Backup Withholding is a tax mechanism where the IRS requires payers to withhold a flat 24% on certain payments when the payee fails to provide a correct taxpayer identification number or is subject to IRS backup withholding requirements. Regular Withholding applies standard tax withholding rates based on income, filing status, and exemptions; to understand the differences and implications for your finances, read more in this article.

Table of Comparison

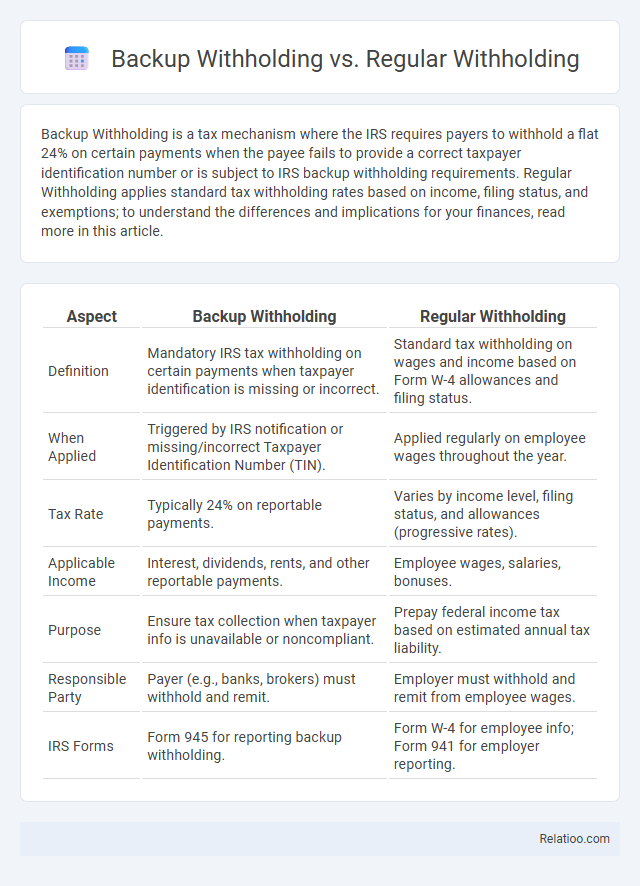

| Aspect | Backup Withholding | Regular Withholding |

|---|---|---|

| Definition | Mandatory IRS tax withholding on certain payments when taxpayer identification is missing or incorrect. | Standard tax withholding on wages and income based on Form W-4 allowances and filing status. |

| When Applied | Triggered by IRS notification or missing/incorrect Taxpayer Identification Number (TIN). | Applied regularly on employee wages throughout the year. |

| Tax Rate | Typically 24% on reportable payments. | Varies by income level, filing status, and allowances (progressive rates). |

| Applicable Income | Interest, dividends, rents, and other reportable payments. | Employee wages, salaries, bonuses. |

| Purpose | Ensure tax collection when taxpayer info is unavailable or noncompliant. | Prepay federal income tax based on estimated annual tax liability. |

| Responsible Party | Payer (e.g., banks, brokers) must withhold and remit. | Employer must withhold and remit from employee wages. |

| IRS Forms | Form 945 for reporting backup withholding. | Form W-4 for employee info; Form 941 for employer reporting. |

Introduction to Backup Withholding and Regular Withholding

Backup withholding is a tax mechanism requiring payers to withhold a flat 24% on certain payments if the payee fails to provide a correct Taxpayer Identification Number (TIN) or is subject to IRS backup withholding for underreported income. Regular withholding, by contrast, is the routine federal income tax withheld from wages based on the information you provide on Form W-4, reflecting your filing status and allowances. Understanding the differences between backup withholding and regular withholding is essential for ensuring your tax compliance and avoiding unexpected liabilities on payments such as interest, dividends, or freelance income.

Definition of Backup Withholding

Backup withholding is a specific IRS-required tax withholding on certain payments, such as interest, dividends, or other reportable income, when the payee fails to provide a correct taxpayer identification number (TIN) or is subject to IRS notification of underreporting. Unlike regular withholding, which applies to wage income based on IRS withholding tables, backup withholding ensures tax compliance on non-wage payments and is usually set at a flat rate of 24%. Your understanding of backup withholding is essential for accurate tax reporting and avoiding unexpected tax liabilities on miscellaneous income.

