A credit score is a numerical summary reflecting your creditworthiness, while a credit report details your full credit history, including accounts and inquiries. Discover how understanding both can improve your financial health in this article.

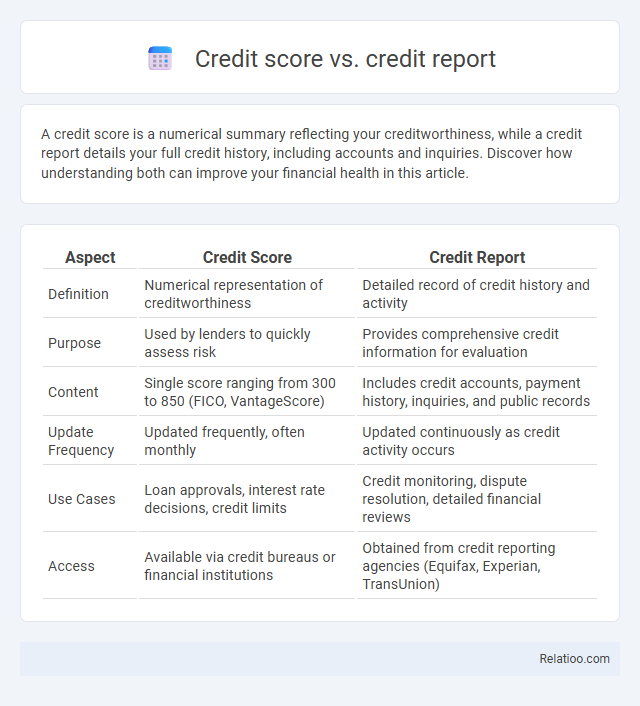

Table of Comparison

| Aspect | Credit Score | Credit Report |

|---|---|---|

| Definition | Numerical representation of creditworthiness | Detailed record of credit history and activity |

| Purpose | Used by lenders to quickly assess risk | Provides comprehensive credit information for evaluation |

| Content | Single score ranging from 300 to 850 (FICO, VantageScore) | Includes credit accounts, payment history, inquiries, and public records |

| Update Frequency | Updated frequently, often monthly | Updated continuously as credit activity occurs |

| Use Cases | Loan approvals, interest rate decisions, credit limits | Credit monitoring, dispute resolution, detailed financial reviews |

| Access | Available via credit bureaus or financial institutions | Obtained from credit reporting agencies (Equifax, Experian, TransUnion) |

Introduction to Credit Score and Credit Report

A credit score is a numerical representation of an individual's creditworthiness, typically ranging from 300 to 850, and is calculated based on credit history, debt levels, and repayment behavior. A credit report is a detailed record of an individual's credit activity, including accounts, payment history, and outstanding debts, maintained by credit bureaus such as Experian, Equifax, and TransUnion. Understanding both the credit score and credit report is essential for managing credit health, as lenders use this information to assess risk and determine loan eligibility.

What is a Credit Score?

A credit score is a numerical representation, typically ranging from 300 to 850, that evaluates an individual's creditworthiness based on their credit history and financial behavior. It is derived from data found in the credit report, which includes information such as payment history, credit utilization, length of credit accounts, types of credit, and recent credit inquiries. Credit scores are crucial for lenders in assessing the risk of lending money, influencing loan approvals, interest rates, and credit limits.

What is a Credit Report?

A credit report is a detailed record of an individual's credit history, including information on credit accounts, payment history, outstanding debts, and public records like bankruptcies. It is compiled by credit bureaus such as Experian, Equifax, and TransUnion to provide lenders with an overview of a person's creditworthiness. Unlike a credit score, which is a numerical summary, the credit report offers comprehensive data used to calculate credit scores and evaluate credit risk.

Key Differences Between Credit Score and Credit Report

Credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850, while a credit report is a detailed record of your credit history including loans, payment history, and account statuses. Your credit report provides the comprehensive data that credit scoring models use to calculate your credit score, making the report more extensive and informative. Understanding these key differences helps you monitor your credit health effectively and address any inaccuracies that may impact Your financial opportunities.

How Credit Scores Are Calculated

Credit scores are calculated using data from your credit report, which includes factors such as payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. Your payment history typically accounts for about 35% of the score, while credit utilization makes up around 30%, emphasizing how responsibly you manage outstanding balances compared to your total credit limits. Understanding these components helps you take control of your credit health, as your credit report provides the detailed account information that credit scoring models use to generate your score.

Components of a Credit Report

A credit report consists of detailed components that include personal information, credit account history, payment history, credit inquiries, and public records such as bankruptcies or liens. These elements collectively provide a comprehensive view of an individual's credit behavior, influencing the credit score calculated by scoring models like FICO or VantageScore. The credit score, derived from the credit report data, quantifies creditworthiness, while "credit" generally refers to the borrowing capacity or overall financial trust extended by lenders.

Why Credit Scores Matter

Credit scores are numerical representations of creditworthiness derived from detailed credit reports maintained by credit bureaus such as Experian, Equifax, and TransUnion. These scores influence lenders' decisions on loan approvals, interest rates, and credit limits by quantifying risk based on payment history, debt levels, and credit utilization. Understanding credit scores is essential for managing financial opportunities and improving access to favorable credit terms, distinguishing them from broader credit reports that provide comprehensive credit activity records.

Importance of Reviewing Your Credit Report

Reviewing your credit report regularly is essential for maintaining financial health and accuracy. Your credit score summarizes your creditworthiness, while your credit report provides detailed information on your credit history, including accounts, payment history, and inquiries. Keeping a close eye on your credit report helps you identify errors, detect fraud, and make informed decisions to improve your credit score and overall credit management.

Common Credit Score and Credit Report Myths

Common myths confuse credit score and credit report as interchangeable, but they serve distinct functions: the credit score is a numerical summary of creditworthiness, typically ranging from 300 to 850, while the credit report provides detailed credit history, including loan accounts, payment history, and inquiries. Many believe checking one's credit report lowers the credit score, but only hard inquiries from credit applications impact scores, whereas personal report checks are soft inquiries and harmless. Misunderstandings also persist that credit scores are static, yet they fluctuate based on ongoing credit behaviors recorded in the credit report, emphasizing the need for regular monitoring of both.

Tips to Improve Your Credit Score and Credit Report

Understanding the differences between your credit score, credit report, and credit is essential for managing your financial health effectively. Your credit score is a numerical representation of your creditworthiness, while your credit report provides a detailed history of your credit activities, and credit refers to your ability to borrow funds. To improve your credit score and credit report, consistently pay bills on time, reduce outstanding debt, monitor your credit report for errors, and avoid opening multiple new credit accounts rapidly.

Infographic: Credit score vs Credit report

relatioo.com

relatioo.com