Operating expenses cover day-to-day business costs such as rent and salaries, while capital expenditures involve investments in long-term assets like equipment and property. Explore this article to understand how balancing these expenditures impacts financial strategy.

Table of Comparison

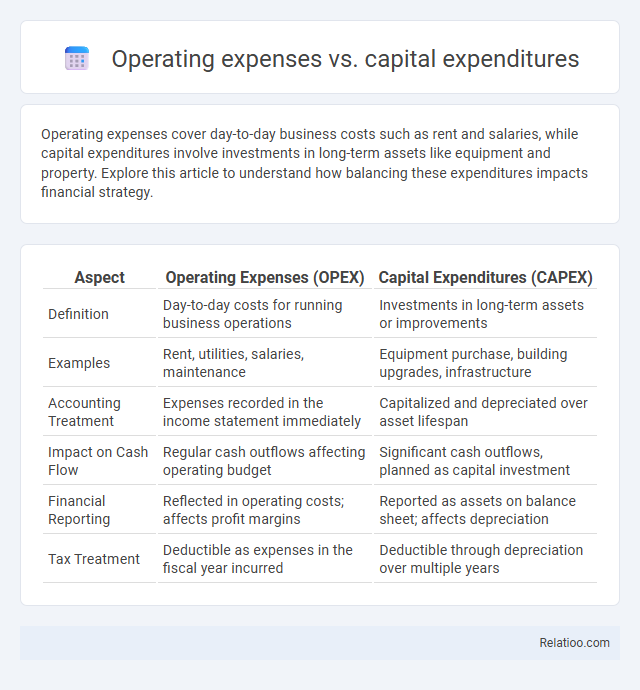

| Aspect | Operating Expenses (OPEX) | Capital Expenditures (CAPEX) |

|---|---|---|

| Definition | Day-to-day costs for running business operations | Investments in long-term assets or improvements |

| Examples | Rent, utilities, salaries, maintenance | Equipment purchase, building upgrades, infrastructure |

| Accounting Treatment | Expenses recorded in the income statement immediately | Capitalized and depreciated over asset lifespan |

| Impact on Cash Flow | Regular cash outflows affecting operating budget | Significant cash outflows, planned as capital investment |

| Financial Reporting | Reflected in operating costs; affects profit margins | Reported as assets on balance sheet; affects depreciation |

| Tax Treatment | Deductible as expenses in the fiscal year incurred | Deductible through depreciation over multiple years |

Understanding Operating Expenses and Capital Expenditures

Operating expenses (OPEX) refer to the ongoing costs required to run daily business operations, such as salaries, utilities, and maintenance, while capital expenditures (CAPEX) involve the purchase or improvement of long-term assets like equipment, buildings, or technology infrastructure. Accurate differentiation between OPEX and CAPEX is essential for financial planning, tax treatment, and cash flow management, as CAPEX typically requires capitalization and depreciation over time compared to the immediate expense recognition of OPEX. Allocation involves assigning portions of these expenses to specific departments or projects to track profitability and optimize resource utilization effectively.

Key Differences Between OPEX and CAPEX

Operating expenses (OPEX) are the day-to-day costs required to run your business, such as rent, utilities, and salaries, while capital expenditures (CAPEX) involve investments in long-term assets like equipment or property that provide value over time. OPEX impacts your income statement immediately as expenses, whereas CAPEX is recorded as an asset on the balance sheet and depreciated over its useful life. Allocation refers to how costs are distributed across departments or projects, affecting both OPEX and CAPEX budgeting decisions.

Examples of Operating Expenses

Operating expenses include costs such as rent, utilities, salaries, office supplies, and maintenance fees required for the day-to-day functioning of a business. Capital expenditures refer to funds used to acquire or upgrade physical assets like buildings, machinery, or technology, which provide long-term value. Proper allocation of your budget between operating expenses and capital expenditures ensures efficient financial management and sustainability.

Common Capital Expenditure Items

Common capital expenditure items include property, plant, and equipment purchases, machinery installations, and technology upgrades essential for long-term business growth. Operating expenses cover everyday costs like salaries, utilities, and maintenance that support ongoing operations without significantly extending asset life. Your financial planning should carefully allocate funds between capital expenditures and operating expenses to maintain operational efficiency and foster sustainable expansion.

Impact on Financial Statements

Operating expenses directly reduce your net income on the income statement as they are incurred for daily business operations, while capital expenditures are recorded as assets on the balance sheet and depreciated over time, affecting both the balance sheet and the income statement through depreciation expense. Allocation involves distributing costs across departments or projects, impacting expense recognition and profitability metrics in financial statements. Understanding these distinctions helps accurately analyze your company's financial health and performance.

Tax Treatment: OPEX vs CAPEX

Operating expenses (OPEX) are fully deductible in the tax year they are incurred, reducing taxable income immediately, while capital expenditures (CAPEX) must be capitalized and depreciated or amortized over the asset's useful life, spreading the tax deduction across multiple years. The tax treatment difference impacts cash flow, as OPEX provides immediate tax relief, whereas CAPEX offers deferred tax benefits through depreciation schedules. Proper allocation between OPEX and CAPEX is critical for accurate financial reporting and optimizing tax liabilities.

Decision-Making: When to Capitalize or Expense

Operating expenses cover your day-to-day costs like rent and utilities, which are fully expensed in the period incurred. Capital expenditures, such as purchasing equipment or property, are capitalized and depreciated over their useful life to match costs with revenue generation. Allocation helps in spreading costs appropriately, aiding decision-making by distinguishing when to capitalize investments for long-term benefits versus expensing immediate operational costs for accurate financial reporting.

Cash Flow Management Strategies

Operating expenses (OPEX) represent everyday costs necessary to run business operations, directly impacting short-term cash flow, while capital expenditures (CAPEX) involve long-term investments in assets that affect cash flow through depreciation and amortization over time. Effective cash flow management strategies balance timely payment of OPEX to maintain operational efficiency with strategic CAPEX planning to ensure sustainable growth without liquidity strain. Allocation of funds requires monitoring cash inflows and outflows carefully, optimizing working capital by adjusting the timing and amount of OPEX and CAPEX to maintain positive cash flow and support business objectives.

Industry-Specific OPEX and CAPEX Considerations

Operating expenses (OPEX) and capital expenditures (CAPEX) vary significantly across industries due to unique operational demands and investment cycles. For example, manufacturing companies allocate substantial CAPEX to machinery and facility upgrades, while technology firms focus more on OPEX for software subscriptions and cloud services. Understanding your industry's specific OPEX and CAPEX considerations enables better budgeting and strategic allocation of resources to optimize financial performance.

Best Practices for Tracking and Reporting

Effective tracking and reporting of operating expenses, capital expenditures, and allocation require clear categorization and consistent documentation to ensure accurate financial analysis. You should implement a robust accounting system that distinguishes routine operating costs from long-term capital investments, while allocating shared expenses proportionally across departments or projects. Regular audits and detailed reports enable transparency, support budgeting decisions, and optimize resource management for improved financial performance.

Infographic: Operating expenses vs Capital expenditures

relatioo.com

relatioo.com