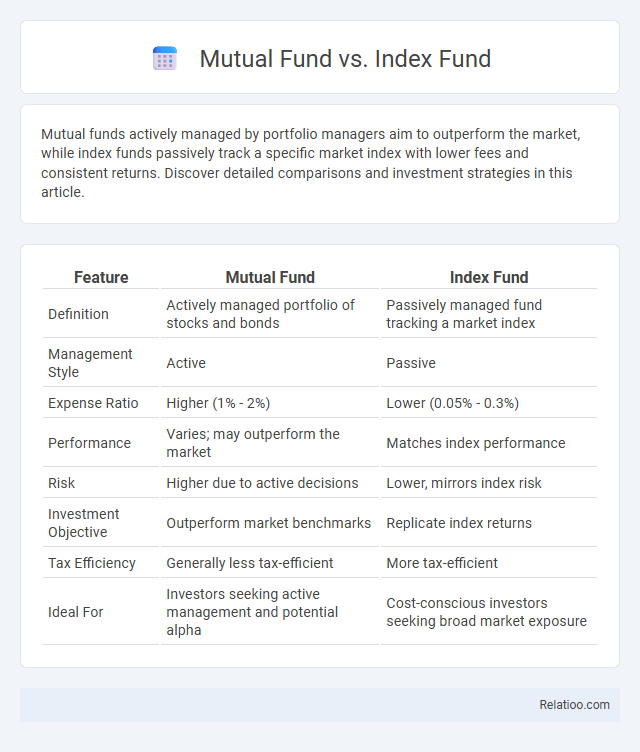

Mutual funds actively managed by portfolio managers aim to outperform the market, while index funds passively track a specific market index with lower fees and consistent returns. Discover detailed comparisons and investment strategies in this article.

Table of Comparison

| Feature | Mutual Fund | Index Fund |

|---|---|---|

| Definition | Actively managed portfolio of stocks and bonds | Passively managed fund tracking a market index |

| Management Style | Active | Passive |

| Expense Ratio | Higher (1% - 2%) | Lower (0.05% - 0.3%) |

| Performance | Varies; may outperform the market | Matches index performance |

| Risk | Higher due to active decisions | Lower, mirrors index risk |

| Investment Objective | Outperform market benchmarks | Replicate index returns |

| Tax Efficiency | Generally less tax-efficient | More tax-efficient |

| Ideal For | Investors seeking active management and potential alpha | Cost-conscious investors seeking broad market exposure |

Understanding Mutual Funds and Index Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio managed by professionals aiming for growth or income. Index funds are a type of mutual fund specifically designed to replicate the performance of a particular market index, such as the S&P 500, offering lower fees due to passive management. Understanding the differences involves recognizing that while all index funds are mutual funds focused on tracking indices, not all mutual funds follow a passive strategy, as many actively manage assets to outperform the market.

How Mutual Funds Work

Mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities, managed by professional fund managers who actively select assets based on research and market analysis. Index funds replicate a specific market index, such as the S&P 500, by holding the same securities in the same proportions, offering low-cost, passive investment options with typically lower fees and reduced turnover. Understanding how mutual funds work helps you decide if active management suits your investment strategy or if the simplicity and cost-efficiency of index funds align better with your financial goals.

How Index Funds Operate

Index funds operate by replicating the performance of a specific market index, such as the S&P 500, through a passive investment strategy that involves holding all or a representative sample of the securities in the index. Unlike actively managed mutual funds, which rely on fund managers to select stocks aiming to outperform the market, index funds seek to match market returns with lower fees and reduced portfolio turnover. Your investment in an index fund offers broad market exposure, diversification, and cost efficiency, making it a preferred choice for long-term investors.

Key Differences Between Mutual Funds and Index Funds

Mutual funds are actively managed investment vehicles where fund managers select securities aiming to outperform the market, often resulting in higher management fees and transaction costs. Index funds are passively managed to replicate a specific market index, offering lower fees, greater tax efficiency, and more consistent performance aligned with the index. Key differences include management style, cost structure, and performance variability, with mutual funds providing potential for above-market returns but increased risk and fees, while index funds emphasize cost-efficiency and market-matching returns.

Investment Objectives and Strategies

Mutual funds aim to generate returns through active management by selecting a diversified portfolio of stocks or bonds based on specific investment objectives, such as growth, income, or capital preservation. Index funds replicate the performance of a specific market index, like the S&P 500, by passively holding the same securities in the same proportions, focusing on long-term market returns with lower management fees. Both mutual funds and index funds offer diversification, but mutual funds employ active strategies to outperform the market, while index funds seek to match benchmark performance efficiently.

Costs and Fees Comparison

Mutual funds typically charge higher management fees and expense ratios compared to index funds due to active portfolio management, which can impact your overall returns over time. Index funds have lower fees because they track a market index passively, reducing operational costs and minimizing expenses passed on to investors. Understanding these cost differences is essential for optimizing your investment strategy and maximizing long-term growth.

Performance and Returns Analysis

Index funds typically deliver consistent returns closely aligned with market benchmarks, offering lower expense ratios and reduced tracking errors compared to actively managed mutual funds. Actively managed mutual funds aim to outperform the market through expert portfolio selection but often incur higher fees and variable returns that may underperform index funds over the long term. Exchange-Traded Funds (ETFs) combine features of both, providing intraday trading flexibility and generally lower costs while tracking specific indices or themes, making their performance and returns highly dependent on fund strategy and market conditions.

Risk Factors in Mutual vs Index Funds

Mutual funds typically carry higher risk due to active management and frequent trading, which can lead to greater volatility and management fees affecting your returns. Index funds, designed to mirror a specific market index, generally offer lower risk by providing broad market exposure with minimal trading and lower costs. Your risk tolerance should guide the choice between the active strategies of mutual funds and the passive, more stable approach of index funds.

Tax Implications for Investors

Mutual funds typically generate higher taxable events due to active trading and capital gains distributions, while index funds offer tax efficiency by minimizing turnover and capital gains realization. Mutual funds may also involve management fees affecting net returns and potential tax liabilities on dividends, whereas index funds primarily aim to replicate market indices with lower expense ratios and reduced tax drag. Investors should consider their tax bracket and investment horizon when choosing between actively managed mutual funds and passive index funds to optimize after-tax returns.

Which Fund Type is Right for You?

Mutual funds offer actively managed portfolios aiming to outperform the market, while index funds track specific market indices with lower fees and consistent performance. Index funds are ideal if you prefer a passive investment approach with predictable returns, whereas mutual funds suit investors seeking professional management and potential for higher gains despite higher costs. Your choice depends on your risk tolerance, investment goals, and preference for active versus passive management strategies.

Infographic: Mutual Fund vs Index Fund

relatioo.com

relatioo.com