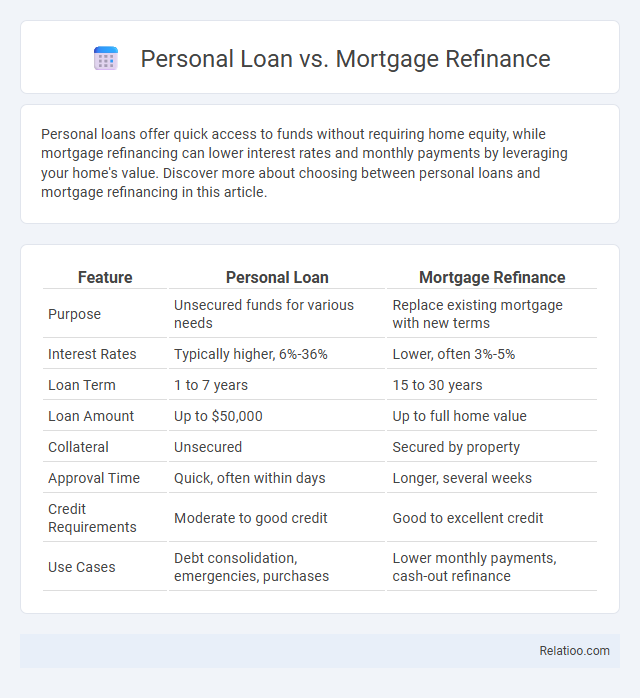

Personal loans offer quick access to funds without requiring home equity, while mortgage refinancing can lower interest rates and monthly payments by leveraging your home's value. Discover more about choosing between personal loans and mortgage refinancing in this article.

Table of Comparison

| Feature | Personal Loan | Mortgage Refinance |

|---|---|---|

| Purpose | Unsecured funds for various needs | Replace existing mortgage with new terms |

| Interest Rates | Typically higher, 6%-36% | Lower, often 3%-5% |

| Loan Term | 1 to 7 years | 15 to 30 years |

| Loan Amount | Up to $50,000 | Up to full home value |

| Collateral | Unsecured | Secured by property |

| Approval Time | Quick, often within days | Longer, several weeks |

| Credit Requirements | Moderate to good credit | Good to excellent credit |

| Use Cases | Debt consolidation, emergencies, purchases | Lower monthly payments, cash-out refinance |

Introduction to Personal Loans and Mortgage Refinance

Personal loans offer unsecured borrowing typically used for consolidating debt, financing large purchases, or covering unexpected expenses, with fixed interest rates and repayment terms. Mortgage refinance involves replacing an existing home loan with a new one, often to reduce interest rates, lower monthly payments, or tap into home equity. Understanding the differences in interest rates, loan terms, and eligibility criteria is crucial when choosing between personal loans and mortgage refinancing options.

Key Differences Between Personal Loans and Mortgage Refinance

Personal loans are unsecured loans with higher interest rates and shorter repayment terms, typically used for smaller expenses or debt consolidation, whereas mortgage refinance involves replacing your existing home loan with a new one to secure lower interest rates or better terms over a longer period. Unlike mortgage refinancing, personal loans generally do not require collateral and do not affect your home equity. Understanding these key differences helps you decide whether your financial goal is to access quick, unsecured funds or to lower your long-term mortgage costs.

Interest Rates: Personal Loan vs Mortgage Refinance

Interest rates for personal loans typically range from 6% to 36%, reflecting unsecured lending risks, whereas mortgage refinance rates are generally lower, often between 2.5% and 5%, due to secured property collateral. Mortgage refinance offers opportunities to reduce monthly payments and overall interest costs by locking in lower rates or changing loan terms, while personal loans usually have fixed, higher interest rates without asset backing. Borrowers should evaluate credit scores, loan amounts, and repayment terms to determine the most cost-effective option for debt consolidation or financing needs.

Loan Terms and Repayment Periods Compared

Personal loans typically offer shorter repayment periods ranging from one to seven years, with fixed interest rates and monthly payments tailored to smaller borrowing amounts. Mortgage refinancing involves replacing your existing home loan with a new one, often extending the repayment period up to 30 years to lower monthly payments or secure better interest rates. Comparing these options, your choice depends on the loan term flexibility you need and how long you plan to manage repayments to optimize financial benefits.

Eligibility Requirements for Each Loan Type

Personal loan eligibility typically requires a stable income, good credit score, and manageable debt-to-income ratio, with fewer collateral demands than mortgage refinance. Mortgage refinance eligibility centers on your home's appraised value, equity, credit history, and debt-to-income ratio, often requiring proof of income and property documentation. Refinancing in general involves meeting lender-specific criteria that balance creditworthiness, financial stability, and asset valuation, which you must carefully evaluate based on your current financial situation.

Application Process: What to Expect

When applying for a personal loan, expect a straightforward process involving credit checks, income verification, and relatively quick approval times. Mortgage refinancing typically requires a more detailed evaluation of your property's value, credit history, and financial documents, resulting in a longer timeline compared to personal loans. Your refinancing application, whether for a mortgage or other types, will demand meticulous documentation and patience due to the complexity and regulatory requirements involved.

Pros and Cons of Personal Loans

Personal loans offer quick access to funds with fixed interest rates and no collateral, making them ideal for covering unexpected expenses or consolidating high-interest debt. However, their interest rates are generally higher than mortgage refinancing, and loan amounts tend to be smaller, which may limit your ability to finance larger projects. You should weigh the convenience and speed of personal loans against potential cost savings from refinancing options that typically provide lower rates and longer repayment terms.

Pros and Cons of Mortgage Refinance

Mortgage refinance offers lower interest rates and monthly payments, improving cash flow and reducing total loan costs over time. The cons include closing costs, potential extension of the loan term, and the risk of losing built-up equity if the property value declines. Personal loans typically have higher interest rates and shorter terms, while mortgage refinance specifically targets existing home loans for better financial terms.

When to Choose Personal Loan Over Mortgage Refinance

Choosing a personal loan over mortgage refinance is ideal when funding smaller expenses like home improvements, debt consolidation, or emergencies without altering the mortgage structure. Personal loans provide faster approval and less stringent credit requirements, making them suitable for borrowers seeking quick access to funds without the lengthy process of refinancing. Mortgage refinance benefits larger, long-term financial restructuring with potential interest savings, whereas personal loans serve short-term needs with fixed terms and predictable payments.

Frequently Asked Questions (FAQs)

Personal loan, mortgage refinance, and refinancing each serve different financial needs, where a personal loan typically offers unsecured credit for various expenses, while mortgage refinance restructures your home loan to lower interest rates or adjust terms, potentially reducing monthly payments. Frequently asked questions often include how refinancing affects credit scores, whether you can use a personal loan to pay off existing debt, and the costs associated with mortgage refinance such as closing fees and appraisal charges. Understanding your eligibility, comparing interest rates, and evaluating long-term savings are crucial steps to decide which option best suits Your financial goals and circumstances.

Infographic: Personal Loan vs Mortgage Refinance

relatioo.com

relatioo.com