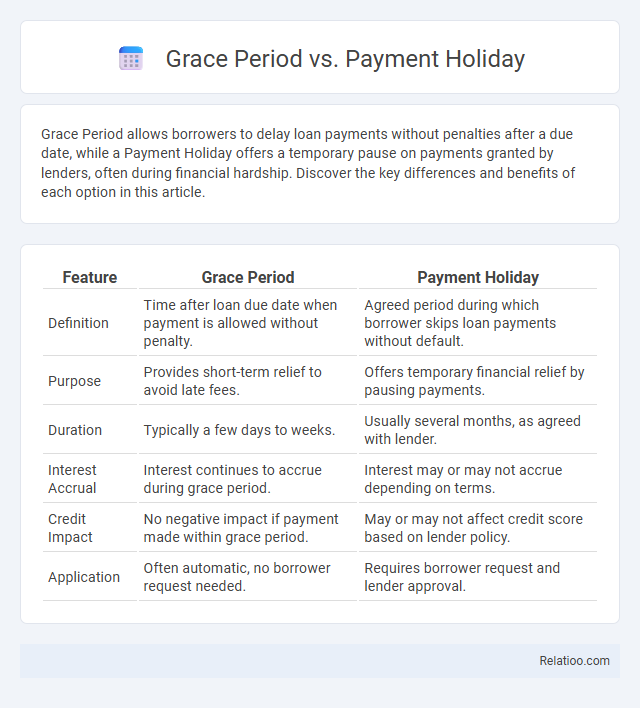

Grace Period allows borrowers to delay loan payments without penalties after a due date, while a Payment Holiday offers a temporary pause on payments granted by lenders, often during financial hardship. Discover the key differences and benefits of each option in this article.

Table of Comparison

| Feature | Grace Period | Payment Holiday |

|---|---|---|

| Definition | Time after loan due date when payment is allowed without penalty. | Agreed period during which borrower skips loan payments without default. |

| Purpose | Provides short-term relief to avoid late fees. | Offers temporary financial relief by pausing payments. |

| Duration | Typically a few days to weeks. | Usually several months, as agreed with lender. |

| Interest Accrual | Interest continues to accrue during grace period. | Interest may or may not accrue depending on terms. |

| Credit Impact | No negative impact if payment made within grace period. | May or may not affect credit score based on lender policy. |

| Application | Often automatic, no borrower request needed. | Requires borrower request and lender approval. |

Understanding Grace Periods: Definition and Purpose

Grace periods refer to a set timeframe after a payment due date during which a borrower can make a payment without incurring penalties or fees, designed to provide financial flexibility and prevent immediate default. Payment holidays, distinct from grace periods, allow borrowers to temporarily pause payments altogether, often negotiated with lenders during financial hardships. Understanding these terms helps clarify borrower protections and the specific conditions under which payments can be delayed or waived without jeopardizing credit standing.

What Is a Payment Holiday? Key Features Explained

A payment holiday is a temporary suspension of loan or mortgage repayments granted by lenders during financial hardship, allowing borrowers to pause payments without penalty. Key features include a defined period--typically ranging from one to six months--where interest may continue to accrue, and the loan term may be extended accordingly. Unlike a grace period that delays due dates within the regular payment schedule, a payment holiday offers a formal break, providing borrowers with flexibility and relief during challenging times.

Grace Period vs Payment Holiday: Core Differences

A grace period is a set timeframe after a payment due date during which no late fees or penalties are applied, allowing borrowers to make payments without impacting credit scores. In contrast, a payment holiday temporarily suspends the requirement to make payments altogether, often requiring prior approval and potentially extending the loan term. Understanding these distinctions helps borrowers manage cash flow effectively without risking loan default or negative credit consequences.

Eligibility Criteria: Who Qualifies for Each Option?

Eligibility criteria for a grace period typically include borrowers who have recently graduated, are unemployed, or facing temporary financial hardship, allowing a delay in loan repayments without penalties. Payment holidays are often granted to individuals demonstrating significant financial distress or unforeseen circumstances, requiring approval from lenders based on income verification and hardship documentation. Your qualification for either option depends on meeting lender-specific requirements, such as creditworthiness, loan type, and current financial status.

Financial Implications: Interest and Penalty Considerations

Grace periods allow borrowers to delay payments without incurring penalties or additional interest, providing temporary financial relief. Payment holidays pause repayments but may result in accumulated interest, increasing the total loan cost over time. Comparing these options helps evaluate the impact on overall debt, with grace periods generally minimizing extra charges while payment holidays often extend loan duration and interest expenses.

Impact on Credit Score: Grace Period Versus Payment Holiday

Grace periods allow borrowers to delay payment without impacting their credit score, as payments within this timeframe are considered on time by credit bureaus. Payment holidays, while offering temporary relief by pausing payments, may be reported differently depending on the lender, possibly leading to negative marks on the credit report. Understanding the distinctions is crucial, as grace periods typically preserve credit scores, whereas payment holidays could cause temporary credit score fluctuations.

Borrower Protections: Legal and Regulatory Insights

Borrower protections in grace periods and payment holidays are established through various legal frameworks designed to prevent default and financial distress. Grace periods legally allow borrowers extra time to meet payment deadlines without penalty, while payment holidays temporarily suspend payments, offering greater flexibility but requiring clear regulatory oversight to avoid abuse. Regulatory guidelines ensure that both options provide transparent terms, protect consumer rights, and promote fair lending practices to mitigate financial risks during economic hardships.

Common Use Cases: When to Choose Grace Periods or Payment Holidays

Grace periods are ideal for short-term financial relief, allowing Your payments to be made after the due date without penalty, commonly used during unexpected cash flow issues or minor delays. Payment holidays provide extended breaks, often lasting several months, suitable for borrowers facing significant financial hardship or temporary income loss. Choosing between a grace period or payment holiday depends on the duration of Your financial difficulty and the lender's specific terms and conditions.

Pros and Cons: Weighing the Benefits and Drawbacks

Grace periods offer temporary relief by postponing payments without penalties, benefiting borrowers facing short-term financial stress, but may increase overall interest costs. Payment holidays allow a full pause on repayments, providing significant short-term cash flow flexibility, yet risk higher accumulated debt and potential credit score impact. Weighing these options depends on individual financial situations, with grace periods suitable for minor delays and payment holidays better for extended hardship, while both require careful consideration of long-term financial consequences.

Making the Right Choice: Factors to Consider

Choosing between a grace period, payment holiday, or deferment requires evaluating cash flow flexibility, interest accrual, and loan terms to minimize financial strain. A grace period temporarily delays payments without accruing penalties, while a payment holiday offers a full payment suspension but may extend the loan tenor and increase interest costs. Consider loan type, lender policies, and long-term financial impact to make an informed decision tailored to your economic situation.

Infographic: Grace Period vs Payment Holiday

relatioo.com

relatioo.com