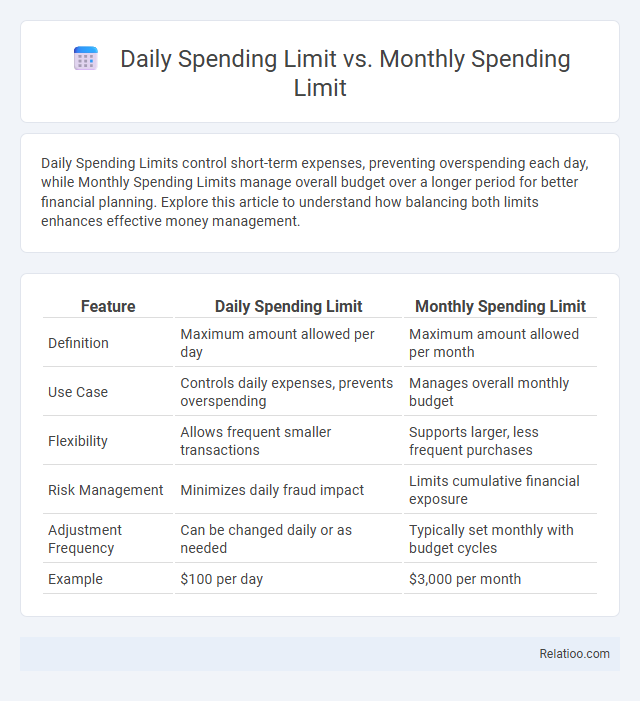

Daily Spending Limits control short-term expenses, preventing overspending each day, while Monthly Spending Limits manage overall budget over a longer period for better financial planning. Explore this article to understand how balancing both limits enhances effective money management.

Table of Comparison

| Feature | Daily Spending Limit | Monthly Spending Limit |

|---|---|---|

| Definition | Maximum amount allowed per day | Maximum amount allowed per month |

| Use Case | Controls daily expenses, prevents overspending | Manages overall monthly budget |

| Flexibility | Allows frequent smaller transactions | Supports larger, less frequent purchases |

| Risk Management | Minimizes daily fraud impact | Limits cumulative financial exposure |

| Adjustment Frequency | Can be changed daily or as needed | Typically set monthly with budget cycles |

| Example | $100 per day | $3,000 per month |

Introduction to Spending Limits

Spending limits control how much you can spend within a set timeframe, helping manage finances effectively. A daily spending limit restricts your expenditures each day, preventing overspending on impulsive purchases. Your monthly spending limit provides a broader budget overview, ensuring you stay on track with long-term financial goals, while overall spending limits offer a comprehensive cap across various accounts or categories.

What is a Daily Spending Limit?

A Daily Spending Limit restricts the maximum amount of money you can spend within a single day, providing tighter control over your daily expenses and preventing overspending. Unlike Monthly Spending Limits, which cap your total spending over a 30-day period, daily limits help manage short-term budgets more effectively. Understanding your Daily Spending Limit ensures you maintain financial discipline without exceeding your spending capacity on any given day.

What is a Monthly Spending Limit?

A Monthly Spending Limit sets a maximum amount you can spend within a single calendar month, helping you control your budget effectively over a longer period than a Daily Spending Limit, which restricts spending within 24 hours. While a general Spending Limit can refer to any predefined cap on expenses, the Monthly Spending Limit provides a clear framework to manage cash flow and prevent overspending throughout the month. Understanding your Monthly Spending Limit allows you to plan purchases strategically and maintain financial discipline without resorting to daily tracking.

Key Differences Between Daily and Monthly Limits

Daily spending limits restrict transaction amounts within a 24-hour period, offering tighter control over short-term expenses, while monthly spending limits cap total expenditures over a 30-day cycle, enabling broader budget management. Daily limits help prevent impulsive overspending by limiting frequent purchases, whereas monthly limits provide an aggregate threshold that accommodates varying spending patterns across weeks. Understanding these distinctions allows users to tailor financial controls based on either immediate cash flow needs or longer-term budgeting goals.

Benefits of Setting a Daily Spending Limit

Setting a daily spending limit helps you control expenses by preventing overspending in a short time frame and maintaining better cash flow management. Unlike monthly spending limits, daily limits offer more granular oversight, allowing you to adjust your budget dynamically based on daily needs. Your financial discipline improves as this approach reduces the risk of depleting funds prematurely, promoting consistent savings and more informed budgeting decisions.

Advantages of a Monthly Spending Limit

A Monthly Spending Limit provides a comprehensive overview of your financial control by capping total expenditures across all transactions within a 30-day period, helping to prevent overspending and manage budget more effectively. Unlike Daily Spending Limits, which restrict spending on a per-day basis, a monthly limit offers flexibility to allocate funds unevenly according to your spending habits, accommodating higher expenses in some days while balancing lower costs on others. Setting Your Monthly Spending Limit empowers long-term financial planning and reduces the risk of exceeding budget, supporting better cash flow management and financial discipline.

Potential Drawbacks of Each Limit Type

Daily spending limits can lead to unexpected restrictions during high-expense days, potentially interrupting urgent purchases or necessary transactions. Monthly spending limits may cause overspending early in the billing cycle, leaving insufficient funds for later needs and complicating budget management. Your ability to effectively control cash flow and avoid declined transactions can be hindered by the rigidity of each spending limit type, requiring careful monitoring and adjustment.

Best Situations for Daily vs Monthly Limits

Daily spending limits provide tight control over short-term expenses, making them ideal for managing cash flow, preventing overspending, and reducing fraud risk during high-frequency transactions. Monthly spending limits suit budget planning and expense tracking over longer periods, aligning well with pay cycles and subscription services. Daily limits work best for businesses with fluctuating daily sales or individuals needing strict short-term control, while monthly limits benefit those seeking overall budget adherence and predictable expense management.

Tips for Choosing the Right Spending Limit

When choosing the right spending limit, consider your financial habits and goals to decide between a daily, monthly, or overall spending limit. Daily spending limits help you control everyday expenses and prevent overspending, while monthly limits provide a broader perspective on your budget management. Assess your cash flow patterns and set limits that align with your income to maintain financial discipline and avoid debt.

Conclusion: Finding Your Ideal Spending Strategy

Daily Spending Limit controls short-term expenses by capping expenditures within a 24-hour period, ideal for managing everyday costs and preventing overspending. Monthly Spending Limit sets a broader boundary on aggregate spending over 30 days, providing greater flexibility while maintaining financial discipline. Spending Limit, encompassing both daily and monthly caps, enables personalized budgeting strategies that align with individual financial goals and cash flow patterns.

Infographic: Daily Spending Limit vs Monthly Spending Limit

relatioo.com

relatioo.com