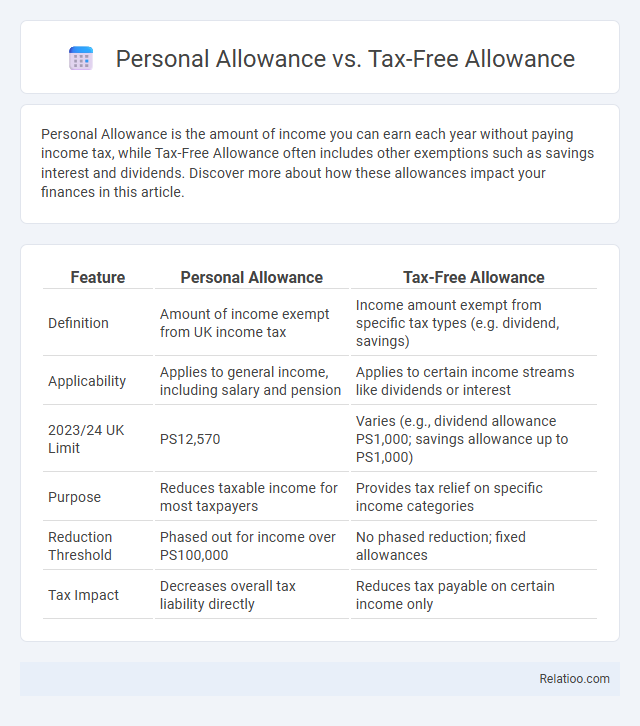

Personal Allowance is the amount of income you can earn each year without paying income tax, while Tax-Free Allowance often includes other exemptions such as savings interest and dividends. Discover more about how these allowances impact your finances in this article.

Table of Comparison

| Feature | Personal Allowance | Tax-Free Allowance |

|---|---|---|

| Definition | Amount of income exempt from UK income tax | Income amount exempt from specific tax types (e.g. dividend, savings) |

| Applicability | Applies to general income, including salary and pension | Applies to certain income streams like dividends or interest |

| 2023/24 UK Limit | PS12,570 | Varies (e.g., dividend allowance PS1,000; savings allowance up to PS1,000) |

| Purpose | Reduces taxable income for most taxpayers | Provides tax relief on specific income categories |

| Reduction Threshold | Phased out for income over PS100,000 | No phased reduction; fixed allowances |

| Tax Impact | Decreases overall tax liability directly | Reduces tax payable on certain income only |

Understanding Personal Allowance

Personal Allowance refers to the amount of income you can earn each tax year without paying income tax, typically set by the government and adjusted annually. Tax-Free Allowance often overlaps with Personal Allowance but can also include other specific exemptions such as savings interest or dividend income thresholds. Understanding Personal Allowance helps you effectively plan your finances by knowing how much of your income remains untaxed, ensuring optimal tax efficiency.

What is Tax-Free Allowance?

Tax-Free Allowance refers to the amount of income you can earn annually without paying any income tax, and it acts as a threshold set by tax authorities such as HM Revenue and Customs (HMRC) in the UK. Personal Allowance is a specific type of Tax-Free Allowance granted to individuals, which often varies based on age, income level, and residency status. Understanding your Tax-Free Allowance is crucial for accurate tax planning and ensuring you maximize your earnings without incurring unnecessary tax liabilities.

Key Differences Between Personal Allowance and Tax-Free Allowance

Personal Allowance refers specifically to the amount of income an individual can earn before paying UK income tax, currently set at PS12,570 for the 2023/24 tax year. Tax-Free Allowance is a broader term that encompasses any income exempt from tax, including Personal Allowance, dividend allowance, and savings allowance. Key differences between Personal Allowance and Tax-Free Allowance lie in their scope: Personal Allowance applies to general income withholding tax, while Tax-Free Allowance covers various types of income exemptions beyond just earnings.

How Personal Allowance Works in the UK

Personal Allowance in the UK refers to the amount of income an individual can earn each tax year without paying income tax, currently set at PS12,570 for most taxpayers. Tax-Free Allowance is a broader term that includes Personal Allowance alongside other specific exemptions and reliefs, such as savings interest and dividend allowances. Personal Allowance works by reducing taxable income, ensuring that only earnings above this threshold are subject to income tax rates set by HMRC.

Eligibility Criteria for Personal Allowance

Personal Allowance refers to the amount of income you can earn before you start paying income tax, typically available to UK taxpayers with a standard eligibility that includes residents under the age of 75 earning above a certain threshold. Unlike Tax-Free Allowance, which may encompass various specific tax exemptions such as savings and dividend allowances, Personal Allowance is a general baseline for income tax calculation. Your eligibility for Personal Allowance may be reduced if your income exceeds PS100,000, and some non-residents or individuals with certain types of income could face different criteria based on residency and tax treaties.

Tax-Free Allowance: Who Qualifies?

Tax-Free Allowance primarily applies to individuals earning below a specific income threshold, allowing them to receive a portion of their income without paying tax. You qualify for the Tax-Free Allowance if your earnings are within the government-set limits, which vary by region and income type. Understanding this allowance ensures you maximize your income by legally minimizing taxable portions under your personal tax obligations.

Impact of Income on Personal Allowance

Personal Allowance represents the amount of income you can earn tax-free in a tax year, typically set at PS12,570 for most taxpayers in the UK. Tax-Free Allowance is a broader term encompassing various reliefs like Personal Allowance and Marriage Allowance, but your Personal Allowance specifically reduces once your income exceeds PS100,000, decreasing by PS1 for every PS2 over this threshold. This reduction impacts your taxable income directly, increasing your tax liability as your earnings grow beyond the set limit.

Reductions and Adjustments to Allowances

Personal Allowance, Tax-Free Allowance, and Personal Allowance can be subject to reductions and adjustments based on your income level and specific tax regulations. High earners may see their Personal Allowance reduced incrementally for incomes above certain thresholds, while certain allowances can be adjusted due to factors like age, blindness, or marriage. Understanding these variations ensures accurate tax calculations and maximizes your eligible reliefs.

Changing Tax Rules: What You Need to Know

Changing tax rules impact your Personal Allowance, Tax-Free Allowance, and other allowances differently, affecting how much income you keep tax-free. Personal Allowance refers to the amount you can earn before paying income tax, while Tax-Free Allowance includes other tax reliefs such as savings and dividend allowances. Staying updated on these changes ensures you optimize your tax position and avoid unexpected liabilities.

Maximising Benefits from Your Allowances

Maximising benefits from your allowances involves understanding the distinctions between Personal Allowance, Tax-Free Allowance, and Personal Allowance as they relate to income tax thresholds. Personal Allowance refers to the amount of income you can earn before paying income tax, while Tax-Free Allowance often includes various tax credits and exemptions that reduce your taxable income further. By carefully managing your income sources and claiming all eligible allowances, you can minimise taxable income and increase your net earnings effectively.

Infographic: Personal Allowance vs Tax-Free Allowance

relatioo.com

relatioo.com