Term life insurance offers affordable, temporary coverage for a specific period, while whole life insurance provides lifelong protection with a cash value component. Discover which policy best suits your financial goals and family's needs in this article.

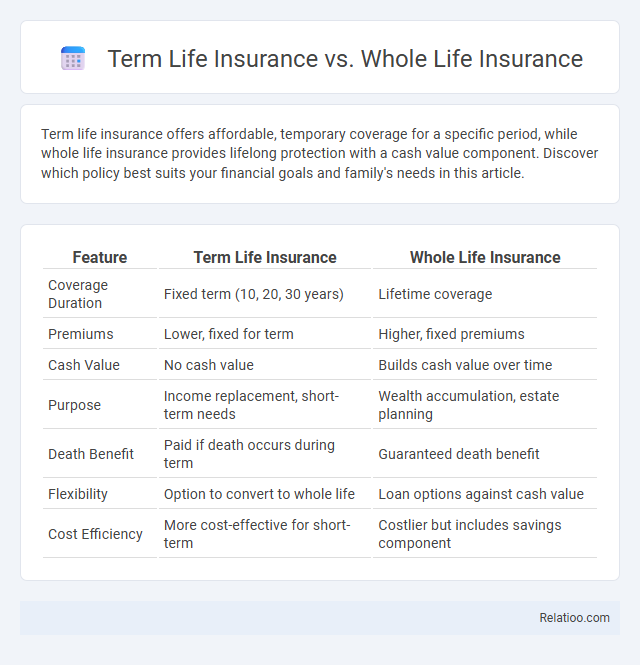

Table of Comparison

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Fixed term (10, 20, 30 years) | Lifetime coverage |

| Premiums | Lower, fixed for term | Higher, fixed premiums |

| Cash Value | No cash value | Builds cash value over time |

| Purpose | Income replacement, short-term needs | Wealth accumulation, estate planning |

| Death Benefit | Paid if death occurs during term | Guaranteed death benefit |

| Flexibility | Option to convert to whole life | Loan options against cash value |

| Cost Efficiency | More cost-effective for short-term | Costlier but includes savings component |

Introduction to Life Insurance Types

Term life insurance offers coverage for a specified period, providing a death benefit if the insured passes away within the term, making it a cost-effective option for temporary needs. Whole life insurance provides lifelong coverage with a fixed premium and includes a cash value component that grows over time, combining protection with investment. Understanding these primary life insurance types helps individuals choose policies that balance financial security, premium costs, and long-term benefits.

What Is Term Life Insurance?

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years, offering a death benefit if the insured passes away within the term. It is often more affordable than whole life insurance because it does not build cash value and focuses solely on protection. Understanding what term life insurance offers can help you choose the right policy to meet your financial security needs during critical years.

What Is Whole Life Insurance?

Whole life insurance provides lifelong coverage with a fixed premium and a cash value component that grows over time. Unlike term life insurance, which only offers protection for a specified period, whole life insurance combines insurance protection with an investment element, allowing Your policy to build savings that can be borrowed against or withdrawn. This type of insurance suits individuals seeking permanent financial security and wealth accumulation.

Key Differences Between Term and Whole Life

Term life insurance offers coverage for a specified period, typically 10 to 30 years, and provides a death benefit without any cash value accumulation. Whole life insurance combines lifelong coverage with a savings component, accumulating cash value that policyholders can borrow against or withdraw. The key differences lie in term life's temporary protection and lower premiums versus whole life's permanent coverage and higher costs, making each suited to different financial goals and needs.

Cost Comparison: Term vs Whole Life Insurance

Term life insurance generally offers lower premiums compared to whole life insurance because it provides coverage for a specified period without accumulating cash value. Whole life insurance includes both a death benefit and a savings component, making it more expensive but also allowing you to build cash value over time. Your choice between term and whole life insurance should consider budget constraints and long-term financial goals.

Pros and Cons of Term Life Insurance

Term Life Insurance offers affordable premiums and straightforward coverage for a set period, making it ideal for short-term financial protection or budgeting needs, but it lacks cash value accumulation and coverage beyond the term. Whole Life Insurance provides lifelong coverage with a cash value component that grows over time, yet it typically involves higher premiums and more complex policies. Your choice should consider the trade-offs between cost, duration of coverage, and financial goals.

Pros and Cons of Whole Life Insurance

Whole life insurance offers lifetime coverage with fixed premiums and a cash value component that grows tax-deferred, providing financial security and a savings element. However, it generally comes with higher premiums compared to term life insurance and may have lower returns on the cash value compared to other investment options. Whole life insurance is best suited for those seeking long-term protection and forced savings, but it may not be the most cost-effective solution for temporary or budget-conscious coverage needs.

Which Insurance Is Better for Different Life Stages?

Term life insurance offers affordable coverage for a specific period, making it ideal for young families and individuals with temporary financial responsibilities. Whole life insurance provides lifelong protection with a cash value component, suiting those seeking long-term security and wealth accumulation. Choosing the best insurance depends on life stage: term insurance fits early career and family-building years, while whole life benefits retirees or those focused on estate planning.

Factors to Consider When Choosing Between Term and Whole Life

When choosing between term life insurance and whole life insurance, consider factors such as your financial goals, budget, and coverage duration. Term life insurance offers affordable premiums for a specific period, ideal for temporary needs like mortgage protection, while whole life insurance provides lifelong coverage with an investment component that builds cash value. Assess Your current financial situation and long-term plans to determine which option aligns best with Your needs and priorities.

Final Verdict: Making the Right Choice

Choosing between Term Life Insurance, Whole Life Insurance, and other insurance types depends on financial goals, budget, and coverage needs. Term Life Insurance offers affordable, temporary protection ideal for income replacement, while Whole Life Insurance provides lifelong coverage with cash value accumulation and higher premiums. Evaluating factors such as duration of coverage, cost, and investment benefits ensures the most suitable insurance policy aligns with personal financial planning.

Infographic: Term Life Insurance vs Whole Life Insurance

relatioo.com

relatioo.com