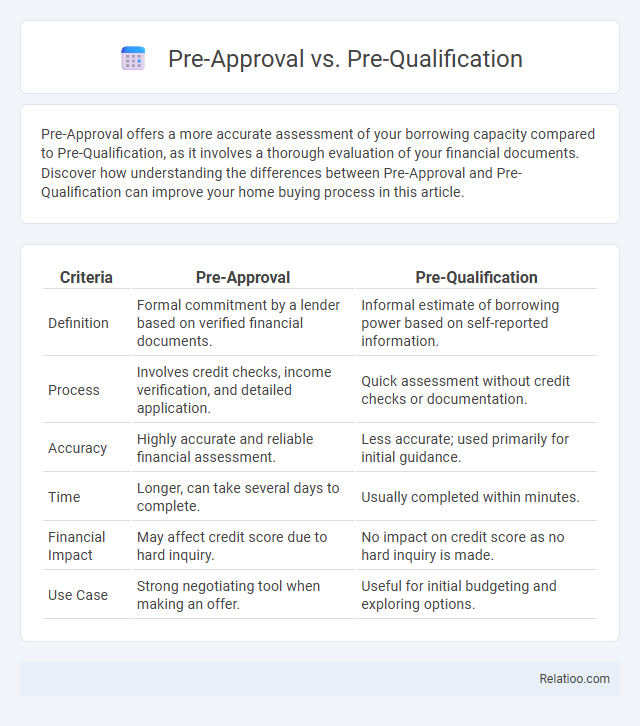

Pre-Approval offers a more accurate assessment of your borrowing capacity compared to Pre-Qualification, as it involves a thorough evaluation of your financial documents. Discover how understanding the differences between Pre-Approval and Pre-Qualification can improve your home buying process in this article.

Table of Comparison

| Criteria | Pre-Approval | Pre-Qualification |

|---|---|---|

| Definition | Formal commitment by a lender based on verified financial documents. | Informal estimate of borrowing power based on self-reported information. |

| Process | Involves credit checks, income verification, and detailed application. | Quick assessment without credit checks or documentation. |

| Accuracy | Highly accurate and reliable financial assessment. | Less accurate; used primarily for initial guidance. |

| Time | Longer, can take several days to complete. | Usually completed within minutes. |

| Financial Impact | May affect credit score due to hard inquiry. | No impact on credit score as no hard inquiry is made. |

| Use Case | Strong negotiating tool when making an offer. | Useful for initial budgeting and exploring options. |

Understanding Pre-Approval and Pre-Qualification

Pre-qualification provides a preliminary estimate of how much a borrower might afford based on self-reported financial information, offering a quick, informal assessment without a credit check. Pre-approval involves a thorough evaluation of a borrower's financial background, including credit reports, income verification, and debt analysis, resulting in a conditional commitment from a lender for a specific loan amount. Understanding the distinction between pre-approval and pre-qualification helps buyers gauge their homebuying readiness and strengthens their negotiating position in the mortgage process.

Key Differences Between Pre-Approval and Pre-Qualification

Pre-qualification is an initial assessment based on self-reported financial information to estimate how much you might borrow, while pre-approval involves a thorough verification of your credit, income, and assets, offering a conditional loan commitment. Pre-approval carries more weight with sellers as it demonstrates your serious intent and financial capability to secure a mortgage. Understanding these distinctions helps you better prepare your mortgage strategy and strengthens your position in competitive real estate markets.

The Pre-Approval Process Explained

The pre-approval process involves a detailed evaluation of Your financial documents, including income, credit score, and debt-to-income ratio, providing a conditional commitment from a lender on how much mortgage you qualify for. Unlike pre-qualification, which offers an estimated loan amount based on self-reported information, pre-approval requires verified documentation, making it a stronger indicator of your buying power. This process speeds up the mortgage approval stage and strengthens your position when negotiating with sellers.

Steps Involved in Mortgage Pre-Qualification

Mortgage pre-qualification involves providing basic financial information such as income, assets, debts, and credit score to a lender, who then offers an estimate of the loan amount a borrower might qualify for. This step requires minimal documentation and serves as an informal assessment of creditworthiness, helping buyers understand their budget before house hunting. Unlike pre-approval, pre-qualification does not guarantee loan approval but streamlines the initial stages of the mortgage process.

Documentation Required for Each Process

Pre-Qualification requires minimal documentation, often just your income, assets, and debts information to provide an initial estimate of loan eligibility. Pre-Approval demands comprehensive documentation, including pay stubs, tax returns, credit reports, and employment verification, offering a more concrete loan commitment. Your Mortgage application involves detailed paperwork such as property details, appraisal reports, title insurance, and final credit checks to complete the loan approval process.

Benefits of Getting Pre-Approved

Getting pre-approved for a mortgage provides a clear understanding of how much you can borrow, giving you a competitive edge in the housing market by demonstrating serious intent to sellers. Your pre-approval involves a thorough credit check and verification of financial documents, resulting in a more accurate and reliable loan estimate compared to pre-qualification, which is often based on self-reported information. This process helps you set a realistic budget and speeds up the mortgage approval once you find your ideal home.

Limitations of Pre-Qualification

Pre-qualification provides an initial estimate of how much you might borrow but comes with significant limitations, as it relies primarily on self-reported financial information without in-depth verification. This process does not guarantee loan approval or lock in an interest rate, which can lead to unexpected surprises during formal underwriting. Understanding these constraints helps you manage expectations and prepare for a more rigorous pre-approval or mortgage application process.

Impact on Home Buying Power

Pre-Approval offers a concrete estimate of your borrowing capacity based on verified financial documents, significantly strengthening Your home buying power by demonstrating seriousness to sellers. Pre-Qualification provides a general idea of potential loan eligibility without document verification, offering less assurance but a quick overview of affordability. Obtaining a Mortgage commitment finalizes your financing plan, enabling confident property offers and smoother transactions by locking in loan terms and interest rates.

Which Is Better: Pre-Approval or Pre-Qualification?

Pre-approval offers a stronger advantage when securing a mortgage, as it provides a verified estimate of how much you can borrow based on a detailed financial review, making your offer more credible to sellers and lenders. Pre-qualification is a quicker, less rigorous process that gives a general idea of your borrowing capacity but lacks the verification needed for competitive homebuying. Choosing pre-approval over pre-qualification positions your mortgage application favorably, potentially speeding up loan processing and improving your chances of approval.

Tips for Choosing the Right Option

Understanding the difference between pre-approval, pre-qualification, and a mortgage is crucial when navigating home financing. You should prioritize obtaining a pre-approval to strengthen your bargaining power and clarify your budget, as it involves a thorough credit check and income verification. Focus on working with reputable lenders who offer transparent terms and personalized advice to ensure the best mortgage option aligns with your financial goals.

Infographic: Pre-Approval vs Pre-Qualification

relatioo.com

relatioo.com