Principal refers to the original amount of money invested or loaned, while capital encompasses the total wealth or assets owned, including principal plus accrued earnings. Discover how understanding the distinction between principal and capital impacts financial growth and investment strategies in this article.

Table of Comparison

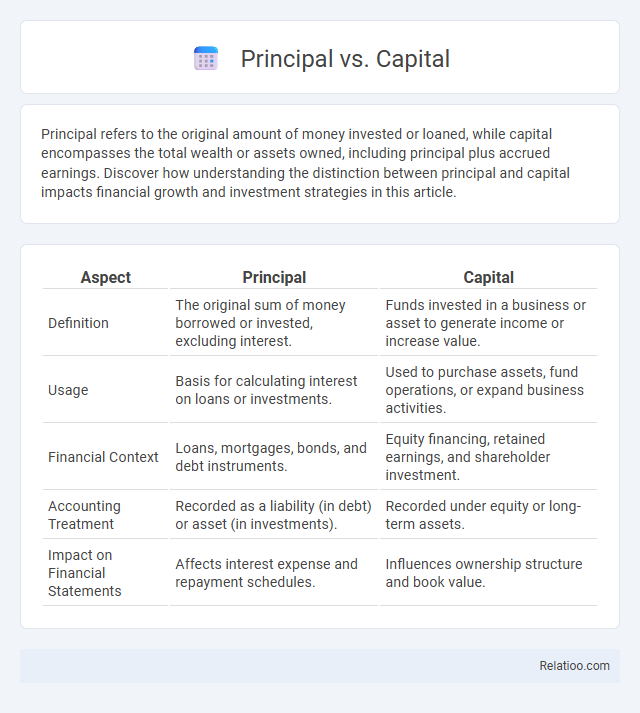

| Aspect | Principal | Capital |

|---|---|---|

| Definition | The original sum of money borrowed or invested, excluding interest. | Funds invested in a business or asset to generate income or increase value. |

| Usage | Basis for calculating interest on loans or investments. | Used to purchase assets, fund operations, or expand business activities. |

| Financial Context | Loans, mortgages, bonds, and debt instruments. | Equity financing, retained earnings, and shareholder investment. |

| Accounting Treatment | Recorded as a liability (in debt) or asset (in investments). | Recorded under equity or long-term assets. |

| Impact on Financial Statements | Affects interest expense and repayment schedules. | Influences ownership structure and book value. |

Understanding the Terms: Principal and Capital

Understanding the terms principal and capital is essential for managing your finances and investments effectively. Principal refers to the original sum of money invested or loaned, while capital represents the total amount of assets or wealth used to generate income or grow a business. Clarifying these distinctions helps you make informed decisions on borrowing, investing, and evaluating financial growth.

Key Differences Between Principal and Capital

Principal refers to the original sum of money invested or loaned, while capital encompasses the total financial resources a business uses, including principal, retained earnings, and reserves. Your principal amount is a fixed figure that determines the basis for interest calculation, whereas capital represents the broader asset base that supports ongoing operations and growth. Understanding the distinction helps in managing investments and business finances effectively by clarifying how funds are allocated and utilized.

Definitions in Financial Contexts

Principal refers to the original sum of money invested or loaned, excluding any interest or earnings accrued. Capital represents the total financial assets or resources available for investment, including retained earnings and equity. Understanding the distinction helps you manage your finances by identifying the fundamental amount (principal) versus the broader pool of assets (capital) used for generating returns.

Principal in Loans and Investments

Principal in loans refers to the original sum of money borrowed, excluding interest, which must be repaid to the lender. In investments, principal represents the initial amount of money invested, serving as the basis for calculating returns or interest earned. Understanding principal is crucial for accurate financial planning, loan amortization schedules, and investment growth analysis.

Capital in Business and Finance

Capital in business and finance refers to the financial assets or resources a company uses to fund its operations, invest in growth, and generate revenue. Unlike principal, which denotes the initial sum of money borrowed or invested excluding interest, capital encompasses equity, debt, and retained earnings that contribute to a firm's overall financial strength. Understanding the distinction between principal and capital is essential for accurately managing cash flow, investment strategies, and balance sheet optimization.

Principal: Role and Importance

Principal represents the original sum of money invested or loaned, forming the core value upon which interest is calculated, making it essential for financial growth and repayment calculations. In contrast, capital often encompasses the total assets or funds available for investment or business operations, while the term "principal" alone specifically denotes the foundational amount without accrued interest. Understanding the principal's role ensures accurate financial planning, risk assessment, and effective management of loans and investments.

Capital: Role and Importance

Capital represents the financial resources or assets invested in a business to generate income and sustain operations, playing a crucial role in growth and stability. Unlike principal, which refers to the original amount of a loan or investment, capital encompasses a broader range of resources including equity, retained earnings, and assets. Understanding the importance of capital helps you ensure your business has sufficient funds to cover expenses, invest in opportunities, and withstand financial challenges.

How Principal and Capital Impact Returns

Principal and capital directly influence your investment returns by determining the base amount on which earnings are calculated. Principal refers to the initial sum of money invested or loaned, while capital encompasses the total funds allocated for investment, including retained earnings. The growth of your returns depends on how effectively this principal or capital is managed, as higher principal amounts generally generate greater returns through interest, dividends, or appreciation.

Practical Examples of Principal vs Capital

Principal refers to the original amount of money invested or loaned, while capital represents the total value of assets or funds available for investment after including profits or additional contributions. For example, if you invest $10,000 as principal in a business and the business generates $2,000 in profits, the capital grows to $12,000, reflecting both the principal and retained earnings. In loan terms, the principal is the initial loan amount that must be repaid before interest, distinguishing it from the total capital required to fund broader business operations.

Choosing the Right Term for Your Financial Needs

Selecting the appropriate term between principal, capital, and fund depends on the specific financial context, such as loans, investments, or business financing. Principal typically refers to the original sum of money borrowed or invested, capital denotes assets or wealth used to generate income, and fund implies a pool of money allocated for a particular purpose. Understanding these distinctions is essential for accurate financial planning and effective communication with lenders, investors, or stakeholders.

Infographic: Principal vs Capital

relatioo.com

relatioo.com