Deductible is the fixed amount you pay out-of-pocket before insurance covers expenses, while coinsurance is the percentage of costs you share with your insurer after the deductible is met. Understand how deductible vs coinsurance impacts your healthcare expenses and coverage details in this article.

Table of Comparison

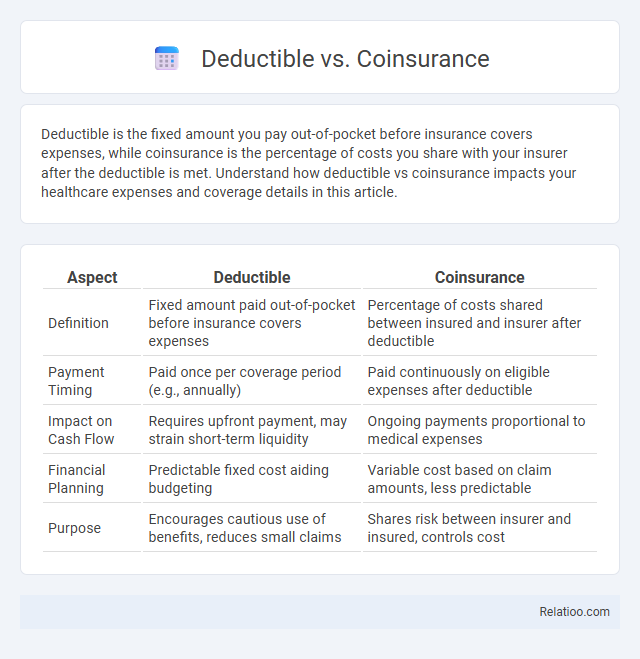

| Aspect | Deductible | Coinsurance |

|---|---|---|

| Definition | Fixed amount paid out-of-pocket before insurance covers expenses | Percentage of costs shared between insured and insurer after deductible |

| Payment Timing | Paid once per coverage period (e.g., annually) | Paid continuously on eligible expenses after deductible |

| Impact on Cash Flow | Requires upfront payment, may strain short-term liquidity | Ongoing payments proportional to medical expenses |

| Financial Planning | Predictable fixed cost aiding budgeting | Variable cost based on claim amounts, less predictable |

| Purpose | Encourages cautious use of benefits, reduces small claims | Shares risk between insurer and insured, controls cost |

Understanding Health Insurance Basics

Understanding health insurance basics requires grasping the differences between deductible, coinsurance, and copayment. Your deductible is the amount you pay out-of-pocket before insurance starts covering expenses, while coinsurance is the percentage of costs you share with the insurer after meeting the deductible. Copayments are fixed fees for specific services, helping you manage healthcare costs effectively.

What Is a Deductible?

A deductible is the fixed amount you pay out-of-pocket for covered healthcare services before your insurance plan starts to pay. Coinsurance is the percentage of costs you share with your insurer after meeting the deductible, while a copayment is a set fee for specific services. Understanding your deductible helps you manage your healthcare expenses and anticipate when insurance coverage begins.

How Does Coinsurance Work?

Coinsurance is the percentage of covered medical expenses a policyholder pays after meeting the deductible, which is a fixed amount paid out-of-pocket before insurance starts covering costs. For example, if the deductible is $1,000 and the coinsurance is 20%, the insured pays the first $1,000, then 20% of subsequent medical bills while the insurer pays the remaining 80%. Understanding coinsurance helps consumers estimate their share of healthcare costs beyond the deductible, impacting overall out-of-pocket expenses.

Key Differences Between Deductible and Coinsurance

Deductible is the fixed amount a policyholder must pay out-of-pocket before the insurance company begins to cover expenses, while coinsurance is the percentage of costs the policyholder pays after the deductible is met. The deductible resets annually, impacting the initial financial responsibility, whereas coinsurance applies continuously during the coverage period, affecting ongoing costs. Understanding these distinctions is crucial for managing healthcare expenses and selecting appropriate insurance plans.

Real-Life Examples: Deductible vs Coinsurance

A deductible is the fixed amount a policyholder pays out-of-pocket before insurance covers expenses, such as a $1,000 deductible on a hospital bill. Coinsurance is the percentage of costs the insured shares with the insurer after the deductible is met, like paying 20% of a $5,000 surgery bill while the insurer pays 80%. In real-life scenarios, if a patient has a $1,000 deductible and 20% coinsurance, they first pay $1,000, followed by 20% of any additional costs, illustrating how these terms affect overall medical expenses.

Impact of Deductible and Coinsurance on Out-of-Pocket Costs

Deductibles require policyholders to pay a specific amount out-of-pocket before insurance coverage begins, significantly influencing initial medical expenses. Coinsurance involves the insured paying a fixed percentage of costs after the deductible is met, impacting the total out-of-pocket amount during ongoing care. Understanding the distinction between deductible amounts and coinsurance percentages is crucial for managing overall healthcare expenses effectively.

Choosing a Health Plan: Deductible vs Coinsurance Considerations

When choosing a health plan, understanding the impact of deductible vs. coinsurance on your out-of-pocket costs is crucial. A deductible is the fixed amount you pay before insurance coverage begins, while coinsurance is the percentage of costs you share with your insurer after meeting the deductible. Your best choice depends on your expected medical expenses and financial situation, balancing upfront costs against ongoing payments.

Pros and Cons of High Deductible vs High Coinsurance Plans

High deductible plans often come with lower monthly premiums, offering financial relief upfront but requiring you to pay more out-of-pocket before insurance begins to cover costs. High coinsurance plans typically feature lower deductibles but can expose you to a larger percentage of medical expenses once the deductible is met, potentially resulting in unpredictable healthcare costs. Choosing between these options depends on your ability to manage upfront expenses versus ongoing cost-sharing, with high deductibles favoring those who prefer predictable lower premiums and high coinsurance suiting those who want smaller initial payments but can handle variable costs later.

Frequently Asked Questions About Deductible and Coinsurance

Deductible and coinsurance are key components of health insurance that affect your out-of-pocket costs. A deductible is the fixed amount you pay before your insurance begins to cover expenses, while coinsurance refers to the percentage of costs you share with your insurer after meeting the deductible. Understanding these terms helps you better manage your healthcare finances and avoid unexpected expenses.

Tips for Managing Deductibles and Coinsurance in Your Budget

To manage deductibles and coinsurance effectively within your budget, start by understanding your insurance plan's cost-sharing structure including deductible amounts and coinsurance percentages. Opt for preventive care covered without cost-sharing to reduce out-of-pocket expenses, and track medical expenses carefully to anticipate when deductibles will be met. Utilize Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) to set aside pre-tax funds, improving financial preparedness for coinsurance payments after deductible thresholds are reached.

Infographic: Deductible vs Coinsurance

relatioo.com

relatioo.com