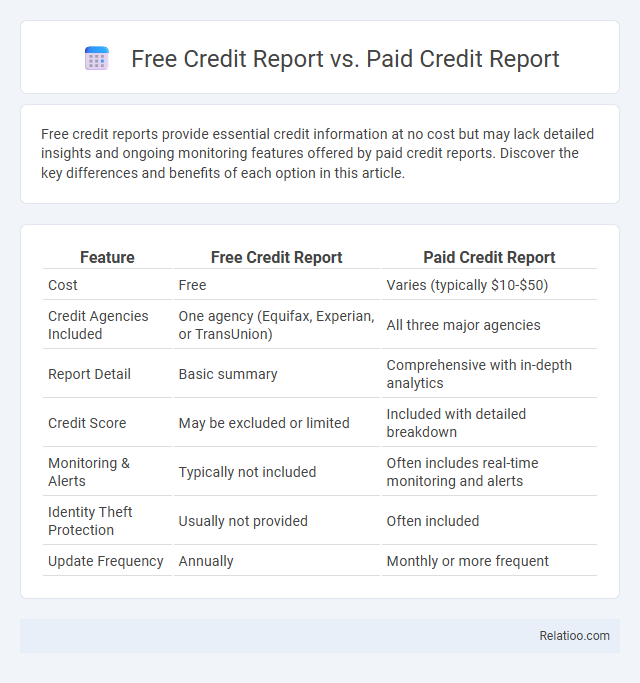

Free credit reports provide essential credit information at no cost but may lack detailed insights and ongoing monitoring features offered by paid credit reports. Discover the key differences and benefits of each option in this article.

Table of Comparison

| Feature | Free Credit Report | Paid Credit Report |

|---|---|---|

| Cost | Free | Varies (typically $10-$50) |

| Credit Agencies Included | One agency (Equifax, Experian, or TransUnion) | All three major agencies |

| Report Detail | Basic summary | Comprehensive with in-depth analytics |

| Credit Score | May be excluded or limited | Included with detailed breakdown |

| Monitoring & Alerts | Typically not included | Often includes real-time monitoring and alerts |

| Identity Theft Protection | Usually not provided | Often included |

| Update Frequency | Annually | Monthly or more frequent |

Introduction to Credit Reports

A credit report is a detailed record of an individual's credit history, including payment behavior, outstanding debts, and credit inquiries, maintained by credit bureaus such as Equifax, Experian, and TransUnion. Free credit reports typically provide basic credit information once per year as mandated by the Fair Credit Reporting Act (FCRA), whereas paid credit reports offer more comprehensive data, including credit scores, monitoring services, and identity theft alerts. Understanding the differences between free and paid credit reports is essential for managing personal finances and ensuring accurate credit reporting.

What is a Free Credit Report?

A free credit report is a detailed summary of your credit history provided at no cost, typically once a year, by major credit reporting agencies such as Equifax, Experian, and TransUnion through AnnualCreditReport.com. It includes information on your credit accounts, payment history, credit inquiries, and public records, helping consumers monitor their credit status and detect potential errors or fraud. Unlike paid credit reports, free credit reports may not always include credit scores or additional monitoring services that come with subscription-based credit products.

Features of Paid Credit Reports

Paid credit reports offer comprehensive features such as detailed credit score analysis, personalized credit monitoring alerts, and access to multiple credit bureau data. These reports often include additional insights like credit improvement tips, identity theft protection, and historical credit trends not found in free credit reports. Unlike free credit reports, paid services provide real-time updates and more frequent reporting options to help users maintain better control over their financial health.

Key Differences: Free vs Paid Credit Reports

Free credit reports provide basic credit information at no cost, often updated annually through official sources like AnnualCreditReport.com, while paid credit reports offer more frequent updates, detailed credit scores, and additional monitoring services. Paid reports typically include alerts for credit changes, identity theft protection, and in-depth analyses that help consumers better understand their credit health. The key difference lies in the level of detail, frequency of access, and added features beyond the free annual credit snapshot.

Accuracy and Update Frequency Comparison

Free credit reports typically provide basic credit information with limited update frequency, often refreshing every 30 days, which may affect the accuracy of recent credit activity. Paid credit reports offer more detailed insights and are updated more frequently, sometimes weekly, enhancing the accuracy and timeliness of your credit data. Your choice impacts how current and precise the credit report is, influencing financial decisions like loan approvals or credit monitoring.

Access to Credit Scores: Free vs Paid

Free credit reports provide basic access to credit scores, typically updated once a year, offering a snapshot of your financial standing without cost. Paid credit reports often include more frequent updates, detailed credit score ranges, and personalized analysis tools, enabling better monitoring and understanding of credit health. Access to comprehensive credit scores through paid services can enhance credit management by providing deeper insights into factors affecting creditworthiness.

Additional Tools and Monitoring Services

Paid credit reports often include additional tools such as detailed credit score tracking, personalized financial advice, and identity theft protection services that free credit reports typically lack. Free credit reports provide essential information like your credit history and current credit status but do not offer ongoing monitoring or alerts for changes in your credit profile. You can enhance your financial management by choosing a credit report service that combines comprehensive credit data with advanced monitoring features to quickly detect discrepancies or fraudulent activity.

Security and Privacy Considerations

Free credit reports typically offer basic information with limited access controls, raising potential privacy risks if obtained from unverified sources. Paid credit reports often include enhanced security features such as identity theft monitoring and secure portals to protect sensitive financial data. Reviewing credit reports from reputable agencies ensures stronger encryption protocols and compliance with privacy regulations, safeguarding personal information against unauthorized access.

When to Choose a Paid Credit Report

A paid credit report often provides more detailed information, including tradelines, payment history, and credit inquiries, making it ideal when you need an in-depth analysis for loan applications or dispute resolutions. Free credit reports, available annually from major bureaus, offer basic snapshots sufficient for casual monitoring but may miss timely updates or comprehensive data. You should choose a paid credit report when accuracy and thorough insight into your credit profile are critical for financial decisions or legal purposes.

Making the Right Choice for Your Financial Health

Free credit reports provide essential insights into your credit history without cost, ideal for regular monitoring to detect errors and potential identity theft. Paid credit reports often include more detailed information, such as credit scores and in-depth analysis, which can be beneficial for making significant financial decisions like applying for loans or mortgages. Choosing the right credit report depends on your specific needs: use free reports for routine checks and opt for paid reports when comprehensive data is necessary to improve or maintain your financial health.

Infographic: Free Credit Report vs Paid Credit Report

relatioo.com

relatioo.com