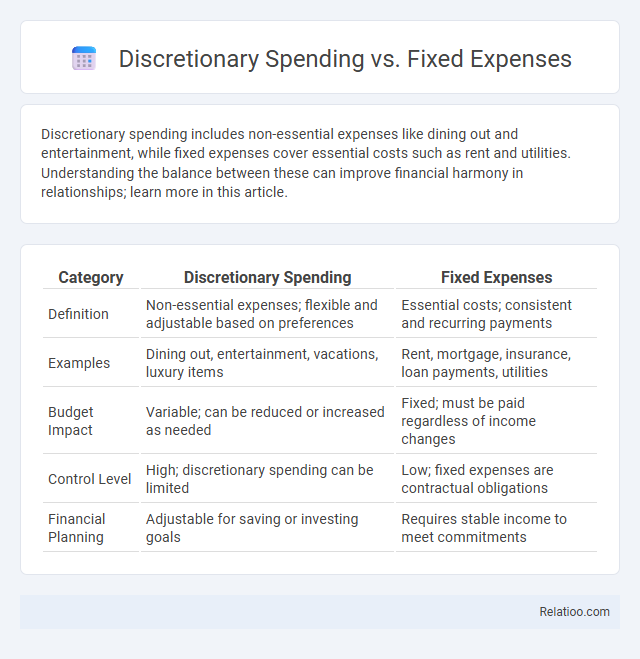

Discretionary spending includes non-essential expenses like dining out and entertainment, while fixed expenses cover essential costs such as rent and utilities. Understanding the balance between these can improve financial harmony in relationships; learn more in this article.

Table of Comparison

| Category | Discretionary Spending | Fixed Expenses |

|---|---|---|

| Definition | Non-essential expenses; flexible and adjustable based on preferences | Essential costs; consistent and recurring payments |

| Examples | Dining out, entertainment, vacations, luxury items | Rent, mortgage, insurance, loan payments, utilities |

| Budget Impact | Variable; can be reduced or increased as needed | Fixed; must be paid regardless of income changes |

| Control Level | High; discretionary spending can be limited | Low; fixed expenses are contractual obligations |

| Financial Planning | Adjustable for saving or investing goals | Requires stable income to meet commitments |

Understanding Discretionary Spending

Discretionary spending refers to non-essential expenses that you choose to spend on, such as dining out, entertainment, and hobbies, unlike fixed expenses which are regular, mandatory payments like rent, utilities, and loan installments. Understanding your discretionary spending is crucial for effective budgeting, as it allows you to identify areas where you can cut costs to save or redirect funds toward financial goals. Monitoring these expenditures helps maintain a balance between enjoyment and financial stability, empowering your overall money management strategy.

What Are Fixed Expenses?

Fixed expenses are recurring costs that remain constant each month, such as rent, mortgage payments, insurance premiums, and utility bills. These expenses are essential for maintaining your household or business operations and are typically non-negotiable in the short term. Understanding fixed expenses is crucial for effective budgeting, as they represent the baseline financial obligations that must be covered before allocating funds to discretionary spending.

Key Differences Between Discretionary and Fixed Costs

Discretionary spending refers to non-essential expenses that can be adjusted or eliminated based on budget preferences, such as entertainment or dining out, while fixed expenses are regular, unavoidable costs like rent, mortgage, or insurance payments that remain consistent over time. Key differences between discretionary and fixed costs include variability and necessity; discretionary costs fluctuate depending on individual choices, whereas fixed costs are predictable and necessary for maintaining basic living standards or business operations. Managing the balance between these expenses is crucial for effective budgeting and financial planning, as reducing discretionary spending can provide flexibility without impacting essential obligations.

Examples of Discretionary Spending

Discretionary spending includes non-essential expenses such as dining out, entertainment, hobbies, and luxury purchases, distinguishing it from fixed expenses like rent, mortgage, or insurance premiums that remain constant each month. Variable expenses may overlap with discretionary spending but also encompass necessary costs that fluctuate, such as utilities or groceries. Understanding examples of discretionary spending helps you identify where your budget can be adjusted to improve financial flexibility and savings potential.

Common Fixed Expense Categories

Common fixed expense categories include rent or mortgage payments, utility bills, and insurance premiums, which remain constant regardless of monthly income fluctuations. These costs are essential for maintaining household stability and financial planning accuracy. Understanding the distinction between fixed expenses and discretionary spending, such as dining out or entertainment, helps budget effectively by ensuring essential obligations are met first.

Impact on Monthly Budgeting

Discretionary spending includes non-essential expenses like dining out or entertainment, which you can adjust to manage your monthly budget effectively. Fixed expenses, such as rent or mortgage payments and loan installments, remain constant and require priority in budget planning to avoid financial strain. Understanding the impact of these categories helps you allocate funds wisely, ensuring essential costs are covered while allowing flexibility in discretionary spending for better financial control.

Managing Discretionary Spending Effectively

Managing discretionary spending effectively requires a clear distinction between fixed expenses, like rent and utilities, and variable discretionary costs such as dining out or entertainment. You can optimize your budget by prioritizing essential fixed expenses and setting limits on discretionary spending to avoid overspending. Regularly tracking and adjusting your discretionary budget enables better control over your finances and supports long-term financial goals.

Strategies to Reduce Fixed Expenses

Reducing fixed expenses requires a strategic approach such as negotiating lower rates on recurring bills, refinancing loans for better interest rates, and eliminating unused subscriptions. You can audit your monthly commitments to identify non-essential services that may be downgraded or canceled to create immediate savings. Implementing these strategies helps improve financial flexibility and supports better budgeting by lowering your fixed expense burden.

Balancing Discretionary and Fixed Expenses

Balancing discretionary spending and fixed expenses requires careful budgeting to ensure financial stability and flexibility. Fixed expenses like rent, utilities, and loan payments must be prioritized as they are essential and recurring, while discretionary spending on non-essential items such as entertainment and dining out should be adjusted according to the remaining budget. Monitoring monthly income and using budgeting tools can help maintain an optimal balance, preventing overspending and promoting savings goals.

Financial Planning: Prioritizing Expenses

Effective financial planning requires distinguishing between discretionary spending, fixed expenses, and variable expenses to prioritize your budget accurately. Fixed expenses, such as rent and insurance, remain constant and must be paid first, while discretionary spending includes non-essential items that can be adjusted based on financial goals. Understanding these categories helps you allocate funds efficiently, ensuring essential obligations are met before directing resources toward flexible spending.

Infographic: Discretionary Spending vs Fixed Expenses

relatioo.com

relatioo.com