Finance charges accrue based on the outstanding balance over time, while late fees are fixed penalties applied after missed payment deadlines. Explore detailed differences and impacts of finance charges and late fees in this article.

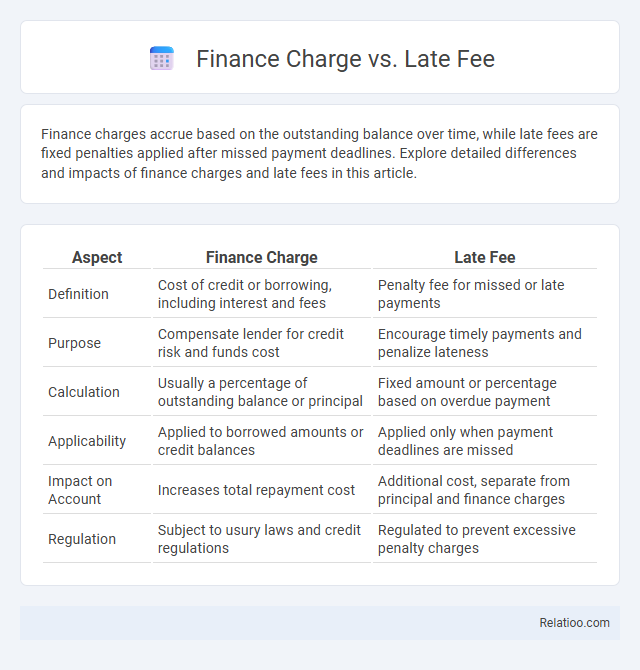

Table of Comparison

| Aspect | Finance Charge | Late Fee |

|---|---|---|

| Definition | Cost of credit or borrowing, including interest and fees | Penalty fee for missed or late payments |

| Purpose | Compensate lender for credit risk and funds cost | Encourage timely payments and penalize lateness |

| Calculation | Usually a percentage of outstanding balance or principal | Fixed amount or percentage based on overdue payment |

| Applicability | Applied to borrowed amounts or credit balances | Applied only when payment deadlines are missed |

| Impact on Account | Increases total repayment cost | Additional cost, separate from principal and finance charges |

| Regulation | Subject to usury laws and credit regulations | Regulated to prevent excessive penalty charges |

Understanding Finance Charges

Finance charges represent the total cost of borrowing, including interest, fees, and other related expenses, expressed as a dollar amount or percentage of the principal. Unlike late fees, which are penalties for missed or delayed payments, finance charges accrue continuously based on the outstanding balance and terms of the credit agreement. Understanding finance charges is crucial for managing debt effectively and avoiding unexpected costs on credit cards, loans, or other financing options.

What Is a Late Fee?

A late fee is a penalty charged when you fail to make a payment by the due date, often expressed as a fixed amount or a percentage of the missed payment. It differs from a finance charge, which represents the total cost of borrowing including interest, fees, and other related costs over time. Understanding late fees helps you avoid unnecessary extra charges and maintain a good credit standing.

Key Differences Between Finance Charges and Late Fees

Finance charges represent the total cost of borrowing, including interest and fees accrued over time, whereas late fees are specific penalties imposed for missing payment deadlines. Your finance charge affects the overall cost of credit and is calculated based on your outstanding balance, while late fees are fixed or percentage amounts added for each missed or delayed payment. Understanding these distinctions helps you manage your credit expenses and avoid unnecessary penalties.

How Finance Charges Are Calculated

Finance charges are typically calculated based on the average daily balance or the outstanding principal multiplied by the periodic interest rate, factoring in the annual percentage rate (APR) set by the lender. Late fees are fixed or percentage-based penalties applied when a payment is overdue and do not directly affect the finance charge calculation but increase the total amount owed. Understanding the distinction between finance charges and late fees helps borrowers anticipate the true cost of credit and avoid unnecessary expenses.

Triggers for Late Fees

Late fees are triggered by missed or delayed payments beyond the due date, typically outlined in the credit agreement or billing statement. Finance charges accrue based on the principal balance and interest rate, reflecting the cost of borrowing over time, regardless of payment timeliness. Understanding these triggers is crucial for managing credit accounts and avoiding unnecessary penalties.

Impact on Your Credit Score

Finance charges represent the interest costs on outstanding credit card balances and typically do not directly affect your credit score unless they lead to increased debt. Late fees occur when payments are missed or delayed and can negatively impact your credit score if reported to credit bureaus, signaling payment delinquency. Both finance charges and late fees can increase your total debt burden, but only late fees have a direct impact on your credit score by potentially lowering your payment history rating.

Ways to Avoid Finance Charges

Finance charges typically result from carrying a balance on credit accounts and include interest fees calculated based on the outstanding amount, while late fees arise from missing payment deadlines. You can avoid finance charges by paying your credit card balance in full each month, setting up automatic payments, and monitoring your statements regularly to prevent interest from accruing. Managing your credit utilization and making timely payments also helps keep both finance charges and late fees at bay.

Strategies to Prevent Late Fees

Implementing automatic payments and setting up payment reminders are effective strategies to prevent late fees, helping avoid additional financial burdens. Monitoring account statements regularly allows for early detection of potential payment issues, reducing the risk of incurring finance charges. Prioritizing timely payments preserves credit scores and minimizes overall borrowing costs by eliminating unnecessary late fees and finance charges.

Legal Regulations and Consumer Rights

Finance charges encompass the total cost of borrowing, including interest and fees, regulated by the Truth in Lending Act (TILA) to ensure transparency in credit terms. Late fees are specific penalties imposed when your payment is delayed, governed by state laws that cap the maximum allowable amount to protect consumers from excessive charges. Understanding these distinctions and legal protections helps you assert your consumer rights and avoid unfair financial penalties.

Choosing the Right Financial Product

Finance charges represent the total cost of borrowing, including interest and fees, while late fees are penalties applied for missed payments. When choosing the right financial product, it's crucial to compare the annual percentage rate (APR) to understand the true cost of credit, not just the potential late fees. Evaluating both the finance charge and late fee structure helps ensure selecting a product aligned with your budget and payment habits.

Infographic: Finance Charge vs Late Fee

relatioo.com

relatioo.com