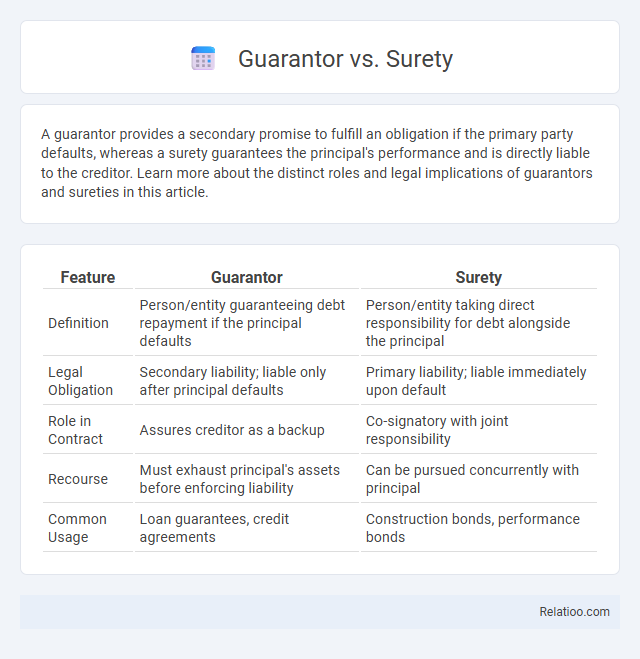

A guarantor provides a secondary promise to fulfill an obligation if the primary party defaults, whereas a surety guarantees the principal's performance and is directly liable to the creditor. Learn more about the distinct roles and legal implications of guarantors and sureties in this article.

Table of Comparison

| Feature | Guarantor | Surety |

|---|---|---|

| Definition | Person/entity guaranteeing debt repayment if the principal defaults | Person/entity taking direct responsibility for debt alongside the principal |

| Legal Obligation | Secondary liability; liable only after principal defaults | Primary liability; liable immediately upon default |

| Role in Contract | Assures creditor as a backup | Co-signatory with joint responsibility |

| Recourse | Must exhaust principal's assets before enforcing liability | Can be pursued concurrently with principal |

| Common Usage | Loan guarantees, credit agreements | Construction bonds, performance bonds |

Introduction to Guarantor and Surety

A guarantor legally promises to fulfill another party's debt or obligation if that party defaults, offering a secondary layer of financial security in contracts. A surety, however, provides a primary obligation alongside the principal debtor, being equally responsible for the debt from the start. Understanding the differences between your role as a guarantor or surety helps clarify the extent of your financial commitment and liability in legal agreements.

Key Definitions: Guarantor vs Surety

A guarantor is an individual or entity that provides a secondary promise to fulfill an obligation if the primary party defaults, often involved in loans and credit agreements. A surety, on the other hand, acts as a co-signatory who is directly liable from the outset alongside the principal debtor, ensuring immediate responsibility for the debt or obligation. The key distinction between guarantor and surety lies in the surety's joint and several liability, whereas a guarantor's responsibility arises only after the principal defaults.

Legal Framework: Guarantor and Surety

The legal framework distinguishes a guarantor as a party who provides a secondary obligation to pay only if the primary obligor defaults, whereas a surety assumes direct and primary liability for the debt or obligation. Under most jurisdictional laws, the surety relationship is more stringent, requiring explicit consent and documentation, while guarantor roles may be more flexible with enforceability tied closely to the principal contract. Your understanding of these differences is crucial for drafting legally binding agreements that clearly define the extent of financial responsibility and risk exposure.

Core Responsibilities in Each Role

A guarantor legally assures the fulfillment of a borrower's obligations if they default, primarily responsible for repayment under the loan agreement. A surety directly undertakes the obligation alongside the principal debtor, being equally liable for the debt and often required to perform immediately upon default. While both roles involve credit risk assumption, the guarantor's liability is secondary and contingent, whereas the surety's liability is primary and immediate, making their core responsibilities distinct in loan enforcement and risk management.

Differences in Liability: Guarantor vs Surety

The differences in liability between a guarantor and a surety hinge on the nature of their obligations; a surety is primarily liable from the moment the principal debtor defaults, assuming immediate responsibility for the debt, while a guarantor's liability is secondary and arises only after the creditor exhausts remedies against the principal debtor. Your role as a guarantor involves backing the debt as a fallback, whereas a surety undertakes more direct and immediate accountability. Understanding these distinctions is crucial for assessing the risk and legal exposure involved in financial agreements.

Rights and Protections for Guarantors and Sureties

Guarantors and sureties both assume secondary liability for a debtor's obligations, but guarantors have distinct rights allowing them to demand the creditor exhaust remedies against the principal debtor before pursuing them. Sureties possess the right of subrogation, enabling them to step into the creditor's shoes once the debt is paid, thereby enforcing the creditor's rights against the principal debtor. Protections for both include indemnity rights and defenses against creditor misconduct or invalid claims, ensuring they are not unfairly held liable beyond their contractual commitments.

Common Use Cases and Examples

Guarantors are commonly used in loan agreements to provide a backup source of repayment if the primary borrower defaults, such as a parent co-signing a student loan for their child. Sureties often appear in construction contracts, where a surety bond guarantees the contractor will fulfill project obligations, protecting the project owner. Your choice between a guarantor, surety, or co-surety depends on the level of obligation and legal liability involved in ensuring debt or contractual performance.

Termination of Obligations

Termination of obligations differs significantly among guarantor, surety, and indemnitor arrangements. A guarantor's liability typically ends when the principal debt is fully paid, the agreement expires, or the creditor releases the guarantor. Surety obligations often terminate upon principal debt satisfaction or creditor release, whereas indemnitors may have broader, ongoing responsibilities until all indemnified losses are resolved.

Risks and Considerations

A guarantor assumes secondary liability, stepping in only if the primary debtor defaults, which limits their immediate risk but requires thorough assessment of the debtor's creditworthiness and financial stability. A surety holds primary liability, making them directly responsible for the obligation from inception, exposing them to higher risk and necessitating careful evaluation of contract terms and potential default scenarios. Understanding the distinctions and legal implications of each role is crucial for accurately assessing financial exposure and drafting enforceable agreements.

How to Choose Between a Guarantor and a Surety

Choosing between a guarantor and a surety depends on your risk tolerance and the level of legal obligation you require. A guarantor offers a secondary promise to pay only if the primary debtor defaults, making it a conditional and often less risky option for you. A surety provides a primary and direct obligation to fulfill the debt, creating a stronger commitment that benefits lenders but carries greater accountability for the person assuming the role.

Infographic: Guarantor vs Surety

relatioo.com

relatioo.com