuition fees have steadily increased, leading many students to rely on student loans that now total over $1.7 trillion in the U.S. Explore how tuition costs impact student loan debt and financial planning in this article.

Table of Comparison

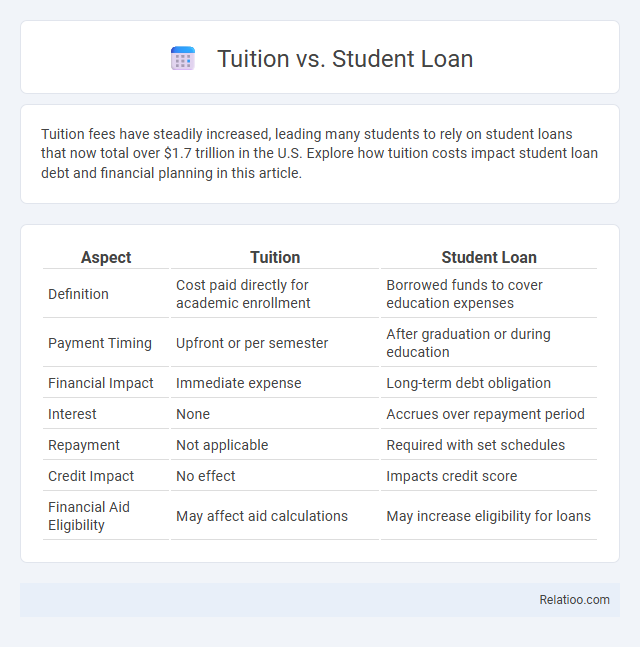

| Aspect | Tuition | Student Loan |

|---|---|---|

| Definition | Cost paid directly for academic enrollment | Borrowed funds to cover education expenses |

| Payment Timing | Upfront or per semester | After graduation or during education |

| Financial Impact | Immediate expense | Long-term debt obligation |

| Interest | None | Accrues over repayment period |

| Repayment | Not applicable | Required with set schedules |

| Credit Impact | No effect | Impacts credit score |

| Financial Aid Eligibility | May affect aid calculations | May increase eligibility for loans |

Understanding Tuition Costs

Tuition costs represent the direct fees charged by educational institutions for instruction and access to campus resources. Student loans are borrowed funds specifically designed to cover tuition and related educational expenses, with repayment required after graduation. Understanding tuition costs involves analyzing institutional charges, potential scholarships, and financial aid options to minimize reliance on student loans and manage overall education expenses effectively.

What Are Student Loans?

Student loans are financial aid options specifically designed to help students cover their educational expenses, such as tuition fees, books, and living costs. Unlike grants or scholarships, student loans must be repaid with interest over a specified period, often after graduation. Understanding the differences between tuition costs and student loans is crucial for managing college expenses and long-term financial planning.

Types of Tuition Fees

Tuition fees vary widely based on institution type, program level, and residency status, typically categorized into in-state, out-of-state, and international fees. These fees include mandatory charges such as course fees, lab fees, and technology fees that contribute to the overall cost of education. Understanding these distinctions is crucial for comparing tuition costs against student loan options, which are often needed to bridge the financial gap for many students.

Types of Student Loans

Types of student loans include federal loans such as Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans, each with specific eligibility criteria and repayment options. Private student loans, offered by banks or credit unions, often require a credit check and may have higher interest rates compared to federal loans. Understanding these options helps you choose the best loan type to finance your tuition while managing repayment effectively.

Comparing Upfront Payments vs Borrowing

Paying tuition upfront requires immediate access to your funds, eliminating interest and reducing long-term costs. Student loans allow you to borrow for education expenses, spreading out repayment over time but often increasing the total amount paid due to interest. Your choice between upfront tuition payment and borrowing impacts your financial stability and debt management strategy.

Interest Rates and Repayment Terms

Tuition costs vary widely depending on the institution and program, often influencing the decision between paying upfront or using student loans. Student loans typically come with interest rates ranging from 3% to 12%, influenced by federal or private loan types, while repayment terms can span 10 to 30 years with options for income-driven plans or deferment. Comparing tuition payment with loan financing requires evaluating long-term financial impacts, including interest accrual and flexible repayment conditions to minimize overall debt burden.

Long-Term Financial Impacts

Tuition costs directly affect a student's immediate financial burden, often necessitating student loans that accrue interest over time and increase total repayment amounts. Student loans can impact credit scores and limit financial flexibility for years after graduation, often influencing long-term financial goals such as homeownership or retirement savings. Evaluating tuition expenses against the potential debt load helps students make informed decisions to minimize future financial stress and optimize their economic stability.

Pros and Cons of Paying Tuition Directly

Paying tuition directly allows you to avoid accumulating debt and interest payments, providing a clear financial path with no strings attached. However, this method requires having sufficient funds upfront, which may strain your savings or limit cash flow for other expenses. Carefully weighing your financial situation helps determine if paying tuition directly aligns with your goals and reduces long-term financial burden.

Pros and Cons of Student Loans

Student loans provide immediate financial support for tuition fees, enabling you to attend your desired institution without upfront costs, but they often come with high-interest rates and long-term repayment obligations that can lead to significant debt. While tuition payments require upfront cash or scholarships, avoiding loan interest, they can be a barrier if sufficient funds are unavailable. Carefully weigh the pros of accessible funds through student loans against cons like potential credit impact and future financial strain before deciding your education funding strategy.

Choosing the Best Option for You

Choosing the best option between tuition payment methods and student loans requires careful evaluation of your financial situation and future earning potential. Tuition paid upfront or through scholarships reduces debt burden, while student loans provide immediate access to education but accumulate interest over time. Your decision should balance affordability, repayment terms, and long-term financial goals to ensure sustainable education financing.

Infographic: Tuition vs Student Loan

relatioo.com

relatioo.com