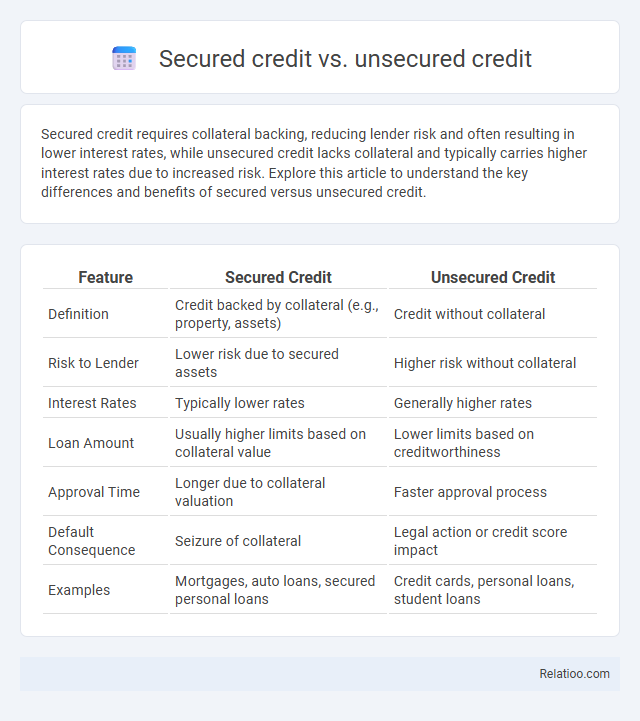

Secured credit requires collateral backing, reducing lender risk and often resulting in lower interest rates, while unsecured credit lacks collateral and typically carries higher interest rates due to increased risk. Explore this article to understand the key differences and benefits of secured versus unsecured credit.

Table of Comparison

| Feature | Secured Credit | Unsecured Credit |

|---|---|---|

| Definition | Credit backed by collateral (e.g., property, assets) | Credit without collateral |

| Risk to Lender | Lower risk due to secured assets | Higher risk without collateral |

| Interest Rates | Typically lower rates | Generally higher rates |

| Loan Amount | Usually higher limits based on collateral value | Lower limits based on creditworthiness |

| Approval Time | Longer due to collateral valuation | Faster approval process |

| Default Consequence | Seizure of collateral | Legal action or credit score impact |

| Examples | Mortgages, auto loans, secured personal loans | Credit cards, personal loans, student loans |

Introduction to Secured and Unsecured Credit

Secured credit requires collateral, such as property or assets, to guarantee loan repayment, reducing lender risk and often resulting in lower interest rates. Unsecured credit, like credit cards or personal loans, does not require collateral, making it riskier for lenders and typically carrying higher interest rates. Understanding the differences between secured and unsecured credit helps consumers choose the best financing option based on their creditworthiness and financial goals.

Defining Secured Credit: Key Features

Secured credit requires collateral, such as property or assets, which reduces the lender's risk and often results in lower interest rates compared to unsecured credit. Unsecured credit, including most credit cards and personal loans, does not require collateral, making it riskier for lenders and typically leading to higher interest rates. Understanding the distinction between these credit types can help you manage your borrowing strategy effectively and protect your financial health.

Understanding Unsecured Credit Options

Unsecured credit options, unlike secured credit, do not require collateral, making them accessible but typically carrying higher interest rates due to increased lender risk. Common forms include credit cards, personal loans, and lines of credit, which allow you to borrow funds based on your creditworthiness alone. Understanding your unsecured credit options helps you manage debt more effectively and avoid potential financial pitfalls associated with higher charges and stricter repayment terms.

Types of Secured Credit Products

Secured credit products include mortgage loans, auto loans, and secured credit cards, each backed by collateral such as real estate, vehicles, or cash deposits, reducing lender risk. These products often feature lower interest rates and higher credit limits due to the security provided by the collateral. Compared to unsecured credit types like personal loans or credit cards, secured credit offers stronger borrowing terms but requires asset pledging.

Common Unsecured Credit Products

Common unsecured credit products include credit cards, personal loans, and lines of credit, which do not require collateral for approval. These products typically carry higher interest rates compared to secured credit options like mortgages or auto loans, as lenders take on more risk without asset backing. Understanding the differences helps you choose the right credit product to fit your financial needs and credit profile.

Risk Factors: Borrowers vs. Lenders

Secured credit carries lower risk for lenders due to collateral, reducing the likelihood of loss, while borrowers face the risk of asset repossession upon default. Unsecured credit poses higher risk for lenders as there is no collateral, leading to higher interest rates to compensate for potential losses, and borrowers risk damaging their credit score or facing legal action if unable to repay. Overall, credit risk management involves balancing borrower creditworthiness against potential lender exposure to default, influencing approval, terms, and recovery options.

Interest Rates: Secured vs. Unsecured Credit

Secured credit typically offers lower interest rates because it is backed by collateral, reducing the lender's risk, while unsecured credit carries higher rates due to the lack of security and increased default risk. Your ability to qualify for secured credit can result in more favorable loan terms and lower overall borrowing costs. Understanding the difference in interest rates between secured and unsecured credit is essential for managing your credit wisely.

Approval Process and Credit Requirements

Secured credit requires collateral such as a car or savings account, which simplifies the approval process and lowers credit requirements because the lender has a guaranteed asset to claim if you default. Unsecured credit relies solely on your creditworthiness, making the approval process stricter and credit requirements higher to mitigate risk for the lender. Understanding these differences helps you choose the right type of credit based on your financial situation and approval likelihood.

Impact on Credit Score and Financial Health

Secured credit, backed by collateral such as a savings account or property, typically has a positive impact on your credit score by demonstrating reliable repayment behavior and lowering the risk to lenders. Unsecured credit, like credit cards or personal loans, can improve your credit score if managed responsibly but carries a higher risk of debt accumulation, potentially harming your financial health. Regularly using and paying secured and unsecured credit on time helps build a strong credit profile while avoiding missed payments prevents negative marks that could lower your credit score and damage your financial stability.

Choosing the Right Credit Type for Your Needs

Secured credit requires collateral, reducing lender risk and often resulting in lower interest rates, making it suitable for those with limited credit history or seeking larger loan amounts. Unsecured credit, lacking collateral, typically has higher interest rates but offers flexibility and faster approval, ideal for short-term financing or everyday purchases. Understanding these differences helps you choose the right credit type that aligns with your financial goals and repayment capacity.

Infographic: Secured credit vs Unsecured credit

relatioo.com

relatioo.com