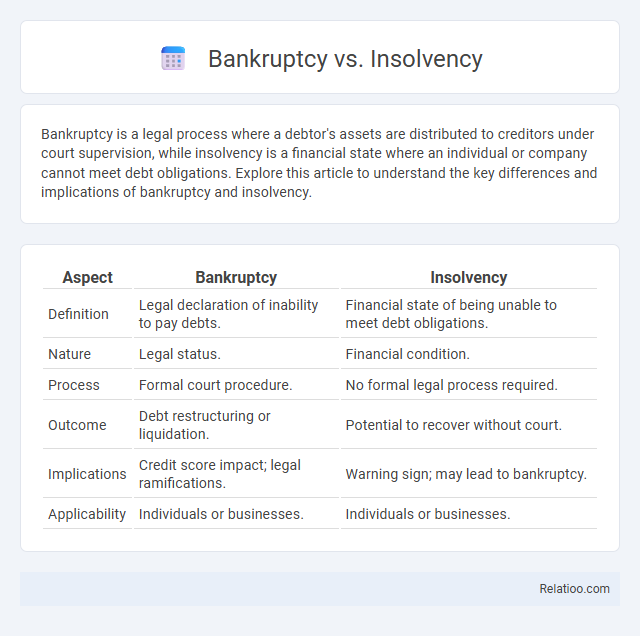

Bankruptcy is a legal process where a debtor's assets are distributed to creditors under court supervision, while insolvency is a financial state where an individual or company cannot meet debt obligations. Explore this article to understand the key differences and implications of bankruptcy and insolvency.

Table of Comparison

| Aspect | Bankruptcy | Insolvency |

|---|---|---|

| Definition | Legal declaration of inability to pay debts. | Financial state of being unable to meet debt obligations. |

| Nature | Legal status. | Financial condition. |

| Process | Formal court procedure. | No formal legal process required. |

| Outcome | Debt restructuring or liquidation. | Potential to recover without court. |

| Implications | Credit score impact; legal ramifications. | Warning sign; may lead to bankruptcy. |

| Applicability | Individuals or businesses. | Individuals or businesses. |

Understanding Bankruptcy and Insolvency: Key Differences

Bankruptcy is a legal process where an individual or business is declared unable to pay outstanding debts, resulting in court-managed asset liquidation or debt reorganization. Insolvency, however, is a financial state characterized by the inability to meet debt obligations as they come due, serving as a precursor to potential bankruptcy filings. Understanding the distinction between insolvency as a financial condition and bankruptcy as a legal status is crucial for effective debt management and legal decision-making.

Legal Definitions: Bankruptcy vs Insolvency

Bankruptcy is a legal status declared by a court when an individual or business cannot repay outstanding debts, leading to a formal process involving asset liquidation or restructuring under federal bankruptcy laws such as Chapter 7 or Chapter 13 in the United States. Insolvency, legally defined as the inability to meet financial obligations as they come due, serves as a financial state or condition rather than a court-declared status, often preceding bankruptcy proceedings. Understanding the distinction, bankruptcy is a specific legal resolution, while insolvency is a financial indicator that may lead to bankruptcy filings.

Causes Leading to Bankruptcy and Insolvency

Causes leading to bankruptcy and insolvency often include excessive debt accumulation, poor cash flow management, and unexpected financial crises such as job loss or medical emergencies. Insolvency occurs when liabilities exceed assets or when You cannot meet your financial obligations as they come due, while bankruptcy is a legal process initiated to address insolvency through court proceedings. Understanding these causes helps in recognizing early warning signs and seeking timely financial advice to avoid prolonged financial distress.

Signs and Symptoms of Financial Distress

Financial distress manifests through key signs such as missed debt payments, declining cash flow, and inability to meet operational expenses, often indicating insolvency where liabilities exceed assets. Bankruptcy is a legal status triggered when a debtor files for protection after prolonged insolvency, marked by creditor actions, lawsuits, or asset seizures. Recognizing symptoms like escalating debts, creditor pressure, and deteriorating financial ratios is crucial for early intervention before formal bankruptcy proceedings.

Bankruptcy Process Explained

The bankruptcy process involves a legal procedure where an individual or business declares inability to repay outstanding debts, leading to asset liquidation or reorganization under court supervision. Insolvency refers to the financial state of being unable to meet debt obligations, which may or may not result in formal bankruptcy proceedings. Understanding your bankruptcy process can help you navigate debt relief options, protect your credit, and manage creditor claims effectively.

Insolvency Resolution Mechanisms

Insolvency resolution mechanisms are crucial processes designed to help businesses or individuals address insolvency, where liabilities exceed assets or cash flow is insufficient to meet debts. These mechanisms include restructuring options, debt repayment plans, and legal proceedings aiming to restore financial viability without immediate liquidation. Understanding your options within insolvency resolution ensures better management of financial distress, distinguishing it from outright bankruptcy, which is a legal declaration of inability to pay debts.

Impact on Businesses: Bankruptcy vs Insolvency

Bankruptcy legally declares a business unable to meet debt obligations, leading to court-supervised liquidation or reorganization, which significantly disrupts operations and creditor relationships. Insolvency, a financial state where liabilities exceed assets or cash flow cannot cover debts, signals business distress but does not automatically trigger legal proceedings. Understanding the distinction is crucial for firms to manage risks, as insolvency offers a chance for restructuring before bankruptcy imposes legal constraints and asset forfeiture.

Consequences for Individuals and Creditors

Bankruptcy results in a legal declaration that an individual or entity cannot repay outstanding debts, often leading to asset liquidation to satisfy creditors and potential discharge of remaining debts, thereby protecting the individual from further collection actions. Insolvency, a financial state where liabilities exceed assets or inability to meet debt obligations, may not always lead to bankruptcy but signals financial distress requiring negotiation or restructuring with creditors to avoid legal consequences. The distinction impacts creditors differently: bankruptcy enforces a structured repayment plan or asset distribution under court supervision, while insolvency allows creditors to pursue varied remedies depending on the debtor's financial arrangements and jurisdictional laws.

Recovery and Rebuilding After Financial Distress

Bankruptcy and insolvency both indicate severe financial distress, but bankruptcy is a legal process declaring inability to pay debts, while insolvency refers to a financial state where liabilities exceed assets. Recovery after insolvency often involves restructuring debts and improving cash flows, whereas post-bankruptcy rebuilding includes court-approved repayment plans or discharge of debts enabling a fresh start. You can rebuild financial stability by focusing on budgeting, securing reliable income sources, and improving credit management to ensure long-term economic resilience.

Choosing the Right Solution: Bankruptcy or Insolvency

Understanding the distinctions between bankruptcy and insolvency is crucial when choosing the right financial solution, as bankruptcy is a legal status involving court proceedings to eliminate or restructure debts, while insolvency refers to the inability to meet financial obligations without necessarily entering legal action. Assessing factors like asset protection, debt type, and impact on credit score guides whether bankruptcy or alternative insolvency arrangements, such as debt restructuring or settlements, better address individual or business financial distress. Consulting with legal and financial experts ensures tailored strategies that optimize debt relief while minimizing long-term financial consequences.

Infographic: Bankruptcy vs Insolvency

relatioo.com

relatioo.com