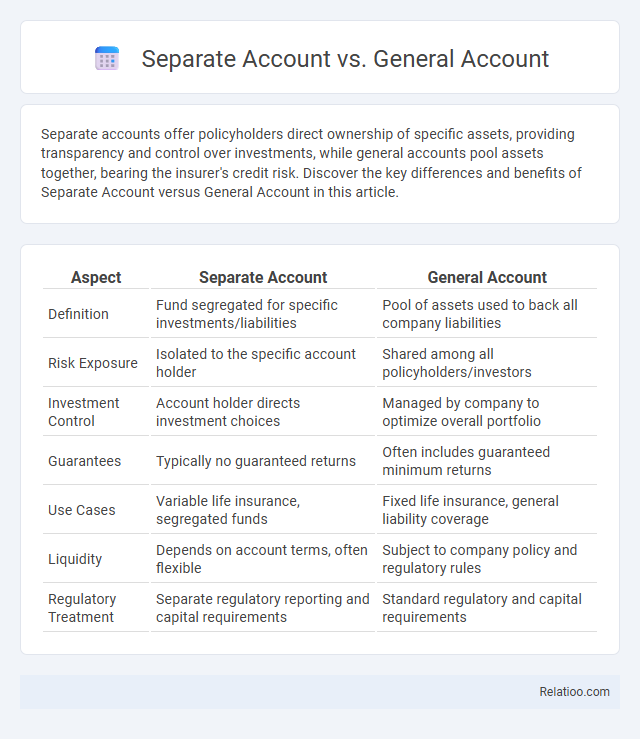

Separate accounts offer policyholders direct ownership of specific assets, providing transparency and control over investments, while general accounts pool assets together, bearing the insurer's credit risk. Discover the key differences and benefits of Separate Account versus General Account in this article.

Table of Comparison

| Aspect | Separate Account | General Account |

|---|---|---|

| Definition | Fund segregated for specific investments/liabilities | Pool of assets used to back all company liabilities |

| Risk Exposure | Isolated to the specific account holder | Shared among all policyholders/investors |

| Investment Control | Account holder directs investment choices | Managed by company to optimize overall portfolio |

| Guarantees | Typically no guaranteed returns | Often includes guaranteed minimum returns |

| Use Cases | Variable life insurance, segregated funds | Fixed life insurance, general liability coverage |

| Liquidity | Depends on account terms, often flexible | Subject to company policy and regulatory rules |

| Regulatory Treatment | Separate regulatory reporting and capital requirements | Standard regulatory and capital requirements |

Introduction to Separate and General Accounts

Separate accounts are investment portfolios managed distinctly from a company's general assets, allowing for personalized strategies aligned with your financial goals. General accounts represent a company's consolidated pool of assets used to back guarantees and obligations, ensuring stability and risk management across all customers. Understanding the difference between separate and general accounts helps you choose the right investment structure for tailored risk and return preferences.

Definition of Separate Account

A Separate Account is a distinct investment portfolio owned by an insurance company that holds assets segregated from the company's General Account, providing policyholders with specific investment options and direct exposure to market performance. Unlike the General Account, which pools all assets and guarantees fixed returns, the Separate Account assumes investment risk, allowing Your returns to fluctuate based on asset performance. Understanding the definition of a Separate Account helps clarify how it differs from the General Account, highlighting its role in offering personalized investment strategies within insurance products.

Definition of General Account

The General Account refers to the insurance company's main pool of assets used to back most of its insurance policies and obligations, encompassing both investments and liabilities on its balance sheet. Unlike Separate Accounts, which hold specific assets segregated for variable products and are not subject to the insurer's creditors, the General Account assets are commingled and guarantee fixed returns or benefits. Understanding Your exposure involves recognizing that General Account guarantees rely on the insurer's overall financial health, while Separate Accounts offer investment performance tied directly to chosen assets.

Key Differences Between Separate and General Accounts

Separate accounts hold assets dedicated to specific obligations or clients, ensuring your investments are insulated from the insurer's general liabilities. General accounts pool all assets and liabilities together, exposing your funds to the insurer's overall financial strength and risks. The key difference lies in asset segregation and risk exposure, with separate accounts offering more protection for your designated funds compared to general accounts.

Investment Strategies in Separate vs. General Accounts

Separate accounts offer personalized investment strategies tailored to Your specific financial goals, providing greater transparency and control over asset allocation compared to general accounts. General accounts pool assets from multiple investors, employing a diversified, conservative investment approach managed by the institution to balance risk and returns across all clients. The flexibility of separate accounts allows for targeted investments in equities, bonds, or alternative assets, while general accounts prioritize stable, long-term growth through fixed income and broad market exposure.

Risk Factors: Separate vs. General Accounts

Separate accounts isolate assets from the insurer's general account, reducing exposure to the insurer's credit risk, whereas general accounts pool assets, exposing policyholders to the insurer's overall financial health and potential insolvency. Risk factors in separate accounts include market volatility and investment performance, directly affecting the policyholder, while general accounts transfer investment risk to the insurer, offering more stable but potentially lower returns. Understanding these distinctions is crucial for evaluating risk tolerance and investment objectives in insurance products.

Regulatory and Legal Aspects

Separate accounts are legally distinct from the insurer's general account, offering policyholders enhanced protection by isolating assets from general creditors under strict regulatory oversight. General accounts pool all assets and liabilities, exposing policyholder funds to the insurer's overall financial risks and subjecting them to broader state insurance regulations. Your choice between separate and general accounts impacts regulatory protections and legal recourse, as separate accounts often comply with more stringent segregation requirements to safeguard your invested premiums.

Suitability for Investors

Separate accounts offer personalized investment strategies tailored to Your specific financial goals and risk tolerance, making them highly suitable for investors seeking customized portfolio management. General accounts pool assets from multiple investors, providing diversified risk but less individual control, which may be better suited for those preferring a more hands-off approach. Comparing separate accounts within insurance products, such as variable annuities, investors benefit from potential tax advantages and investment flexibility but must consider higher fees and market risk.

Pros and Cons of Separate and General Accounts

Separate accounts offer enhanced protection by segregating your assets from the insurer's general risk pool, reducing credit risk and providing clearer transparency for investment performance. However, separate accounts may lack guaranteed returns and expose your investments to market volatility, unlike general accounts, which offer fixed returns backed by the insurer's overall financial strength but come with limited flexibility and potential lower yields. Choosing between separate and general accounts depends on your risk tolerance and investment goals, balancing safety with potential growth.

Choosing Between Separate and General Accounts

Choosing between Separate and General Accounts depends on your investment goals and risk tolerance. Separate Accounts offer individualized portfolio management with greater control and transparency, minimizing risk through tailored asset allocation. General Accounts pool assets collectively, providing diversification but less customization, which may impact Your ability to meet specific financial objectives.

Infographic: Separate Account vs General Account

relatioo.com

relatioo.com