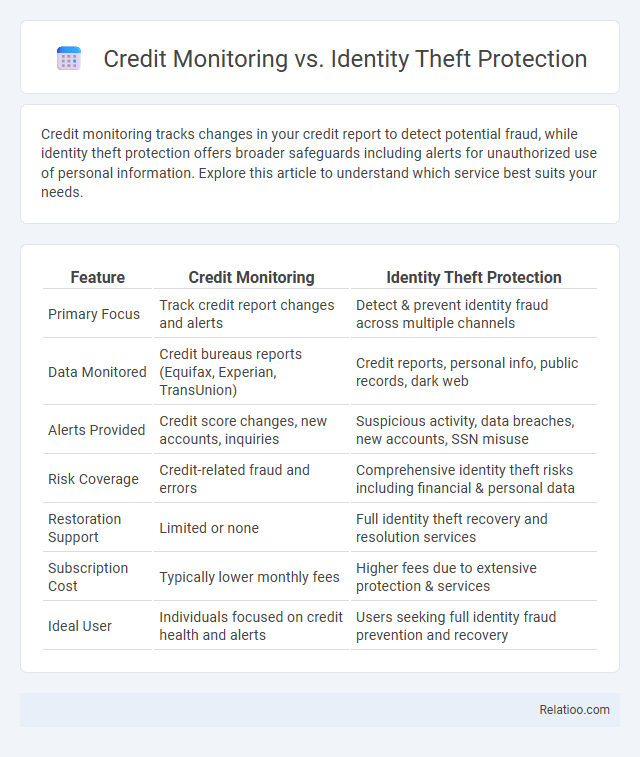

Credit monitoring tracks changes in your credit report to detect potential fraud, while identity theft protection offers broader safeguards including alerts for unauthorized use of personal information. Explore this article to understand which service best suits your needs.

Table of Comparison

| Feature | Credit Monitoring | Identity Theft Protection |

|---|---|---|

| Primary Focus | Track credit report changes and alerts | Detect & prevent identity fraud across multiple channels |

| Data Monitored | Credit bureaus reports (Equifax, Experian, TransUnion) | Credit reports, personal info, public records, dark web |

| Alerts Provided | Credit score changes, new accounts, inquiries | Suspicious activity, data breaches, new accounts, SSN misuse |

| Risk Coverage | Credit-related fraud and errors | Comprehensive identity theft risks including financial & personal data |

| Restoration Support | Limited or none | Full identity theft recovery and resolution services |

| Subscription Cost | Typically lower monthly fees | Higher fees due to extensive protection & services |

| Ideal User | Individuals focused on credit health and alerts | Users seeking full identity fraud prevention and recovery |

Introduction to Credit Monitoring and Identity Theft Protection

Credit monitoring involves continuous tracking of your credit reports from major bureaus like Experian, Equifax, and TransUnion, alerting you to changes such as new accounts or inquiries that could indicate fraudulent activity. Identity theft protection services extend beyond credit monitoring by also securing personal information, monitoring for suspicious activity across various platforms, and often providing recovery assistance if identity theft occurs. Understanding the differences between these services helps consumers choose the right level of protection based on their risk tolerance and financial needs.

What is Credit Monitoring?

Credit Monitoring is a service that continuously tracks your credit reports and alerts you to any significant changes, such as new accounts, inquiries, or suspicious activities, helping you detect potential fraud early. Unlike Identity Theft Protection, which offers broader safeguards including identity restoration and insurance, Credit Monitoring focuses specifically on your credit data. By using Credit Monitoring, your financial health is closely watched, enabling you to respond swiftly to unauthorized activity and reduce the risk of identity theft.

What is Identity Theft Protection?

Identity Theft Protection refers to services designed to detect, prevent, and resolve identity theft incidents by monitoring personal information such as Social Security numbers, bank accounts, and credit cards for suspicious activity. Unlike credit monitoring, which primarily tracks changes to your credit report, identity theft protection offers broader safeguards including dark web surveillance, identity restoration support, and alerts for fraudulent use of personal data. These services aim to minimize financial loss and provide assistance in recovering your identity after theft occurs.

Key Differences Between Credit Monitoring and Identity Theft Protection

Credit monitoring services primarily track changes in your credit reports, alerting you to new accounts, credit inquiries, or significant credit score shifts that may indicate fraudulent activity. Identity theft protection offers a more comprehensive safeguard by monitoring a wide range of personal information beyond credit data, including Social Security numbers, bank accounts, and dark web activity, alongside identity restoration assistance if theft occurs. The key difference lies in scope: credit monitoring focuses on credit file alerts, whereas identity theft protection delivers broader surveillance and recovery services to address various facets of identity fraud.

Benefits of Credit Monitoring

Credit monitoring provides real-time alerts on changes to your credit report, helping you detect potential fraud or errors quickly. By tracking factors like new accounts, credit inquiries, and delinquent payments, credit monitoring enables you to respond swiftly to unauthorized activities. This proactive defense significantly reduces the risk of identity theft and protects your financial reputation.

Benefits of Identity Theft Protection

Identity Theft Protection offers comprehensive benefits beyond Credit Monitoring by actively detecting and alerting users to suspicious activities across multiple financial accounts, social security usage, and personal information breaches. It provides real-time alerts on identity risks, access to recovery services, and insurance coverage for potential financial loss, which credit monitoring alone does not encompass. This proactive approach helps prevent identity theft before significant damage occurs, restoring security and peace of mind.

Limitations of Credit Monitoring

Credit monitoring tracks changes in your credit report, such as new accounts or inquiries, but it does not prevent identity theft or alert you to unauthorized use outside of credit activities. It has limited scope as it cannot detect fraudulent activity in bank accounts, medical records, or non-credit-related personal information. Unlike identity theft protection services, credit monitoring lacks comprehensive recovery assistance and does not cover social security number misuse or data breaches beyond the credit bureaus.

Limitations of Identity Theft Protection

Identity theft protection services primarily focus on alerting you to suspicious activity but often cannot prevent identity theft from occurring. These services may not cover all types of fraud or unauthorized use, leaving gaps in comprehensive protection against complex identity theft schemes. Understanding these limitations helps you make informed decisions about supplementing identity theft protection with credit monitoring and personal vigilance.

Choosing Between Credit Monitoring and Identity Theft Protection

Credit monitoring services track changes in your credit report to alert you of suspicious activity, helping to detect potential identity theft early. Identity theft protection offers a broader scope, including credit monitoring, dark web scanning, and recovery assistance if your identity is compromised. When choosing between the two, consider your risk level and needs: credit monitoring suits those primarily focused on financial account security, while identity theft protection provides comprehensive safeguards against various forms of identity fraud.

Final Recommendations for Protecting Your Financial Identity

Credit monitoring tracks changes to your credit report, alerting you to potential fraud, while identity theft protection offers broader services including dark web monitoring and recovery assistance. Identity theft refers to the unauthorized use of your personal information, causing financial damage and requiring swift action. To best protect your financial identity, invest in a comprehensive identity theft protection service combined with regular credit monitoring and maintain vigilance over your financial accounts.

Infographic: Credit Monitoring vs Identity Theft Protection

relatioo.com

relatioo.com