Operating expenses include costs directly related to core business activities, such as salaries and rent, whereas non-operating expenses are unrelated to primary operations, like interest and investment losses. Explore this article to understand how the distinction impacts financial analysis and decision-making.

Table of Comparison

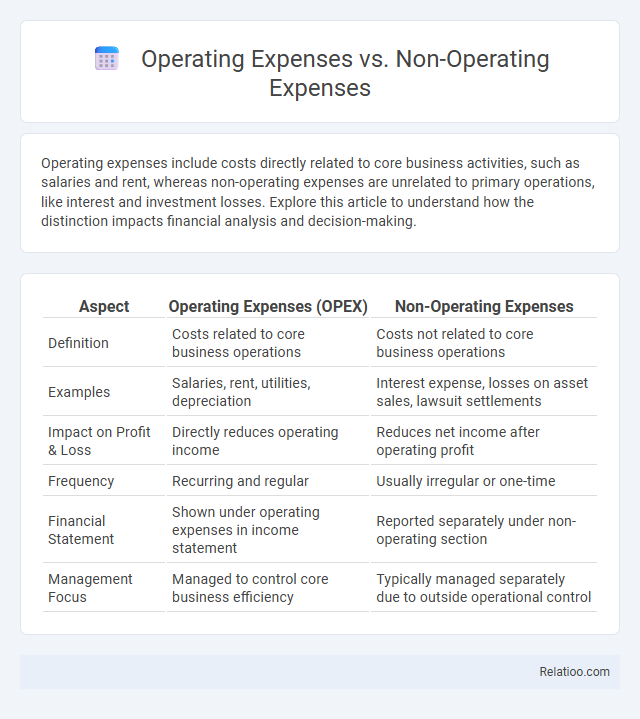

| Aspect | Operating Expenses (OPEX) | Non-Operating Expenses |

|---|---|---|

| Definition | Costs related to core business operations | Costs not related to core business operations |

| Examples | Salaries, rent, utilities, depreciation | Interest expense, losses on asset sales, lawsuit settlements |

| Impact on Profit & Loss | Directly reduces operating income | Reduces net income after operating profit |

| Frequency | Recurring and regular | Usually irregular or one-time |

| Financial Statement | Shown under operating expenses in income statement | Reported separately under non-operating section |

| Management Focus | Managed to control core business efficiency | Typically managed separately due to outside operational control |

Introduction to Operating and Non-Operating Expenses

Operating expenses represent the regular costs incurred during the core business activities, including salaries, rent, utilities, and office supplies. Non-operating expenses arise from activities unrelated to the primary operations, such as interest payments, losses from asset sales, and restructuring costs. Understanding the distinction between operating and non-operating expenses is crucial for accurate financial analysis and effective cost management.

Defining Operating Expenses

Operating expenses represent the costs essential for running your core business activities, including rent, utilities, salaries, and inventory costs. Non-operating expenses, in contrast, arise from secondary activities such as interest payments, losses on investments, or lawsuits. Understanding the distinction between operating expenses and these other costs helps you analyze your company's operational efficiency and profitability accurately.

Understanding Non-Operating Expenses

Non-operating expenses are costs unrelated to a company's core business activities, such as interest payments, losses on asset sales, and restructuring charges, distinguishing them from operating expenses which include costs directly tied to production and daily operations like salaries and utilities. Understanding non-operating expenses is crucial for accurately assessing a company's financial health, as these expenses can significantly influence net income without reflecting operational efficiency. Investors analyze non-operating expenses separately to evaluate the sustainability of earnings and to identify potential financial risks outside the core business operations.

Key Differences Between Operating and Non-Operating Expenses

Operating expenses are the costs incurred from core business activities such as rent, utilities, and salaries, which directly impact your company's profitability. Non-operating expenses, including interest payments and losses from investments, arise from activities outside the primary operations and affect net income but not operating income. Understanding these distinctions helps you accurately analyze financial statements and make strategic business decisions.

Common Examples of Operating Expenses

Operating expenses typically include costs directly related to core business activities such as rent, utilities, salaries, and office supplies. Non-operating expenses arise from secondary activities like interest payments, losses on asset sales, or lawsuit settlements. Understanding these distinctions helps businesses accurately categorize expenses for financial reporting and analysis.

Common Examples of Non-Operating Expenses

Non-operating expenses include costs not related to your core business operations, such as interest expenses, losses on asset sales, and lawsuit settlements. Operating expenses, like salaries, rent, and utilities, are directly tied to daily business activities. Understanding the distinction between these expenses helps you analyze financial statements accurately and manage your company's profitability effectively.

Impact on Financial Statements

Operating expenses directly reduce operating income on the income statement, reflecting costs essential for core business activities such as salaries, rent, and utilities. Non-operating expenses, including interest payments and losses from asset sales, appear below operating income and affect net income but are not tied to primary business operations. Total expenses impact the overall profitability and cash flow, playing a critical role in assessing company performance and guiding financial analysis.

Importance in Business Decision-Making

Operating expenses directly impact a company's core business functions and are crucial for budgeting and forecasting profitability. Non-operating expenses, such as interest and losses, influence financial performance but are peripheral to daily operations, aiding in assessing overall financial health. Understanding the distinction between these expenses enables accurate cost management and strategic decision-making to optimize resource allocation and improve business sustainability.

Managing and Controlling Expenses Effectively

Operating expenses, such as rent, salaries, and utilities, directly impact your company's core business functions and require continuous monitoring to ensure efficient resource allocation. Non-operating expenses, including interest payments and loss on asset sales, must be controlled through strategic financial planning to minimize their effect on overall profitability. Effective management of all expenses involves detailed budgeting, regular variance analysis, and implementing cost-saving measures to maintain healthy cash flow and maximize your business's financial sustainability.

Conclusion: Optimizing Expense Strategies

Optimizing expense strategies requires distinguishing operating expenses, which include costs directly tied to core business activities like salaries and utilities, from non-operating expenses such as interest payments or losses from asset sales. Effective management enhances profitability by minimizing unnecessary operating costs while carefully controlling non-operating expenses to reduce overall financial strain. A strategic balance between these expense categories improves cash flow, supports sustainable growth, and maximizes shareholder value.

Infographic: Operating Expenses vs Non-Operating Expenses

relatioo.com

relatioo.com