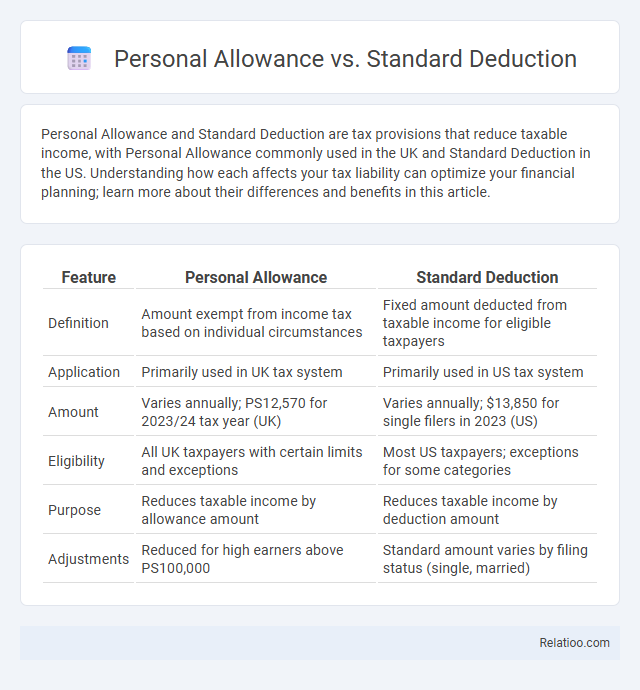

Personal Allowance and Standard Deduction are tax provisions that reduce taxable income, with Personal Allowance commonly used in the UK and Standard Deduction in the US. Understanding how each affects your tax liability can optimize your financial planning; learn more about their differences and benefits in this article.

Table of Comparison

| Feature | Personal Allowance | Standard Deduction |

|---|---|---|

| Definition | Amount exempt from income tax based on individual circumstances | Fixed amount deducted from taxable income for eligible taxpayers |

| Application | Primarily used in UK tax system | Primarily used in US tax system |

| Amount | Varies annually; PS12,570 for 2023/24 tax year (UK) | Varies annually; $13,850 for single filers in 2023 (US) |

| Eligibility | All UK taxpayers with certain limits and exceptions | Most US taxpayers; exceptions for some categories |

| Purpose | Reduces taxable income by allowance amount | Reduces taxable income by deduction amount |

| Adjustments | Reduced for high earners above PS100,000 | Standard amount varies by filing status (single, married) |

Understanding Personal Allowance and Standard Deduction

Understanding Personal Allowance and Standard Deduction is crucial for maximizing your tax benefits in different countries; Personal Allowance typically refers to the amount of income you can earn before paying income tax, commonly used in the UK tax system. The Standard Deduction, primarily used in the United States, provides a fixed deduction amount that reduces taxable income without needing to itemize deductions. Comparing both helps you determine which tax benefit better applies to your financial situation, optimizing your overall tax liability.

Key Differences Between Personal Allowance and Standard Deduction

The key difference between Personal Allowance and Standard Deduction lies in their application and eligibility criteria: Personal Allowance is the amount of income you can earn tax-free primarily in the UK, while the Standard Deduction is a fixed deduction available to U.S. taxpayers that reduces taxable income regardless of expenses. Personal Allowance varies based on income level and specific conditions like age or blindness, whereas the Standard Deduction is a uniform amount adjusted annually for inflation. Your choice or eligibility depends on the country's tax system and your individual financial situation, with Personal Allowance often impacting tax brackets and Standard Deduction simplifying tax filing in the U.S. system.

Eligibility Criteria for Personal Allowance

Personal Allowance eligibility primarily depends on your income level, age, and residency status, with most UK taxpayers entitled to a tax-free personal allowance up to PS12,570 for the 2023/24 tax year. The Standard Deduction, common in the US tax system, offers a fixed reduction in taxable income based on filing status, without additional age or income restrictions. You must meet specific conditions, such as not being a non-resident alien or claimed as a dependent, to qualify for the UK Personal Allowance, distinguishing it from the broader, less conditional Standard Deduction.

Who Qualifies for the Standard Deduction?

The standard deduction primarily benefits taxpayers who do not itemize deductions and varies based on filing status, age, and blindness, with specific amounts set by the IRS each tax year. Single filers, married couples filing jointly, heads of household, and qualifying widows or widowers can all qualify for the standard deduction, which simplifies tax filing and often reduces taxable income more than the personal allowance. The personal allowance, a feature in some tax systems separate from the standard deduction, directly reduces taxable income and is generally available to all individuals, but the standard deduction offers a broader, itemization-free method for lowering tax liability.

Calculation Methods: Personal Allowance vs Standard Deduction

Personal Allowance in the UK is a fixed amount deducted from your taxable income annually, typically set by the government and adjusted for inflation or income thresholds. The Standard Deduction, commonly used in the U.S., is a flat-dollar amount that reduces your taxable income without requiring itemization, varying by filing status and updated yearly by the IRS. Understanding these calculation methods helps you determine which reduces your taxable income more effectively based on your specific financial situation.

Impact on Taxable Income

Personal Allowance reduces taxable income by a fixed amount exempt from income tax, effectively lowering the overall tax burden for individuals. Standard Deduction simplifies tax filings by allowing a uniform deduction without itemizing, which reduces taxable income by a standard fixed value set by tax authorities. Comparing the two, Personal Allowance targets tax relief based on individual eligibility, while Standard Deduction provides a straightforward, flat reduction, both crucial in minimizing taxable income but applicable in different tax systems or scenarios.

Updates and Changes in Tax Laws

The Personal Allowance in the UK increased to PS13,000 for the 2024/25 tax year, reflecting inflation adjustments, while the U.S. Standard Deduction saw a rise to $14,400 for single filers in 2024 under new IRS guidelines. Recent tax law reforms have narrowed eligibility for Personal Allowances in high-income UK earners, phasing out allowances beyond PS125,140 in income. In contrast, the U.S. tax code maintained the Standard Deduction thresholds but introduced targeted credits and phases out based on income brackets, impacting overall taxpayer benefits.

Pros and Cons of Personal Allowance

Personal Allowance offers a tax-free income threshold, reducing taxable income up to a specific limit, which benefits low to moderate earners by lowering their overall tax liability. However, its limitation lies in gradual reduction or elimination at higher income levels, reducing effectiveness for high earners. Unlike Standard Deduction, which provides a flat reduction applicable to all taxpayers regardless of income or deductions, Personal Allowance may require additional calculations and can complicate tax planning.

Advantages and Disadvantages of Standard Deduction

The Standard Deduction simplifies tax filing by reducing taxable income with a fixed amount, benefiting taxpayers who do not itemize deductions by saving time and reducing paperwork. However, it may be disadvantageous if your itemizable expenses exceed the standard amount, potentially leading to a higher tax bill compared to itemizing. You should evaluate your personal financial situation to determine whether the Standard Deduction or Personal Allowance offers greater tax savings based on your deductible expenses and filing status.

Which Option is Best for You?

Choosing between Personal Allowance and Standard Deduction depends on your income level and filing status, as both reduce taxable income but apply differently depending on the tax system and country. The Personal Allowance, commonly used in the UK, allows a specific amount of income to be earned tax-free, while the Standard Deduction in the US offers a fixed deduction amount regardless of expenses, benefiting taxpayers without significant itemized deductions. To determine which option is best, consider your total income, possible deductions, and whether itemizing offers greater tax savings compared to claiming the Standard Deduction or relying on Personal Allowance thresholds.

Infographic: Personal Allowance vs Standard Deduction

relatioo.com

relatioo.com