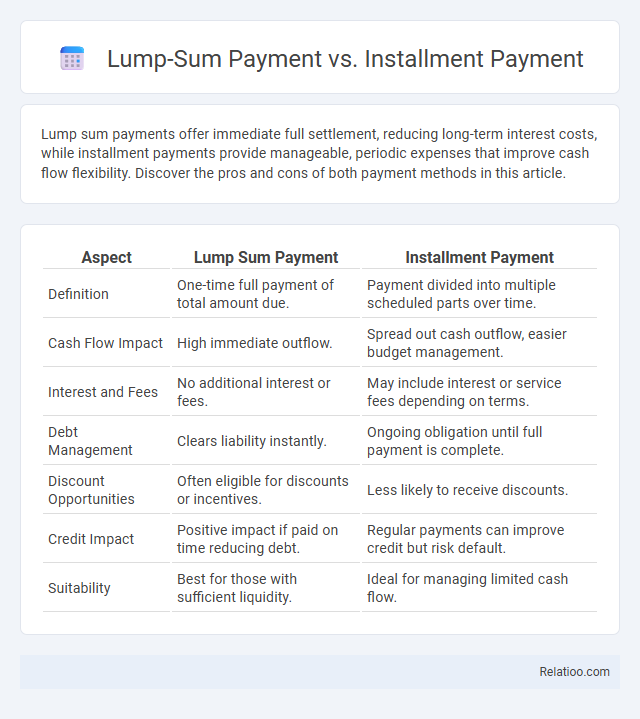

Lump sum payments offer immediate full settlement, reducing long-term interest costs, while installment payments provide manageable, periodic expenses that improve cash flow flexibility. Discover the pros and cons of both payment methods in this article.

Table of Comparison

| Aspect | Lump Sum Payment | Installment Payment |

|---|---|---|

| Definition | One-time full payment of total amount due. | Payment divided into multiple scheduled parts over time. |

| Cash Flow Impact | High immediate outflow. | Spread out cash outflow, easier budget management. |

| Interest and Fees | No additional interest or fees. | May include interest or service fees depending on terms. |

| Debt Management | Clears liability instantly. | Ongoing obligation until full payment is complete. |

| Discount Opportunities | Often eligible for discounts or incentives. | Less likely to receive discounts. |

| Credit Impact | Positive impact if paid on time reducing debt. | Regular payments can improve credit but risk default. |

| Suitability | Best for those with sufficient liquidity. | Ideal for managing limited cash flow. |

Understanding Lump Sum Payments

Lump sum payments involve paying the entire amount upfront, offering the advantage of avoiding interest and fees associated with extended payment schedules. This payment method is common in settlements, real estate, and loans, where a single large payment provides financial clarity and potentially saves money over time. Understanding lump sum payments helps you make informed decisions about managing your finances and choosing the best payment option for your needs.

Defining Installment Payments

Installment payments refer to a series of predetermined, equal payments made over a specified period to settle a total amount owed, often involving interest or fees. This method contrasts with lump sum payments, where the entire amount is paid upfront, providing immediate full settlement but requiring higher initial capital. Payment plans offer flexible options, usually structured by lenders or service providers, allowing borrowers or customers to manage cash flow by spreading payments while maintaining agreed terms and conditions.

Key Differences Between Lump Sum and Installment Payments

Lump sum payments require you to pay the entire amount upfront, often resulting in fewer administrative fees and potential discounts. Installment payments divide the total cost into smaller, manageable amounts over a specified period, which can ease your cash flow but may include interest or fees. Choosing between these options depends on your financial situation, the cost implications, and your preference for immediate versus prolonged payment obligations.

Financial Implications of Lump Sum Payments

Lump sum payments offer immediate full settlement of debts or investments, often resulting in lower total interest costs compared to installment payments or payment plans. This payment method can improve credit scores by reducing outstanding balances quickly but requires sufficient liquidity to avoid cash flow issues. Choosing lump sum payments can maximize savings on financing charges but may limit funds available for other investments or expenses.

Pros and Cons of Installment Payments

Installment payments offer the advantage of spreading out the total cost over time, improving cash flow management and making large purchases more accessible. However, they often come with interest or fees, increasing the overall expense compared to lump sum payments. The risk of missed payments can impact credit scores and potentially lead to penalties, making careful budgeting essential.

Suitability of Each Payment Method

Lump sum payments suit buyers with immediate full funds, offering simplicity and potential discounts, ideal for those avoiding long-term obligations. Installment payments fit individuals seeking manageable periodic expenses without large upfront cash, balancing cash flow with ownership acquisition over time. Payment plans cater to customers requiring extended flexibility, often with tailored terms and interest, supporting those who prioritize budget adaptability and financial planning.

Tax Considerations: Lump Sum vs Installments

Choosing between a lump sum payment and installment payments significantly affects tax liability, as lump sum payments are typically taxed in the year received, potentially pushing the recipient into a higher tax bracket. Installment payments spread income over multiple years, allowing for more manageable tax obligations and reducing the risk of a large one-time tax burden. Taxpayers should consult with a tax advisor to evaluate the impact of each option on their overall tax strategy and optimize their financial outcomes accordingly.

Risk Management in Payment Structures

Lump sum payments minimize the risk of prolonged financial obligation by completing the transaction upfront, reducing exposure to market fluctuations and payment defaults. Installment payments distribute financial risk over time but introduce potential delays or defaults, requiring robust credit assessment and monitoring mechanisms. Payment plans balance flexibility and risk by structuring payments to align with cash flow, necessitating clear terms to mitigate the risk of incomplete payments and ensuring consistent revenue streams.

How to Choose the Right Payment Option

Choosing the right payment option depends on your financial stability, cash flow, and long-term budget goals. A lump sum payment offers immediate full settlement often with discounts, while installment payments spread the cost over time, easing short-term financial pressure. Your decision should balance upfront affordability with overall cost minimization for optimal financial planning.

Real-Life Scenarios: Lump Sum and Installment Decisions

Choosing between a lump sum payment and installment payments depends on your financial situation and goals. Lump sum payments often save money by avoiding interest and fees, ideal when you have sufficient funds upfront. Installment payments and structured payment plans provide flexibility in cash flow management, making them suitable for those prioritizing monthly budget stability over immediate full payment.

Infographic: Lump Sum Payment vs Installment Payment

relatioo.com

relatioo.com