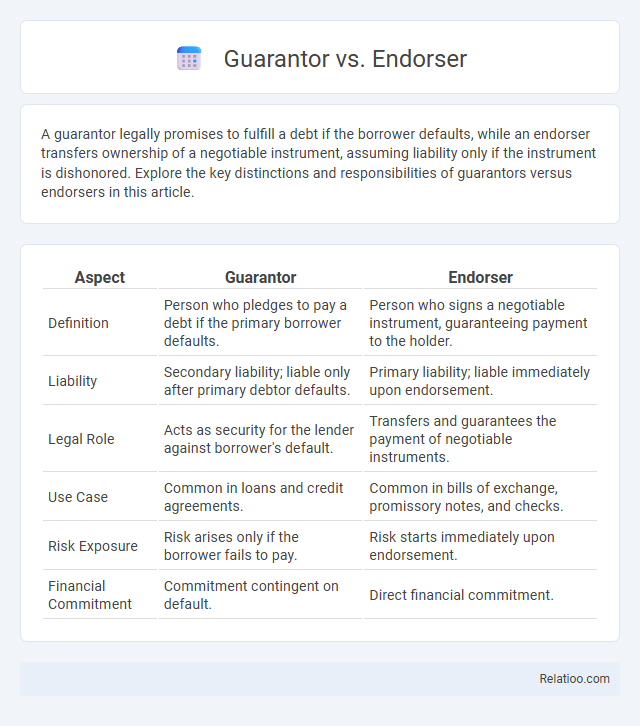

A guarantor legally promises to fulfill a debt if the borrower defaults, while an endorser transfers ownership of a negotiable instrument, assuming liability only if the instrument is dishonored. Explore the key distinctions and responsibilities of guarantors versus endorsers in this article.

Table of Comparison

| Aspect | Guarantor | Endorser |

|---|---|---|

| Definition | Person who pledges to pay a debt if the primary borrower defaults. | Person who signs a negotiable instrument, guaranteeing payment to the holder. |

| Liability | Secondary liability; liable only after primary debtor defaults. | Primary liability; liable immediately upon endorsement. |

| Legal Role | Acts as security for the lender against borrower's default. | Transfers and guarantees the payment of negotiable instruments. |

| Use Case | Common in loans and credit agreements. | Common in bills of exchange, promissory notes, and checks. |

| Risk Exposure | Risk arises only if the borrower fails to pay. | Risk starts immediately upon endorsement. |

| Financial Commitment | Commitment contingent on default. | Direct financial commitment. |

Understanding the Roles: Guarantor vs Endorser

A guarantor provides a legally binding promise to repay a debt if the primary borrower defaults, ensuring a higher level of security for lenders in loan agreements. An endorser, typically associated with negotiable instruments like checks or promissory notes, transfers ownership or guarantees payment by signing the document, assuming responsibility if the original issuer fails to pay. Understanding the distinct roles clarifies that guarantors back the borrower's obligations directly, whereas endorsers facilitate the transfer and assurance of payment through financial instruments.

Key Definitions: Who is a Guarantor? Who is an Endorser?

A guarantor is a person or entity that promises to fulfill the debt obligation if the primary borrower defaults, providing a secondary legal commitment to the lender. An endorser is an individual who signs a negotiable instrument, such as a promissory note or check, thereby transferring rights or guaranteeing payment to a subsequent party. The key difference lies in the guarantor's explicit secondary liability, while the endorser's role primarily involves endorsing payment or transferring ownership of the instrument.

Main Responsibilities of a Guarantor

A guarantor's main responsibility is to ensure the repayment of a debt or fulfillment of an obligation if the primary borrower defaults, making them legally liable for the outstanding balance. Unlike an endorser who merely signs a negotiable instrument to transfer ownership and may not be liable for repayment, the guarantor provides a secondary guarantee, pledging to cover the debt fully if the debtor cannot pay. You should understand that a guarantor's commitment involves a higher level of financial risk and legal obligation than other parties in a loan or credit agreement.

Core Duties of an Endorser

The core duties of an endorser involve transferring the ownership of a negotiable instrument by signing it, thereby guaranteeing payment to the holder only if the instrument is dishonored. You must ensure the instrument is properly endorsed to uphold the chain of title and secure your liability in case the maker defaults. Unlike a guarantor, who provides a secondary promise to pay, an endorser's responsibility primarily centers on the endorsement process and contingent liability upon non-payment.

Legal Implications: Guarantor vs Endorser

A guarantor legally commits to fulfilling a debtor's obligations if the debtor defaults, bearing secondary liability enforceable through a written guarantee agreement. An endorser, primarily in negotiable instruments, transfers the instrument's rights and can be held liable only upon dishonor of the instrument, with liability depending on endorsement type and notice requirements. The guarantor's liability is collateral and contingent, whereas the endorser faces primary liability upon non-payment, reflecting distinct legal duties and enforcement scenarios in contract and commercial law.

Financial Risks for Guarantors and Endorsers

Guarantors and endorsers both assume significant financial risks by promising to fulfill another party's debt obligations if they default, potentially affecting Your credit score and financial stability. Guarantors bear primary responsibility after the borrower defaults, often facing legal actions and immediate repayment demands, whereas endorsers typically risk liability only if the final holder of the financial instrument enforces payment. Understanding the distinctions in these roles is crucial to accurately assessing your exposure to financial loss and legal ramifications in lending or credit agreements.

Use Cases: When to Choose a Guarantor or an Endorser

A guarantor is ideal for secured loans or credit agreements where a third party promises to fulfill the borrower's obligations if they default, commonly used in mortgages or business loans. An endorser is appropriate for negotiable instruments like promissory notes or checks, transferring liability by signing or endorsing the document, often used in trade or finance transactions. Choose a guarantor when long-term credit assurance is needed, whereas an endorser suits short-term, transferable debt scenarios.

Impact on Creditworthiness and Liability

A guarantor legally guarantees repayment of a loan if the primary borrower defaults, significantly increasing their liability and potentially affecting their creditworthiness due to the risk exposure. An endorser transfers negotiable instruments, such as promissory notes, agreeing to pay if the maker defaults, which may impact their credit score if they are called upon to fulfill payment obligations. Compared to a guarantor, an endorser's liability is often more limited in scope but equally crucial to credit risk assessment by lenders.

Differences in Documentation and Agreements

Guarantors provide a secondary promise to pay a debtor's obligation if the primary borrower defaults, usually formalized through a separate guarantee agreement detailing the scope and conditions. Endorsers transfer rights or obligations by signing a negotiable instrument like a promissory note, with endorsement written directly on the document, creating immediate liability. The consistent distinction lies in documentation: guarantees involve distinct, often detailed contracts, while endorsements appear directly on financial instruments, reflecting different legal commitments and responsibilities.

Choosing the Right Option: Guarantor or Endorser?

Choosing the right option between a guarantor and an endorser depends on your specific financial needs and risk tolerance. A guarantor provides a secondary guarantee to repay a loan if you default, offering stronger assurance to lenders, while an endorser is more commonly associated with endorsing negotiable instruments, such as promissory notes, transferring payment responsibility. Understanding the legal obligations involved ensures you select the best role to support your financial agreements.

Infographic: Guarantor vs Endorser

relatioo.com

relatioo.com