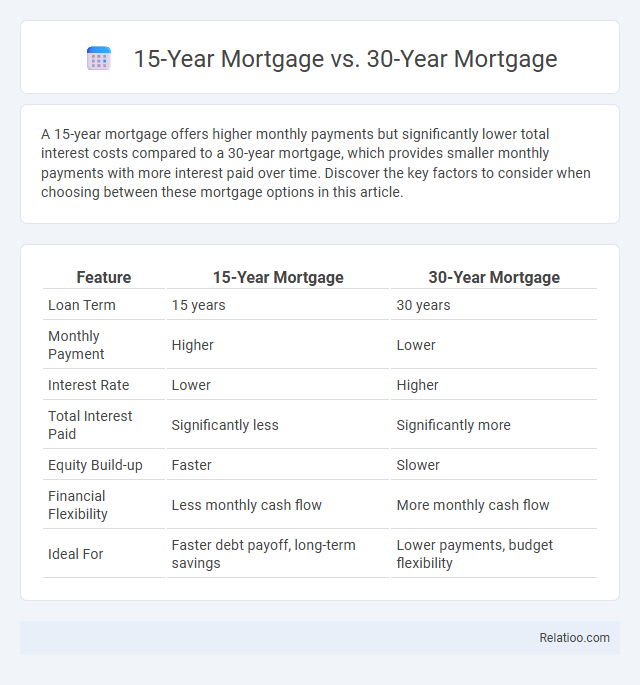

A 15-year mortgage offers higher monthly payments but significantly lower total interest costs compared to a 30-year mortgage, which provides smaller monthly payments with more interest paid over time. Discover the key factors to consider when choosing between these mortgage options in this article.

Table of Comparison

| Feature | 15-Year Mortgage | 30-Year Mortgage |

|---|---|---|

| Loan Term | 15 years | 30 years |

| Monthly Payment | Higher | Lower |

| Interest Rate | Lower | Higher |

| Total Interest Paid | Significantly less | Significantly more |

| Equity Build-up | Faster | Slower |

| Financial Flexibility | Less monthly cash flow | More monthly cash flow |

| Ideal For | Faster debt payoff, long-term savings | Lower payments, budget flexibility |

Understanding 15-Year vs 30-Year Mortgages

A 15-year mortgage typically offers lower interest rates and allows you to build equity faster compared to a 30-year mortgage, which generally has higher monthly payments but more affordable installments spread over a longer period. Your choice impacts total interest paid, monthly budget flexibility, and the speed at which you own your home outright. Understanding these differences helps you align your mortgage with financial goals and long-term stability.

Key Differences Between 15-Year and 30-Year Terms

A 15-year mortgage offers higher monthly payments but significantly lower interest rates and total interest costs compared to a 30-year mortgage, making it ideal for homeowners aiming for faster equity buildup and interest savings. In contrast, a 30-year mortgage provides more affordable monthly payments due to extended repayment terms, increasing overall interest expenses but enhancing cash flow flexibility. The key differences involve payment size, interest rate, total interest paid, and the pace at which home equity accumulates.

Interest Rates: 15-Year vs 30-Year Mortgage

15-year mortgages typically offer lower interest rates compared to 30-year mortgages, resulting in significant savings over the loan term. Choosing a 15-year mortgage means higher monthly payments but reduces the total interest paid and allows you to build equity faster. Your decision between a 15-year and a 30-year mortgage should prioritize long-term financial goals and cash flow flexibility.

Monthly Payment Comparison

A 15-year mortgage typically features higher monthly payments compared to a 30-year mortgage due to the shorter repayment period, but it results in significant interest savings over the life of the loan. In contrast, a 30-year mortgage offers lower monthly payments, making it more affordable for many borrowers, though it accumulates more total interest. Evaluating the monthly payment difference is crucial for homeowners balancing budget constraints with long-term financial goals.

Total Interest Paid Over the Life of the Loan

A 15-year mortgage typically results in significantly less total interest paid compared to a 30-year mortgage due to the shorter repayment period and often lower interest rates. In contrast, a 30-year mortgage spreads payments over twice the time, increasing the total interest even if monthly payments are lower. Choosing a mortgage term directly impacts the overall cost, with a shorter loan term saving tens of thousands in interest payments over the life of the loan.

Building Home Equity Faster

A 15-year mortgage accelerates home equity building by requiring higher monthly payments but significantly reducing interest costs over the loan term compared to a 30-year mortgage. In contrast, a 30-year mortgage offers lower monthly payments but accumulates less equity early on due to slower principal repayment. Homebuyers prioritizing faster equity growth often choose 15-year loans to leverage reduced interest expenses and increased principal contributions per payment.

Affordability and Budget Flexibility

A 15-year mortgage offers higher monthly payments but significantly less interest over the loan term, making it ideal for borrowers prioritizing long-term savings and faster equity buildup. A 30-year mortgage provides lower monthly payments, enhancing affordability and budget flexibility, but results in higher overall interest costs. Evaluating income stability and financial goals helps determine whether prioritizing immediate affordability or long-term savings best fits a borrower's budget strategy.

Long-Term Financial Impact

Choosing a 15-year mortgage over a 30-year mortgage significantly reduces your total interest payments, saving you tens of thousands of dollars throughout the loan term. Your monthly payments will be higher with a 15-year mortgage, but the faster principal repayment builds equity more quickly and shortens the time you remain in debt. Understanding the long-term financial impact of each mortgage type enables you to make decisions aligned with your investment goals and cash flow preferences.

Pros and Cons of 15-Year Mortgages

A 15-year mortgage offers lower interest rates and faster equity buildup, saving you thousands in interest payments compared to a 30-year mortgage. However, higher monthly payments can strain your budget and reduce financial flexibility. You benefit from paying off your home sooner but must ensure your income comfortably covers the increased monthly cost.

Pros and Cons of 30-Year Mortgages

A 30-year mortgage offers lower monthly payments, making it more affordable and easier for your budget to handle compared to a 15-year mortgage, but it comes with higher total interest costs over the loan's life. This mortgage option provides greater flexibility in cash flow, but you will pay more in interest and build equity slower than with a shorter-term 15-year mortgage. You can benefit from lower financial strain upfront, but carefully consider the long-term cost implications.

Infographic: 15-Year Mortgage vs 30-Year Mortgage

relatioo.com

relatioo.com