Credit cards build positive credit history and increase purchasing power, while debit cards limit spending to available funds and avoid debt. Discover the advantages and best uses of each payment method in this article.

Table of Comparison

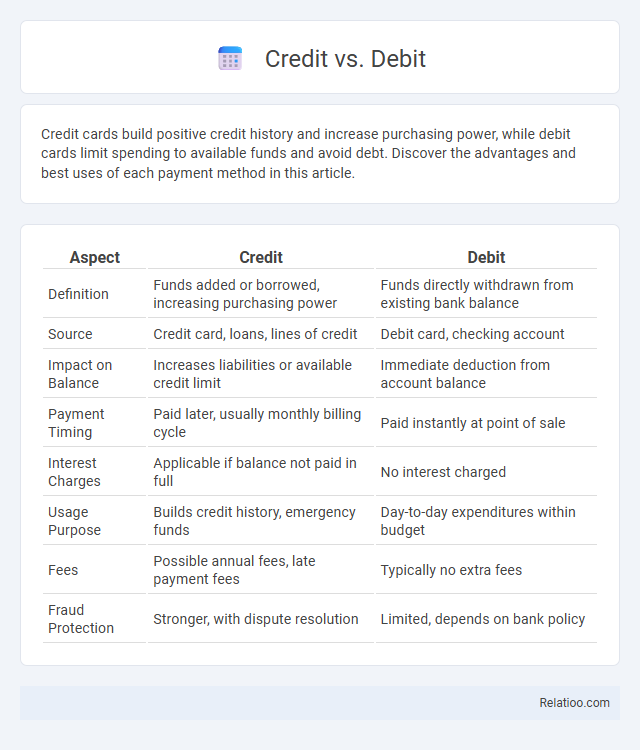

| Aspect | Credit | Debit |

|---|---|---|

| Definition | Funds added or borrowed, increasing purchasing power | Funds directly withdrawn from existing bank balance |

| Source | Credit card, loans, lines of credit | Debit card, checking account |

| Impact on Balance | Increases liabilities or available credit limit | Immediate deduction from account balance |

| Payment Timing | Paid later, usually monthly billing cycle | Paid instantly at point of sale |

| Interest Charges | Applicable if balance not paid in full | No interest charged |

| Usage Purpose | Builds credit history, emergency funds | Day-to-day expenditures within budget |

| Fees | Possible annual fees, late payment fees | Typically no extra fees |

| Fraud Protection | Stronger, with dispute resolution | Limited, depends on bank policy |

Understanding Credit and Debit Cards

Understanding credit and debit cards is essential for managing your finances effectively. Credit cards allow you to borrow funds up to a certain limit and pay them back later with interest, while debit cards withdraw money directly from your checking account for immediate purchases. Your choice between credit and debit impacts your budgeting, credit score, and spending habits significantly.

Key Differences Between Credit and Debit

Credit cards allow you to borrow money up to a set limit, requiring repayment with interest if not paid in full monthly, while debit cards withdraw funds directly from your bank account, limiting spending to your available balance. Spending with credit can build your credit score when managed responsibly, whereas debit transactions do not affect your credit history. Understanding these key differences helps you manage your finances by choosing the appropriate payment method for your needs.

Advantages of Using Credit Cards

Credit cards offer the advantage of building a positive credit history, which is essential for securing loans and favorable interest rates. They provide enhanced security features such as fraud protection and zero-liability policies, reducing the risk of financial loss. Reward programs and cashback incentives further incentivize spending, making credit cards a valuable financial tool compared to debit cards or cash.

Benefits of Choosing Debit Cards

Debit cards offer direct access to funds without accruing interest, promoting controlled spending and effective budgeting. They minimize the risk of debt accumulation, since transactions are limited to the available balance in the account. This financial discipline supports better money management compared to credit cards, which can lead to overspending and high-interest charges.

Risks Associated with Credit Cards

Credit cards pose risks such as accumulating high-interest debt and potential damage to credit scores due to missed payments. Unauthorized transactions and identity theft remain significant threats without proper security measures. Responsible usage and regular monitoring help mitigate financial risks associated with credit card spending.

Potential Pitfalls of Debit Card Usage

Debit card usage can expose your bank account to potential overdraft fees and limited fraud protection compared to credit cards. Unlike credit cards, fraudulent debit transactions may immediately affect your available funds, causing disruptions in your daily spending. Understanding these risks is crucial to managing your finances and avoiding unexpected penalties.

Security Features: Credit vs Debit

Credit cards offer enhanced security features such as fraud protection, zero liability policies, and advanced encryption, making them safer for online and large transactions. Debit cards provide security measures like PIN verification and immediate transaction alerts, but your bank account is directly exposed, increasing risk if compromised. Understanding these differences helps you choose the best option to protect your financial information during everyday spending.

Impact on Credit Score

Using credit cards responsibly, such as making timely payments and maintaining low credit utilization, positively impacts your credit score by demonstrating reliable borrowing behavior. Debit card spending does not affect your credit score because it draws funds directly from your bank account without involving credit. Overspending on credit cards or missing payments can harm your credit score, while prudent use can build credit history and improve overall creditworthiness.

Which Card to Use: Situational Comparison

Choosing between credit and debit cards depends on your spending habits and financial goals; credit cards offer rewards and build credit, making them ideal for large purchases or emergencies, while debit cards limit overspending by using your available funds directly. Spending decisions should factor in security, fees, and the potential to earn cashback or travel points, with credit cards often providing better fraud protection and benefits. Your best card choice varies by situation: use credit for online shopping or big expenses, debit for daily necessities, and evaluate rewards programs to maximize value.

Tips for Responsible Card Management

Maintaining responsible card management requires tracking all credit and debit transactions regularly to avoid overspending and ensure timely payments, which helps build a strong credit score. Limiting credit card usage to essential purchases and paying balances in full each month minimizes interest charges and debt accumulation. Utilizing budgeting apps linked to both credit and debit cards can provide real-time spending insights, promoting financial discipline and preventing unnecessary expenditures.

Infographic: Credit vs Debit

relatioo.com

relatioo.com