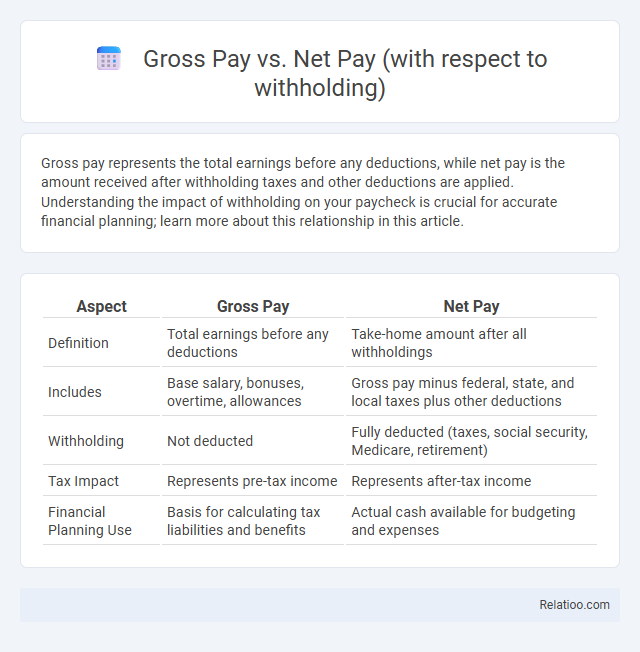

Gross pay represents the total earnings before any deductions, while net pay is the amount received after withholding taxes and other deductions are applied. Understanding the impact of withholding on your paycheck is crucial for accurate financial planning; learn more about this relationship in this article.

Table of Comparison

| Aspect | Gross Pay | Net Pay |

|---|---|---|

| Definition | Total earnings before any deductions | Take-home amount after all withholdings |

| Includes | Base salary, bonuses, overtime, allowances | Gross pay minus federal, state, and local taxes plus other deductions |

| Withholding | Not deducted | Fully deducted (taxes, social security, Medicare, retirement) |

| Tax Impact | Represents pre-tax income | Represents after-tax income |

| Financial Planning Use | Basis for calculating tax liabilities and benefits | Actual cash available for budgeting and expenses |

Understanding Gross Pay: Definition and Components

Gross pay represents the total earnings you receive before any deductions, including salary, bonuses, and overtime wages. Understanding gross pay is essential because it serves as the baseline for calculating withholding taxes such as federal income tax, Social Security, and Medicare contributions. Your net pay is the amount left after all mandatory and voluntary withholdings are subtracted from your gross pay, reflecting your actual take-home income.

What is Net Pay? Key Differences Explained

Net pay is the amount of money you receive after all mandatory withholdings, such as federal and state taxes, Social Security, and Medicare contributions, are deducted from your gross pay. Gross pay represents your total earnings before any deductions, while withholding refers to the specific amounts withheld by your employer for tax purposes. Understanding net pay helps you better manage your income by showing the actual funds available after these key deductions.

The Role of Withholding in Payroll Processing

Gross pay represents the total earnings before any deductions, while net pay is the amount employees receive after withholding taxes and other deductions. Withholding plays a critical role in payroll processing by ensuring accurate deduction of federal, state, and local taxes directly from gross pay, preventing underpayment or penalties. Effective withholding management streamlines compliance with tax regulations and supports timely remittance of payroll taxes to governing authorities.

Common Payroll Deductions Affecting Your Net Pay

Gross pay represents your total earnings before any deductions, while net pay is the actual amount you receive after withholdings such as federal and state income taxes, Social Security, Medicare, and other common payroll deductions like health insurance premiums and retirement contributions. Withholding refers to the portion of your gross pay that your employer deducts to cover taxes and other mandatory or voluntary expenses, directly impacting your net pay calculation. Understanding these common payroll deductions helps you better anticipate your take-home pay and manage your finances effectively.

Taxes Withheld from Gross Pay: Federal, State, and Local

Gross pay represents Your total earnings before any deductions, while net pay is the amount you receive after taxes and other withholdings are subtracted. Taxes withheld from gross pay include federal income tax, state income tax, and local taxes, which directly reduce Your take-home pay. Understanding these deductions helps You accurately track how much of Your earnings are allocated to various government tax obligations.

Benefits and Retirement Contributions: Impact on Take-Home Pay

Gross pay represents the total earnings before any deductions, while net pay reflects the amount after withholding taxes, benefits, and retirement contributions are subtracted. Benefits such as health insurance premiums and retirement plan contributions reduce taxable income, thereby decreasing immediate take-home pay but enhancing long-term financial security. Understanding the impact of withholding on benefits and retirement contributions is crucial for accurate budgeting and maximizing overall compensation value.

Calculating Your Net Pay: Step-by-Step Breakdown

Gross pay represents the total earnings before any deductions, while net pay is the actual amount you receive after subtracting withholding taxes such as federal, state, Social Security, and Medicare contributions. Calculating your net pay involves first determining your gross wages, then applying the appropriate withholding percentages based on your tax status and allowances, and finally deducting any other voluntary contributions like retirement plans or health insurance premiums. Understanding these components ensures accurate payroll calculations and helps you anticipate your take-home income effectively.

Gross Pay vs Net Pay: Real-World Examples

Gross pay represents your total earnings before any deductions, including taxes and benefits withholding, while net pay is your actual take-home amount after these withholdings. For example, if your gross pay is $5,000 per month and your tax and benefit deductions total $1,200, your net pay will be $3,800. Understanding the difference helps you better manage your budget and expectations around your paycheck and tax liabilities.

Why Knowing Your Net Pay Matters for Personal Budgeting

Gross pay represents the total earnings before any deductions, while net pay is the amount you actually receive after withholding taxes and other deductions. Understanding your net pay is crucial for personal budgeting because it reflects the true disposable income available for expenses, savings, and investments. Accurately accounting for withholding ensures you manage your finances effectively without overestimating your spending capacity.

Frequently Asked Questions About Withholding and Paychecks

Gross pay represents the total earnings before any deductions, while net pay is the amount left after withholding taxes, Social Security, Medicare, and other payroll deductions. Withholding refers to the portion of an employee's earnings that an employer deducts to cover federal, state, and local income taxes as well as other mandatory contributions. Frequently asked questions about withholding and paychecks often address how withholding amounts are calculated, why net pay differs from gross pay, and how employees can adjust their withholding allowances to optimize their take-home pay.

Infographic: Gross Pay vs Net Pay (with respect to withholding)

relatioo.com

relatioo.com