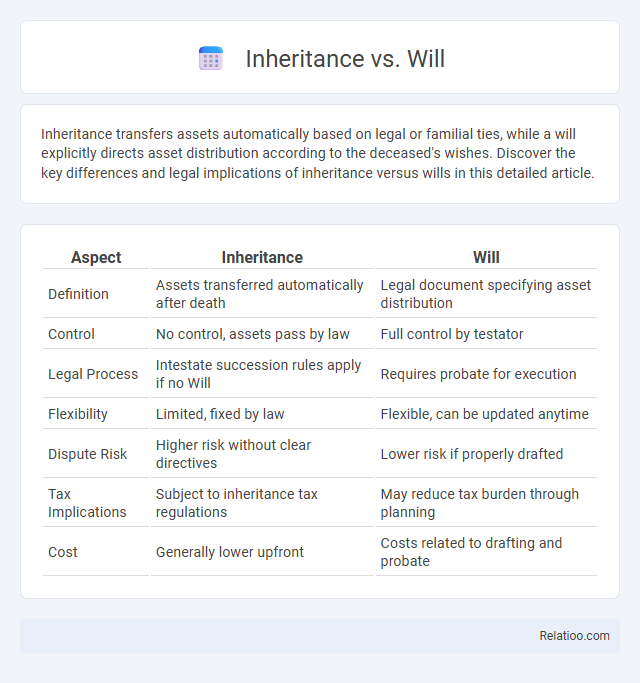

Inheritance transfers assets automatically based on legal or familial ties, while a will explicitly directs asset distribution according to the deceased's wishes. Discover the key differences and legal implications of inheritance versus wills in this detailed article.

Table of Comparison

| Aspect | Inheritance | Will |

|---|---|---|

| Definition | Assets transferred automatically after death | Legal document specifying asset distribution |

| Control | No control, assets pass by law | Full control by testator |

| Legal Process | Intestate succession rules apply if no Will | Requires probate for execution |

| Flexibility | Limited, fixed by law | Flexible, can be updated anytime |

| Dispute Risk | Higher risk without clear directives | Lower risk if properly drafted |

| Tax Implications | Subject to inheritance tax regulations | May reduce tax burden through planning |

| Cost | Generally lower upfront | Costs related to drafting and probate |

Understanding Inheritance and Wills

Inheritance involves the transfer of assets and liabilities from a deceased individual to their heirs, typically governed by state laws when no will exists. A will is a legal document that details how an individual's estate should be distributed, specifying beneficiaries, executors, and guardianship, ensuring the deceased's wishes are honored. Understanding both inheritance and wills is crucial for effective estate planning, preventing disputes, and ensuring a clear transfer of property and responsibilities.

Key Differences Between Inheritance and Wills

Inheritance refers to the assets and rights passed down to beneficiaries upon a person's death, while a will is a legal document that outlines how those assets should be distributed. The key difference lies in that inheritance occurs as a result of the will or state laws if no will exists, whereas a will serves as the formal instruction guiding the process. Without a valid will, inheritance follows intestacy laws, which determine heirs and asset division based on jurisdiction-specific regulations.

Legal Definitions: Inheritance vs Will

Inheritance refers to the property or assets received by heirs or beneficiaries after the death of an individual, based on legal entitlement or testamentary instructions. A will is a legally binding document that specifies how a person's estate should be distributed upon their death, appointing executors and detailing beneficiary allocations. Understanding legal definitions clarifies that inheritance is the outcome of asset transfer, while a will is the formal instrument that directs this process.

Types of Inheritance: Intestate vs Testate

Types of inheritance are primarily divided into intestate and testate categories. Intestate inheritance occurs when a person dies without a valid will, causing the estate to be distributed according to state laws, whereas testate inheritance involves distributing assets according to a legally valid will created by the deceased. Understanding these distinctions helps you ensure your estate plan aligns with your wishes and legal requirements.

Importance of Making a Will

Creating a will is crucial for ensuring your assets are distributed according to your wishes, which can prevent family disputes and legal complications after your passing. Without a will, inheritance laws dictate how your estate is divided, often leading to outcomes that may not reflect your intentions. Securing your legacy through a clear, legally binding will provides peace of mind and protects your loved ones from unnecessary uncertainty.

How Inheritance Laws Work

Inheritance laws determine how a deceased person's assets are distributed, either through a will or according to intestacy rules when no will exists. A will explicitly states the decedent's wishes, guiding the legal transfer of property, while inheritance laws provide a default framework based on family relationships and jurisdiction-specific rules. Understanding the differences ensures proper estate planning and asset allocation according to legal requirements and personal intentions.

Probate Process: What Happens Next

The probate process involves validating a will or distributing assets when there is no will (intestate inheritance), ensuring the legal transfer of property according to the deceased's wishes or state law. Your estate enters probate to settle debts, appraise assets, and officially assign ownership to heirs or beneficiaries. Understanding the probate timeline and required court filings helps streamline asset distribution and resolve disputes efficiently.

Common Misconceptions About Wills and Inheritance

Common misconceptions about wills and inheritance often stem from the belief that a will is the only necessary document for transferring assets after death. You may assume that having a will guarantees a smooth distribution, but probate processes and legal challenges can complicate matters significantly. Understanding the distinctions between inheritance laws, wills, and trusts can prevent disputes and ensure your estate is managed according to your wishes.

Protecting Your Assets: Tips and Strategies

Protecting your assets requires understanding the distinctions between inheritance, wills, and trusts to ensure your estate is distributed according to your wishes. A well-drafted will specifies how your assets will be allocated, while a trust can offer greater control, privacy, and protection from probate. You should implement strategies such as updating beneficiary designations, establishing trusts, and consulting estate planning professionals to safeguard your wealth and minimize legal challenges.

Choosing the Right Estate Planning Option

Choosing the right estate planning option depends on your unique financial situation and family needs, with inheritance, wills, and trusts each offering distinct benefits. A will directs the distribution of your assets upon death but goes through probate, whereas inheritance laws apply when there is no will, potentially causing delays and disputes. Trusts provide greater control and privacy by managing assets during and after your lifetime, helping you ensure Your estate is handled according to your specific wishes.

Infographic: Inheritance vs Will

relatioo.com

relatioo.com