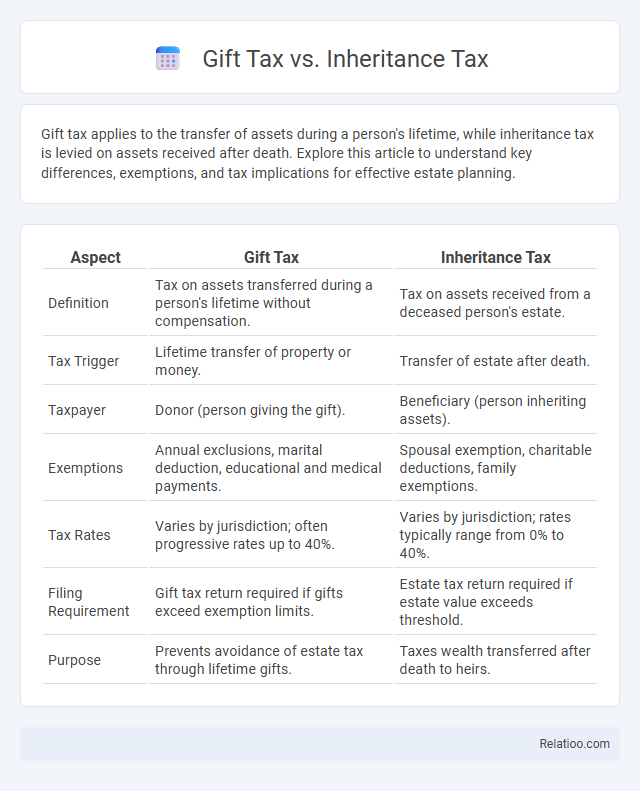

Gift tax applies to the transfer of assets during a person's lifetime, while inheritance tax is levied on assets received after death. Explore this article to understand key differences, exemptions, and tax implications for effective estate planning.

Table of Comparison

| Aspect | Gift Tax | Inheritance Tax |

|---|---|---|

| Definition | Tax on assets transferred during a person's lifetime without compensation. | Tax on assets received from a deceased person's estate. |

| Tax Trigger | Lifetime transfer of property or money. | Transfer of estate after death. |

| Taxpayer | Donor (person giving the gift). | Beneficiary (person inheriting assets). |

| Exemptions | Annual exclusions, marital deduction, educational and medical payments. | Spousal exemption, charitable deductions, family exemptions. |

| Tax Rates | Varies by jurisdiction; often progressive rates up to 40%. | Varies by jurisdiction; rates typically range from 0% to 40%. |

| Filing Requirement | Gift tax return required if gifts exceed exemption limits. | Estate tax return required if estate value exceeds threshold. |

| Purpose | Prevents avoidance of estate tax through lifetime gifts. | Taxes wealth transferred after death to heirs. |

Introduction to Gift Tax and Inheritance Tax

Gift tax applies to the transfer of assets or money from one individual to another without receiving something of equal value in return, and it typically targets the donor's contributions above a certain exemption limit. Inheritance tax is levied on the estate or the beneficiaries receiving assets after someone's death, based on the estate's total value and applicable thresholds. You should understand these tax distinctions to optimize your estate planning and minimize tax liabilities through strategic gifting and inheritance management.

Definitions: Gift Tax vs Inheritance Tax

Gift tax applies to the transfer of assets or money from one individual to another without receiving something of equal value in return during the giver's lifetime. Inheritance tax is levied on the beneficiaries who receive assets or property after the death of the original owner. Both taxes aim to regulate asset transfers but differ primarily in timing and the nature of the transaction.

Key Differences Between Gift and Inheritance Taxes

Gift tax applies when you transfer assets during your lifetime, while inheritance tax is imposed on beneficiaries receiving assets after someone's death. Gift tax is paid by the giver, with annual exclusion limits, whereas inheritance tax is typically paid by the recipient and varies based on relationship and estate value. Understanding these key differences ensures proper tax planning and compliance with IRS regulations.

How Gift Tax Works

Gift tax applies to the transfer of assets from one individual to another without receiving something of equal value in return, typically triggered when the gift exceeds the annual exclusion amount set by the IRS, which is $17,000 per recipient in 2024. The giver, or donor, is generally responsible for paying the gift tax, though strategies like the lifetime exemption--currently $12.92 million per individual--allow many gifts to bypass immediate taxation. In comparison, inheritance tax is levied on beneficiaries receiving assets after death, varying by state, whereas gifting during a donor's lifetime can reduce the taxable estate and potentially minimize future estate tax liabilities.

How Inheritance Tax Works

Inheritance tax is a levy imposed on assets received from a deceased person's estate, calculated based on the value of the inheritance and the beneficiary's relationship to the deceased. The tax rate varies by jurisdiction, with many countries using progressive rates and exemptions or thresholds to reduce the tax burden for close relatives. Unlike gift tax, which applies to transfers made during a person's lifetime, inheritance tax is triggered only after death, ensuring that estate distribution complies with legal and tax obligations.

Exemptions and Thresholds

Gift tax and inheritance tax both impose financial obligations on transferred assets, but their exemptions and thresholds differ significantly depending on jurisdiction. You can gift up to $17,000 per recipient annually in the U.S. without incurring gift tax, while the federal estate tax exemption allows up to $12.92 million to pass tax-free upon death as of 2023. Understanding these limits helps optimize tax planning strategies and maximizes the value of your transferred assets.

Tax Rates and Calculation Methods

Gift tax rates vary by jurisdiction, commonly ranging from 18% to 40%, and are calculated based on the fair market value of assets transferred during the donor's lifetime. Inheritance tax applies to beneficiaries receiving assets after death, with rates often between 0% and 40%, depending on the relationship to the decedent and asset value. Gifting strategies can minimize tax liabilities through annual exclusions and lifetime exemptions, requiring precise calculation of taxable amounts after deducting these thresholds to optimize tax efficiency.

Filing Requirements and Deadlines

Gift tax requires the donor to file IRS Form 709 if the gift exceeds the annual exclusion amount of $17,000 per recipient in 2023, with the deadline aligned to the donor's federal tax return, typically April 15. Inheritance tax filing depends on state laws--only six states impose inheritance tax, each with distinct filing thresholds and deadlines, usually within nine months of the decedent's death. Gifting that falls below the annual exclusion does not necessitate filing, but cumulative gifts above the lifetime exemption of $12.92 million must be reported to the IRS to avoid penalties.

Strategies for Minimizing Tax Liability

Strategies for minimizing tax liability involve understanding the differences between gift tax, inheritance tax, and gifting mechanisms. Utilizing annual gift tax exclusions, lifetime exemptions, and employing trusts can reduce taxable estate values while preserving wealth transfer benefits. Proper timing, documentation, and leveraging state-specific tax laws further optimize tax outcomes in estate planning.

Conclusion: Choosing the Best Tax Planning Approach

Selecting the optimal tax planning strategy depends on individual financial goals, asset types, and timing preferences, with gift tax laws favoring early transfers to minimize estate size and inheritance tax targeting wealth passed at death. Gifting during one's lifetime allows leveraging annual exclusions and lifetime exemptions, reducing overall tax liability, whereas inheritance tax requires careful estate valuation and may involve higher rates. Combining both approaches prudently often results in significant tax savings and more efficient wealth transfer to beneficiaries.

Infographic: Gift Tax vs Inheritance Tax

relatioo.com

relatioo.com