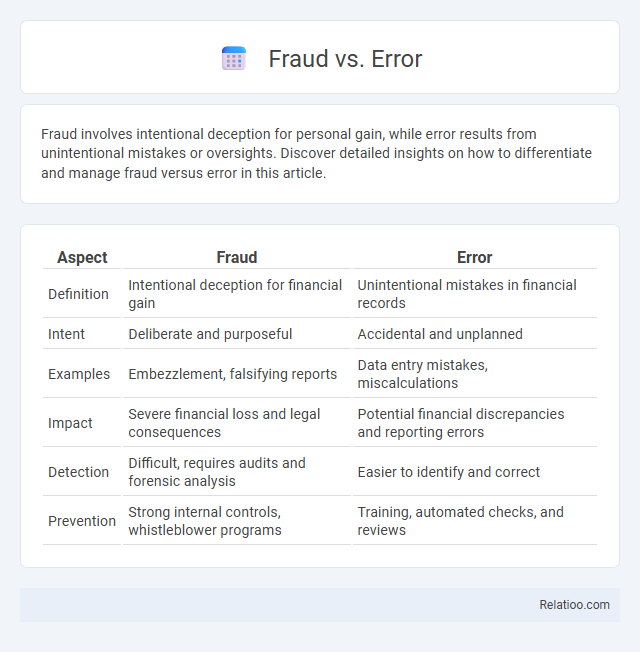

Fraud involves intentional deception for personal gain, while error results from unintentional mistakes or oversights. Discover detailed insights on how to differentiate and manage fraud versus error in this article.

Table of Comparison

| Aspect | Fraud | Error |

|---|---|---|

| Definition | Intentional deception for financial gain | Unintentional mistakes in financial records |

| Intent | Deliberate and purposeful | Accidental and unplanned |

| Examples | Embezzlement, falsifying reports | Data entry mistakes, miscalculations |

| Impact | Severe financial loss and legal consequences | Potential financial discrepancies and reporting errors |

| Detection | Difficult, requires audits and forensic analysis | Easier to identify and correct |

| Prevention | Strong internal controls, whistleblower programs | Training, automated checks, and reviews |

Understanding Fraud and Error: Key Differences

Understanding the differences between fraud and error is crucial for maintaining financial integrity and operational accuracy. Fraud involves deliberate deception to secure unfair or unlawful gain, whereas error is an unintentional mistake resulting from misunderstanding, misinterpretation, or oversight. Your ability to detect and address these distinctions helps protect assets and ensures compliance with regulatory standards.

Defining Fraud: Intentional Deception in Practice

Fraud involves intentional deception designed to secure an unfair or unlawful gain, distinguishing it from errors which are unintentional mistakes or omissions. You must recognize that fraud entails deliberate acts such as falsifying records or misrepresenting information to mislead others. Understanding this intent is crucial for effective detection and prevention in any organizational practice.

What Constitutes an Error? Causes and Types

An error constitutes an unintentional mistake in financial reporting or data entry resulting from human oversight, misunderstanding, or system malfunction. Common causes include clerical mistakes, incorrect application of accounting principles, and data input errors, while types range from arithmetic inaccuracies to misclassifications and omission of transactions. Understanding these errors is crucial for accurate auditing and financial statement integrity, distinguishing them clearly from deliberate fraudulent activities.

Motivations Behind Fraudulent Activities

Fraudulent activities are driven by deliberate intent to deceive or gain financial advantage, often motivated by personal financial pressure, greed, or the desire to meet unrealistic performance targets. Errors, in contrast, arise from unintentional mistakes due to lack of knowledge, oversight, or system failures, lacking malicious intent. Understanding these motivations helps you design better controls to detect and prevent fraud effectively.

Common Sources of Errors in Business Processes

Common sources of errors in business processes include data entry mistakes, miscommunication between departments, and inadequate training of employees. System glitches and outdated software also contribute significantly to operational inaccuracies. These errors often result in financial discrepancies, impact decision-making, and create vulnerabilities that can be exploited for fraud.

Red Flags: Identifying Fraud vs Error

Red flags in identifying fraud versus error often include intentional deception, such as altered documents, unusual financial transactions, or inconsistent explanations, while errors typically result from unintentional mistakes like data entry inaccuracies or miscalculations. Your ability to detect these red flags hinges on scrutinizing patterns that indicate deliberate manipulation rather than simple human oversight. Recognizing signs like suppressed evidence or repeated anomalies helps differentiate fraud from honest errors and safeguards your organization's integrity.

Impact on Organizations: Fraud Compared to Error

Fraud causes deliberate financial loss, reputational damage, and legal consequences for organizations, whereas errors typically result from unintentional mistakes or system failures leading to less severe impacts. Your organization faces higher risks and recovery costs from fraud compared to errors, which often require process improvements or training to resolve. Detecting fraud demands stricter controls and forensic investigations, while errors can be minimized through enhanced quality controls and employee oversight.

Detection Methods: Spotting Fraud and Errors

Detection methods for fraud focus on identifying deliberate deception through anomaly detection, forensic analysis, and behavioral pattern recognition using advanced tools like data mining and AI algorithms. Error detection emphasizes cross-verification, reconciliation, and automated auditing systems to catch unintentional mistakes or discrepancies in records. Combining both approaches enhances the accuracy of financial controls and reduces risks by differentiating intentional fraud from accidental errors.

Prevention Strategies: Minimizing Risks of Fraud and Error

Effective prevention strategies for minimizing risks of fraud and error emphasize robust internal controls, regular employee training, and thorough audit processes. Implementing technology-driven solutions like data analytics and continuous monitoring helps detect anomalies early, safeguarding Your organization from financial loss. Establishing a strong ethical culture and clear reporting channels further reduces vulnerabilities by encouraging accountability and transparency.

Legal and Ethical Consequences: Fraud vs Error

Fraud involves intentional deception to gain unfair or unlawful advantage, leading to severe legal penalties such as fines, imprisonment, and reputational damage, as well as ethical violations including breach of trust and professional misconduct. Errors, typically unintentional mistakes due to oversight or misunderstanding, generally result in corrective actions without criminal charges but may still cause ethical concerns if negligence is proven. Distinguishing fraud from error is crucial for legal systems and organizations to impose appropriate sanctions and maintain ethical standards in financial reporting and corporate governance.

Infographic: Fraud vs Error

relatioo.com

relatioo.com