Separate accounts and segregated accounts both isolate client funds, but separate accounts hold assets individually for each client, offering direct ownership, while segregated accounts pool client funds but keep them distinct from the firm's assets for protection. Discover the detailed differences and benefits of each account type in this article.

Table of Comparison

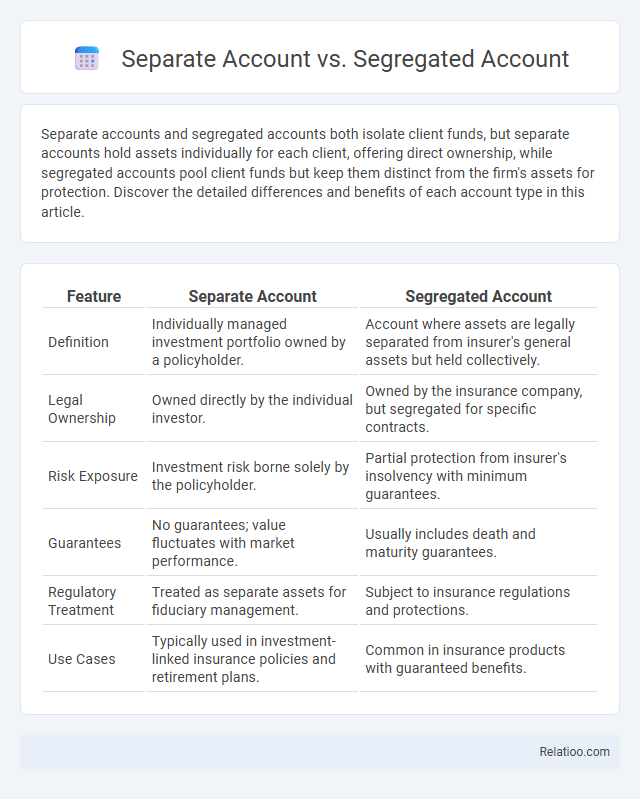

| Feature | Separate Account | Segregated Account |

|---|---|---|

| Definition | Individually managed investment portfolio owned by a policyholder. | Account where assets are legally separated from insurer's general assets but held collectively. |

| Legal Ownership | Owned directly by the individual investor. | Owned by the insurance company, but segregated for specific contracts. |

| Risk Exposure | Investment risk borne solely by the policyholder. | Partial protection from insurer's insolvency with minimum guarantees. |

| Guarantees | No guarantees; value fluctuates with market performance. | Usually includes death and maturity guarantees. |

| Regulatory Treatment | Treated as separate assets for fiduciary management. | Subject to insurance regulations and protections. |

| Use Cases | Typically used in investment-linked insurance policies and retirement plans. | Common in insurance products with guaranteed benefits. |

Introduction to Separate and Segregated Accounts

Separate accounts and segregated accounts both refer to investment vehicles where client assets are maintained independently from the firm's own funds, ensuring protection against creditor claims. Separate accounts typically allow individualized investment strategies tailored to the client's objectives, while segregated accounts are often used in insurance contexts to shield policyholder assets. Understanding the distinctions between these account types is essential for investors seeking asset protection and customized portfolio management.

Definition of a Separate Account

A Separate Account is a distinct investment account managed independently from a company's general assets, often used in insurance and pension funds to segregate assets supporting specific liabilities or contracts. Unlike Segregated Accounts, which are legally separate and protect assets from creditors, Separate Accounts primarily focus on tailored investment management without necessarily providing creditor protection. Understanding the definition and purpose of a Separate Account is crucial for differentiating it from similar financial structures and assessing risk and asset management strategies.

Definition of a Segregated Account

A segregated account is a type of financial account where assets are legally separated and protected from the general assets of the institution holding them, ensuring your funds are safeguarded in case of insolvency. Unlike separate accounts, which might simply refer to the division of accounts for management purposes, segregated accounts offer distinct legal protection under regulatory frameworks such as those governing insurance companies or investment firms. Understanding the definition of a segregated account is crucial for recognizing its role in asset protection and risk management within your financial planning.

Key Differences Between Separate and Segregated Accounts

Separate accounts and segregated accounts differ mainly in their legal and regulatory frameworks; separate accounts typically refer to investment portfolios managed individually on behalf of clients, offering direct ownership of assets, while segregated accounts are often subject to regulatory requirements that ensure the client's assets are kept distinct from the institution's own holdings for protection against insolvency. Separate accounts allow for customized investment strategies and tax advantages, whereas segregated accounts provide added creditor protection and insurance benefits. Understanding these distinctions is crucial for investors seeking tailored asset management versus enhanced security and legal safeguards.

Regulatory Requirements for Both Account Types

Separate accounts and segregated accounts differ notably in regulatory requirements, with segregated accounts often subject to stricter oversight due to their role in protecting client assets from general creditors under insolvency laws. Regulatory frameworks typically mandate separate accounts to maintain distinct records and segregation of client funds but may not impose the same level of asset protection as segregated accounts. Compliance considerations for both account types include adherence to reporting standards, client asset protection regulations, and specific jurisdictional mandates ensuring transparency and fiduciary responsibility.

Risk Management in Separate vs Segregated Accounts

Separate accounts and segregated accounts both provide enhanced risk management by isolating assets to protect your investments from the credit risk of other clients or institutions. In a separate account, your assets are held individually and managed exclusively on your behalf, reducing exposure to systemic risk and ensuring direct ownership. Segregated accounts also isolate funds but typically involve pooling assets while keeping them distinct from the institution's proprietary funds, which may slightly increase counterparty risk compared to fully separate accounts.

Advantages of Separate Accounts

Separate accounts offer personalized investment strategies tailored to individual client needs, providing greater control over asset allocation compared to pooled funds. They enhance transparency and direct ownership of securities, allowing clients to avoid the risks associated with commingled assets. This structure facilitates tax efficiency and customization, making separate accounts advantageous for investors seeking specific portfolio management and risk preferences.

Benefits of Segregated Accounts

Segregated accounts offer enhanced asset protection by legally separating client funds from the firm's assets, reducing the risk of loss in case of insolvency. These accounts improve transparency and regulatory compliance through stringent reporting and oversight, ensuring client investments are secure and accessible. Investors benefit from increased confidence and reduced counterparty risk, making segregated accounts a preferred choice for safeguarding assets.

Use Cases and Industries for Each Account Type

Separate Accounts are predominantly used in investment management to enable clients like You to maintain distinct portfolios tailored to specific objectives, ideal for high-net-worth individuals and institutional investors seeking customized asset management. Segregated Accounts are favored in the insurance and banking sectors, offering legal protection by keeping client assets separate from the institution's own funds, which is crucial for trust companies, custodians, and retirement plan administrators. Separate Accounts, in real estate or legal contexts, serve to isolate funds for specific projects or clients, commonly utilized by developers and law firms to ensure transparency and compliance.

Choosing Between Separate and Segregated Accounts

Choosing between separate and segregated accounts depends on your risk tolerance and investment goals. Separate accounts offer customized investment strategies with direct ownership of securities, providing transparency and control. Segregated accounts, often used by insurance companies, combine the benefits of individual investment with creditor protection under insurance regulations.

Infographic: Separate Account vs Segregated Account

relatioo.com

relatioo.com