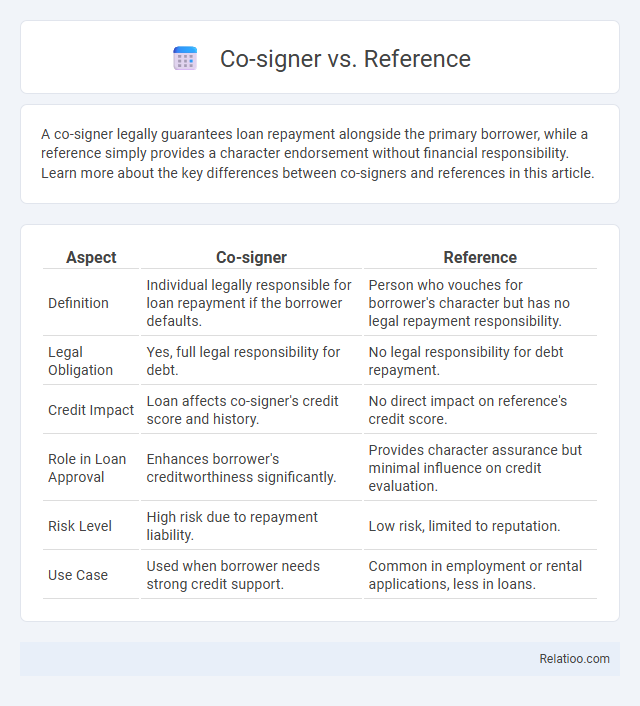

A co-signer legally guarantees loan repayment alongside the primary borrower, while a reference simply provides a character endorsement without financial responsibility. Learn more about the key differences between co-signers and references in this article.

Table of Comparison

| Aspect | Co-signer | Reference |

|---|---|---|

| Definition | Individual legally responsible for loan repayment if the borrower defaults. | Person who vouches for borrower's character but has no legal repayment responsibility. |

| Legal Obligation | Yes, full legal responsibility for debt. | No legal responsibility for debt repayment. |

| Credit Impact | Loan affects co-signer's credit score and history. | No direct impact on reference's credit score. |

| Role in Loan Approval | Enhances borrower's creditworthiness significantly. | Provides character assurance but minimal influence on credit evaluation. |

| Risk Level | High risk due to repayment liability. | Low risk, limited to reputation. |

| Use Case | Used when borrower needs strong credit support. | Common in employment or rental applications, less in loans. |

Understanding the Role of a Co-Signer

A co-signer takes on legal responsibility for a loan if the primary borrower defaults, making their credit and income crucial for loan approval. Unlike references, who only vouch for your character without financial liability, co-signers provide a financial guarantee that influences the lender's decision. Understanding the role of a co-signer helps you secure loans when your credit history or income is insufficient on its own.

What is a Reference?

A reference is a person who can vouch for your character, reliability, or qualifications without being financially responsible for your obligations. Unlike a co-signer, who agrees to repay a loan if you default, a reference provides a testimonial or endorsement to support your application or request. Understanding the difference between a reference and a co-signer helps you determine who to ask when you need support but not financial liability.

Key Differences Between Co-Signer and Reference

A co-signer is a legally responsible party who guarantees loan repayment if the primary borrower defaults, impacting both credit scores, while a reference only provides a character or professional endorsement without financial liability or credit risk. Co-signers typically undergo credit checks and must have strong creditworthiness, whereas references are contacted for verification of the borrower's reliability and background without influencing loan approval or terms. The primary difference lies in financial responsibility and credit impact, making co-signers essential for loan approval when borrowers have insufficient credit history, unlike references who serve purely for credibility validation.

Responsibilities of a Co-Signer

A co-signer takes on full financial responsibility if the primary borrower defaults, making your credit score directly impacted by their payment behavior. Unlike a reference, who only vouches for your character without legal or financial obligations, a co-signer legally guarantees the loan repayment. Understanding the responsibilities of a co-signer ensures you select someone who can reliably cover your debt if necessary.

Responsibilities of a Reference

A reference serves primarily to vouch for Your character or reliability without bearing financial responsibility, unlike a co-signer who legally commits to repaying a loan if You default. Their role involves providing personal or professional insights to support Your application, but they are not obligated to fulfill payment obligations. Understanding this distinction helps clarify that references carry reputational responsibility, not financial risk, unlike co-signers.

When Do You Need a Co-Signer?

You need a co-signer when your credit history or income does not meet the lender's requirements for a loan or lease approval. A co-signer guarantees the debt, assuming full responsibility if you default, while a reference only vouches for your character without legal obligation. Choosing the right support depends on your financial standing and the lender's policy on risk mitigation.

When Is a Reference Required?

A reference is typically required when lenders need additional assurance about a borrower's reliability without assuming financial responsibility, often serving as a character witness rather than a financial guarantor. Unlike a co-signer who shares legal obligation to repay the loan, a reference provides personal or professional credibility but does not impact credit risk directly. References are commonly requested in rental agreements, smaller loans, or service contracts where the lender's primary concern is trustworthiness rather than debt repayment security.

Pros and Cons of Using a Co-Signer

Using a co-signer can significantly improve your chances of loan approval by leveraging their strong credit history to secure better interest rates and loan terms. However, your co-signer assumes substantial financial risk, as missed payments or defaults can damage their credit score and create potential conflicts. Carefully weigh the benefits of increased creditworthiness against the responsibility placed on your co-signer before deciding to use one.

Pros and Cons of Providing a Reference

Providing a reference offers the advantage of supporting loan or rental applications without the financial liability associated with a co-signer, making it a lower-risk option for the reference. However, references typically carry less weight with lenders or landlords compared to co-signers, who guarantee payment and can be held accountable if the primary borrower defaults. The main drawback is that references may not sufficiently strengthen an application in competitive situations, as their role is limited to character endorsement rather than financial assurance.

How to Choose Between a Co-Signer and a Reference

Choosing between a co-signer and a reference depends primarily on the level of financial commitment and credibility required by the lender. A co-signer legally guarantees loan repayment, making them suitable when the borrower's creditworthiness is insufficient, whereas a reference serves only to vouch for character or reliability without financial liability. Evaluating your credit profile, the lender's requirements, and the willingness of a co-signer to undertake repayment responsibility helps determine the most appropriate option.

Infographic: Co-signer vs Reference

relatioo.com

relatioo.com