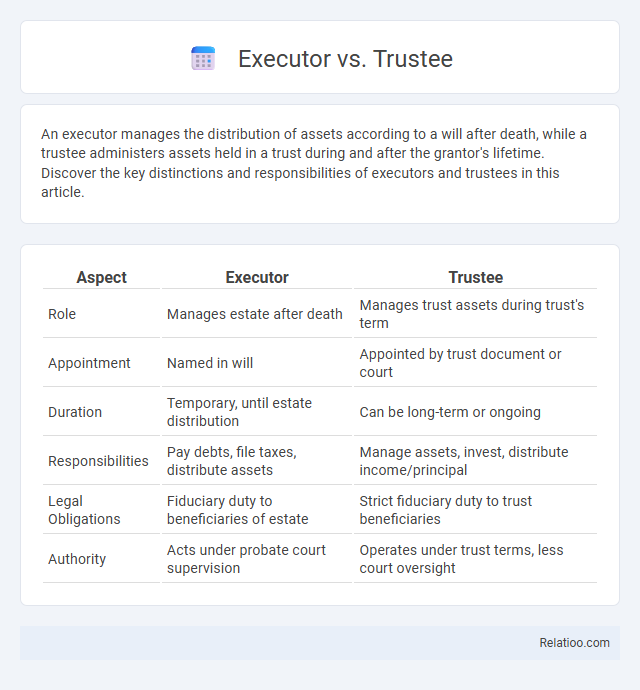

An executor manages the distribution of assets according to a will after death, while a trustee administers assets held in a trust during and after the grantor's lifetime. Discover the key distinctions and responsibilities of executors and trustees in this article.

Table of Comparison

| Aspect | Executor | Trustee |

|---|---|---|

| Role | Manages estate after death | Manages trust assets during trust's term |

| Appointment | Named in will | Appointed by trust document or court |

| Duration | Temporary, until estate distribution | Can be long-term or ongoing |

| Responsibilities | Pay debts, file taxes, distribute assets | Manage assets, invest, distribute income/principal |

| Legal Obligations | Fiduciary duty to beneficiaries of estate | Strict fiduciary duty to trust beneficiaries |

| Authority | Acts under probate court supervision | Operates under trust terms, less court oversight |

Executor vs Trustee: Key Differences Explained

The executor is responsible for managing and distributing a deceased person's assets according to the will, while the trustee administers assets held in a trust for beneficiaries over time. Executors work within probate court to settle debts and transfer property, whereas trustees manage ongoing financial affairs and ensure the trust's terms are upheld. Understanding these roles clarifies how Your estate plan distributes assets efficiently and protects beneficiaries' interests.

Understanding the Roles: Executor and Trustee

An executor manages the administration of your will by ensuring assets are distributed according to your wishes, while a trustee oversees the management of assets held in a trust for beneficiaries, often long-term. Your executor handles tasks such as paying debts and filing taxes during probate, whereas a trustee makes ongoing decisions about trust assets, including investments and distributions. Understanding these distinct roles helps you clarify responsibilities and ensure effective estate planning tailored to your needs.

Legal Responsibilities of Executors

Executors hold crucial legal responsibilities in estate planning by managing the deceased's assets, paying debts, and distributing property according to the will. Your role as an executor includes filing probate court documents, protecting estate assets, and ensuring compliance with state laws and tax obligations. Trustees, in contrast, manage trusts created during a lifetime or after death, with ongoing fiduciary duties distinct from the executor's one-time administration tasks.

Duties and Powers of Trustees

Trustees manage and safeguard trust assets according to the terms set forth in a trust document, holding fiduciary duties to act in the best interests of the beneficiaries. Their powers include investing assets prudently, distributing income or principal as specified, and maintaining accurate records for transparency and accountability. Unlike executors who handle estate administration after death, trustees have ongoing responsibilities throughout the trust's duration in estate planning.

Appointment Process: How Executors and Trustees Are Chosen

Executors and trustees are typically appointed through legal documents such as wills or trusts, where the testator or grantor names individuals or institutions to manage their estate or trust assets. Your choice of executor or trustee often depends on factors like trustworthiness, financial expertise, and ability to handle fiduciary duties, ensuring your estate planning goals are effectively carried out. The court may intervene to appoint an executor or trustee if the named person is unable or unwilling to serve, emphasizing the importance of a clear appointment in your estate planning documents.

Managing Assets: Executor vs Trustee Authority

Managing assets in estate planning differentiates Executor and Trustee authority significantly. Your Executor handles asset distribution according to a will, ensuring debts and taxes are paid during probate. A Trustee manages trust assets post-probate, exercising discretionary control to benefit beneficiaries under trust terms.

Timeline of Tasks: Executor and Trustee Duties Over Time

Executor duties begin immediately after death, involving probate initiation, asset inventory, and debt settlement, typically completed within a year. Trustee responsibilities start when the trust becomes active, often post-probate, managing assets according to trust terms and distributing income or principal to beneficiaries over months or years. Your estate planning should clearly define these timelines to ensure smooth transitions and compliance with legal requirements.

Liabilities and Risks: Executor vs Trustee

Executors handle probate and settling debts with limited personal liability, whereas trustees manage ongoing trust assets and carry fiduciary duties exposing them to broader legal risks. You must understand that trustees face higher accountability for investment decisions and breach of trust claims, while executors primarily ensure debts and taxes are paid from the estate. Proper estate planning involves appointing trustworthy individuals and understanding these distinct liabilities to minimize personal exposure.

Compensation: How Executors and Trustees Are Paid

Executors and trustees are typically entitled to compensation for their services, which is often outlined in state laws or the governing trust and will documents. Your executor's and trustee's fees may be calculated as a percentage of the estate or trust assets, an hourly rate, or a flat fee, depending on the jurisdiction and complexity of the administration. Understanding these compensation structures can help you plan your estate more effectively and ensure fair payment for those managing your affairs.

Choosing the Right Person: Executor or Trustee

Choosing the right person as an executor or trustee is crucial for effective estate planning, as the executor manages probate and ensures debts and taxes are paid, while the trustee administers trust assets per the grantor's instructions. Consider selecting someone trustworthy, organized, and financially savvy, with the ability to handle fiduciary responsibilities and communicate clearly with beneficiaries. Clear understanding of each role's duties reduces conflicts, streamlines asset distribution, and preserves the estate's value.

Infographic: Executor vs Trustee

relatioo.com

relatioo.com