Definition of Regular Withholding

Regular withholding refers to the standard amount of federal income tax employers deduct from employees' wages based on IRS tax tables and the employee's W-4 form information. Backup withholding is an alternative tax withholding applied at a flat rate of 24% on certain payments if the payee fails to provide a correct taxpayer identification number or is subject to IRS notification. General withholding encompasses various forms of tax withholding, including regular and backup withholding, ensuring that taxpayers prepay income taxes throughout the year.

Key Differences Between Backup and Regular Withholding

Backup withholding requires a specific percentage (usually 24%) withheld on certain payments like interest, dividends, or non-employee compensation when the payee fails to provide a correct taxpayer identification number or is subject to IRS backup withholding requirements. Regular withholding applies primarily to wage income, where employers deduct federal income tax based on the employee's Form W-4 information, reflecting their filing status and allowances. Backup withholding acts as a safety net to ensure tax collection from non-reporting taxpayers, whereas regular withholding is a routine tax collection process for salaried or wage earners.

When Does Backup Withholding Apply?

Backup withholding applies when a taxpayer fails to provide a correct Taxpayer Identification Number (TIN) to a payer or the IRS notifies the payer that the TIN provided is incorrect. This withholding is required at a flat rate of 24% on certain types of payments, including interest, dividends, and other reportable payments. Regular withholding typically occurs on wages based on IRS tax tables, while general withholding refers to any tax withheld at source, making backup withholding a specific enforcement mechanism to ensure tax compliance.

Situations Requiring Regular Withholding

Regular withholding is required when you earn wages as an employee and your employer must withhold federal income tax based on your Form W-4 information and IRS tax tables. Backup withholding applies to certain payments like interest, dividends, or reportable payments when the payee fails to provide a correct taxpayer identification number or underreported income. You typically encounter regular withholding in payroll situations where consistent income tax deductions are mandated, unlike backup withholding, which is triggered by specific compliance issues.

Rates and Calculations for Each Withholding Type

Backup withholding mandates a flat 24% tax rate on certain payments like interest and dividends when taxpayers fail to provide a correct taxpayer identification number. Regular withholding varies by income, filing status, and allowances, calculated using IRS tax tables or payroll software to align with annual tax liability. General withholding encompasses both backup and regular methods, ensuring proper tax collection from wages, interest, dividends, and other income sources based on specific IRS guidelines.

IRS Forms and Reporting Requirements

Backup withholding requires payers to withhold a flat 24% on certain payments reported using IRS Forms 1099, such as interest and dividends, when the payee fails to provide a taxpayer identification number or under reports income. Regular withholding typically applies to wages reported on Form W-2, with amounts calculated based on IRS Circular E tables or employee Form W-4 submissions. General withholding encompasses both backup and regular withholding but varies by income type and corresponding IRS Forms, with precise reporting mandated to ensure tax compliance and accurate IRS record-keeping.

Common Mistakes and How to Avoid Them

Backup withholding occurs when the IRS requires a payer to withhold a flat 24% on certain payments due to missing or incorrect taxpayer information, while regular withholding is the standard deduction from wages based on your W-4 form allowances. A common mistake is failing to provide accurate taxpayer identification or misunderstanding when backup withholding applies, leading to unexpected tax deductions. To avoid these issues, ensure your taxpayer information is accurate, update your W-4 regularly, and verify the specific withholding requirements for various income types.

Choosing the Correct Withholding Method for Your Situation

Choosing the correct withholding method depends on your specific tax situation and income sources. Backup withholding applies when a taxpayer fails to provide a correct taxpayer identification number or underreports income, resulting in a flat withholding rate of 24% on certain payments. Regular withholding involves withholding tax based on your Form W-4 allowances and income, while general withholding may refer to various withholding practices, so understanding these distinctions helps you optimize your tax payments and avoid unexpected liabilities.

Infographic: Backup Withholding vs Regular Withholding

relatioo.com

relatioo.com