Discretionary spending, controlled annually through the budget process, funds defense, education, and infrastructure, while mandatory spending covers entitlement programs like Social Security and Medicare based on eligibility criteria. Explore this article to understand how these spending categories impact national fiscal policy and economic priorities.

Table of Comparison

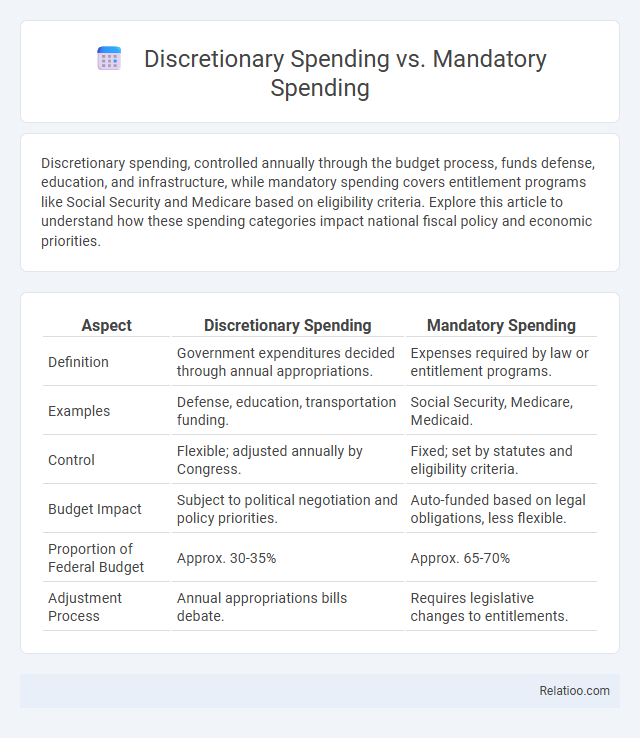

| Aspect | Discretionary Spending | Mandatory Spending |

|---|---|---|

| Definition | Government expenditures decided through annual appropriations. | Expenses required by law or entitlement programs. |

| Examples | Defense, education, transportation funding. | Social Security, Medicare, Medicaid. |

| Control | Flexible; adjusted annually by Congress. | Fixed; set by statutes and eligibility criteria. |

| Budget Impact | Subject to political negotiation and policy priorities. | Auto-funded based on legal obligations, less flexible. |

| Proportion of Federal Budget | Approx. 30-35% | Approx. 65-70% |

| Adjustment Process | Annual appropriations bills debate. | Requires legislative changes to entitlements. |

Understanding Discretionary Spending

Discretionary spending refers to the portion of the federal budget that Congress allocates annually through appropriations bills, covering defense, education, and transportation programs. Your understanding of discretionary spending is essential because it contrasts with mandatory spending, which includes entitlement programs like Social Security and Medicare, funded automatically without annual approval. Managing discretionary spending effectively impacts government priorities and resource distribution across various agencies and services.

What Is Mandatory Spending?

Mandatory spending refers to government expenditures required by law, primarily funding entitlement programs such as Social Security, Medicare, and Medicaid, which consume a significant portion of the federal budget--over 60% in recent years. Unlike discretionary spending, which is determined through annual appropriations by Congress for areas like defense and education, mandatory spending automatically continues unless laws are changed. This category sustains essential social safety nets and benefits, influencing long-term fiscal policy and budget deficits.

Key Differences Between Discretionary and Mandatory Spending

Discretionary spending refers to budget allocations that Congress can adjust annually through appropriation bills, including defense, education, and transportation funding, whereas mandatory spending involves pre-set obligations such as Social Security, Medicare, and interest on debt, driven by existing laws. The key difference lies in flexibility: discretionary spending can be modified each fiscal year based on policy priorities, while mandatory spending is largely predetermined and makes up a significant portion of the federal budget, typically around two-thirds. This structural distinction impacts fiscal policy decisions and the government's ability to respond to economic changes.

Examples of Discretionary Spending Programs

Discretionary spending programs include defense, education, transportation, and veterans' benefits, which are funded through annual congressional appropriations. These programs contrast with mandatory spending, such as Social Security and Medicare, which are funded by statutory obligations without annual review. Understanding the distinction helps you better analyze government budget priorities and their impact on public services.

Major Categories in Mandatory Spending

Mandatory spending primarily includes major categories such as Social Security, Medicare, and Medicaid, which together account for the largest portions of the federal budget. These programs provide essential benefits based on eligibility criteria rather than annual appropriations, ensuring consistent funding for retirement, healthcare, and low-income support. Understanding Your government's allocation in these mandatory categories highlights the significant impact on national fiscal priorities and budget planning.

How the Federal Budget Allocates Funds

The federal budget divides funds into three main categories: discretionary, mandatory, and discretionary spending, each serving distinct purposes. Discretionary spending, controlled through annual appropriations, funds defense, education, and transportation, while mandatory spending covers entitlement programs like Social Security, Medicare, and Medicaid, driven by eligibility rules rather than annual decisions. Understanding these allocations helps you grasp how the government prioritizes resources and manages fiscal policy.

The Role of Congress in Discretionary Spending

Congress controls discretionary spending through the annual appropriations process, determining funding levels for defense, education, and transportation programs. Unlike mandatory spending, which is set by existing laws for entitlement programs like Social Security and Medicare, discretionary spending requires active congressional approval each fiscal year. This process allows Congress to adjust priorities and allocate resources based on current policy goals and economic conditions.

Impact of Mandatory Spending on the National Debt

Mandatory spending, which includes entitlement programs like Social Security, Medicare, and Medicaid, constitutes a significant portion of the federal budget and directly impacts the national debt by consuming a large share of government revenues. Unlike discretionary spending, which is subject to annual appropriations and can be adjusted, mandatory spending grows automatically due to factors like an aging population and rising healthcare costs, limiting fiscal flexibility. Your understanding of this dynamic highlights the challenges policymakers face in managing the national debt while addressing essential social programs.

Trends and Changes in Federal Spending

Federal spending has seen a notable shift over recent decades, with mandatory spending, driven by entitlement programs like Social Security, Medicare, and Medicaid, steadily increasing and representing the largest portion of the budget. Discretionary spending, which includes defense and non-defense programs, has fluctuated but generally accounts for a smaller share compared to mandatory outlays. Trends indicate that rising costs in healthcare and an aging population will continue to drive mandatory spending growth, while discretionary spending faces constraints due to competing budget priorities and legislative caps.

Policy Debates: Reforming Spending Priorities

Policy debates on reforming spending priorities revolve around adjusting the balance between discretionary spending, mandatory spending, and interest payments. Discretionary spending, controlled through annual appropriations, includes defense and education, while mandatory spending covers entitlement programs like Social Security and Medicare, driven by eligibility rules. Reform efforts emphasize containing mandatory spending growth to ensure fiscal sustainability while preserving essential discretionary investments and managing rising interest obligations on federal debt.

Infographic: Discretionary Spending vs Mandatory Spending

relatioo.com

relatioo.com