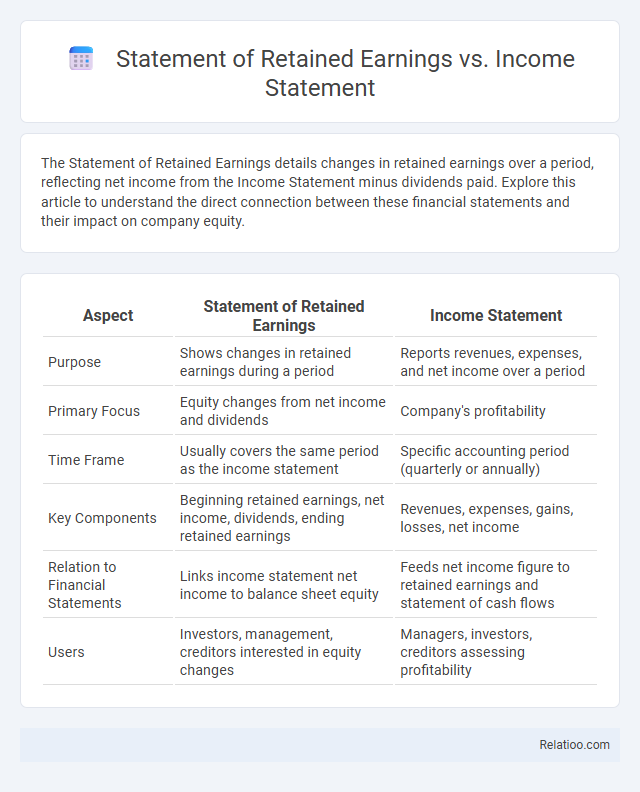

The Statement of Retained Earnings details changes in retained earnings over a period, reflecting net income from the Income Statement minus dividends paid. Explore this article to understand the direct connection between these financial statements and their impact on company equity.

Table of Comparison

| Aspect | Statement of Retained Earnings | Income Statement |

|---|---|---|

| Purpose | Shows changes in retained earnings during a period | Reports revenues, expenses, and net income over a period |

| Primary Focus | Equity changes from net income and dividends | Company's profitability |

| Time Frame | Usually covers the same period as the income statement | Specific accounting period (quarterly or annually) |

| Key Components | Beginning retained earnings, net income, dividends, ending retained earnings | Revenues, expenses, gains, losses, net income |

| Relation to Financial Statements | Links income statement net income to balance sheet equity | Feeds net income figure to retained earnings and statement of cash flows |

| Users | Investors, management, creditors interested in equity changes | Managers, investors, creditors assessing profitability |

Overview of Statement of Retained Earnings

The Statement of Retained Earnings summarizes the changes in retained earnings over a specific period, reflecting net income, dividends, and other adjustments. It connects the net profit from the Income Statement to the equity section of the Balance Sheet, providing insight into how earnings are reinvested or distributed. This statement is essential for understanding a company's financial health and decisions related to profit allocation.

What Is an Income Statement?

An income statement, also known as a profit and loss statement, summarizes a company's revenues and expenses over a specific period to determine net income or loss. It highlights key components such as total sales, cost of goods sold, operating expenses, and taxes, providing crucial insights into profitability and operational performance. Unlike the statement of retained earnings, which focuses on changes in equity from net income and dividends, the income statement centers exclusively on financial results during the reporting period.

Key Differences Between Statement of Retained Earnings and Income Statement

The Statement of Retained Earnings highlights changes in a company's retained earnings over a specific period, showing how net income and dividends impact equity. The Income Statement, however, summarizes revenues and expenses to calculate net profit or loss for that period. Your understanding improves by recognizing the retained earnings statement links net income from the income statement to changes in shareholders' equity, reflecting what portion of profit is reinvested rather than distributed.

Purpose and Importance of Each Financial Statement

The Statement of Retained Earnings highlights changes in a company's retained earnings over a period, showing how profits are reinvested or distributed as dividends, which is crucial for understanding your business's reinvestment strategy. The Income Statement provides a detailed summary of revenues and expenses, revealing profitability and operational performance essential for making informed financial decisions. The Balance Sheet offers a snapshot of assets, liabilities, and equity at a specific point, important for assessing overall financial health and stability.

Main Components: Retained Earnings vs Income Statement

The Statement of Retained Earnings primarily details changes in retained earnings, highlighting net income, dividends paid, and prior period adjustments, while the Income Statement focuses on revenues, expenses, gains, and losses to determine net profit or loss over a period. Retained earnings originate from cumulative net income minus distributions to shareholders, reflecting the company's reinvested earnings rather than immediate operational performance shown in the Income Statement. Understanding these distinctions allows stakeholders to assess profitability via the Income Statement and the impact of profit retention and dividend policy through the Statement of Retained Earnings.

How Each Statement Impacts Financial Analysis

The Statement of Retained Earnings reveals changes in a company's equity by tracking net income distribution and dividend payments, impacting financial analysis by showing reinvested profits for future growth. The Income Statement provides a detailed account of revenues, expenses, and net profit over a period, essential for evaluating operational performance and profitability trends. The Balance Sheet offers a snapshot of assets, liabilities, and shareholders' equity at a specific date, crucial for assessing financial stability, liquidity, and capital structure.

Relationship Between Retained Earnings and Net Income

Net income, reported on the Income Statement, directly impacts retained earnings, which are detailed in the Statement of Retained Earnings. The Statement of Retained Earnings reconciles the beginning retained earnings balance with the ending balance after accounting for net income and dividends paid. This relationship highlights how profitable operations increase retained earnings, linking financial performance to changes in shareholders' equity.

Preparation Process: Step-by-Step Comparison

The preparation process of the Income Statement begins with compiling revenues and subtracting expenses to calculate net income for a specific period. The Statement of Retained Earnings uses the net income from the Income Statement, adjusts for dividends, and updates retained earnings to reflect changes during the period. Your understanding improves by comparing these statements step-by-step, as the Income Statement focuses on profitability, while the Statement of Retained Earnings shows how profits are reinvested or distributed.

Common Mistakes When Using These Statements

Common mistakes when using the Statement of Retained Earnings include confusing net income with retained earnings, leading to inaccurate equity reports. In the Income Statement, errors often arise from misclassifying expenses or revenues, which distorts profitability analysis. Misinterpretation of these financial statements, such as treating retained earnings as cash flow or ignoring depreciation impacts on net income, compromises financial decision-making.

When to Use Statement of Retained Earnings vs Income Statement

The Statement of Retained Earnings is used to track changes in retained earnings over a specific period, showing how profits are reinvested or distributed as dividends, making it essential for assessing long-term equity growth. The Income Statement provides a detailed summary of revenues, expenses, and net income during that same period, offering insight into operational performance and profitability. You should use the Statement of Retained Earnings to understand equity changes linked to earnings and dividend policies, while the Income Statement is critical for evaluating the company's financial performance and profitability in a specific timeframe.

Infographic: Statement of Retained Earnings vs Income Statement

relatioo.com

relatioo.com