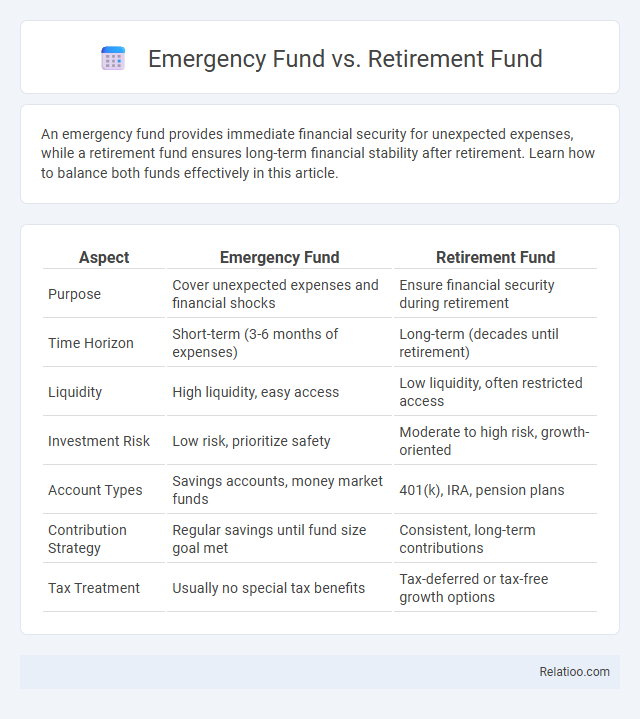

An emergency fund provides immediate financial security for unexpected expenses, while a retirement fund ensures long-term financial stability after retirement. Learn how to balance both funds effectively in this article.

Table of Comparison

| Aspect | Emergency Fund | Retirement Fund |

|---|---|---|

| Purpose | Cover unexpected expenses and financial shocks | Ensure financial security during retirement |

| Time Horizon | Short-term (3-6 months of expenses) | Long-term (decades until retirement) |

| Liquidity | High liquidity, easy access | Low liquidity, often restricted access |

| Investment Risk | Low risk, prioritize safety | Moderate to high risk, growth-oriented |

| Account Types | Savings accounts, money market funds | 401(k), IRA, pension plans |

| Contribution Strategy | Regular savings until fund size goal met | Consistent, long-term contributions |

| Tax Treatment | Usually no special tax benefits | Tax-deferred or tax-free growth options |

Understanding Emergency Funds

Understanding emergency funds is essential for your financial stability, as these savings are specifically set aside to cover unexpected expenses such as medical bills, car repairs, or job loss. Unlike retirement funds, which grow over time through investments for long-term goals, emergency funds must remain easily accessible and liquid for immediate use. Effective money management balances maintaining a robust emergency fund alongside ongoing contributions to retirement accounts, ensuring both short-term security and long-term financial growth.

What is a Retirement Fund?

A retirement fund is a dedicated savings account or investment portfolio designed to provide financial security and income after an individual stops working. It typically includes contributions made during one's working years, invested in assets like stocks, bonds, or mutual funds to grow tax-deferred or tax-free. Effective money management involves balancing contributions to a retirement fund alongside maintaining an emergency fund to ensure both long-term growth and immediate financial protection.

Key Differences Between Emergency and Retirement Funds

Emergency funds provide immediate financial security for unexpected expenses, typically covering three to six months of living costs, while retirement funds are long-term investments designed to support you after you stop working. Emergency funds prioritize liquidity and quick access, whereas retirement funds focus on growth through diversified assets over decades. Efficient money management requires balancing both by maintaining accessible emergency savings alongside consistent contributions to your retirement plan.

Importance of Building an Emergency Fund

Building an emergency fund is a critical component of effective money management, providing a financial safety net that covers unexpected expenses such as medical emergencies, car repairs, or sudden job loss. Unlike retirement funds that are intended for long-term wealth accumulation and future security, an emergency fund ensures immediate liquidity and financial stability during unforeseen crises. Prioritizing the establishment of a fully funded emergency fund, typically covering three to six months of living expenses, reduces reliance on debt and supports overall financial resilience.

Why Retirement Funds Matter for Your Future

Retirement funds matter for your future because they provide financial security when regular income ceases, ensuring you maintain your lifestyle after leaving the workforce. Unlike emergency funds designed for unexpected expenses, retirement funds grow through long-term investments, maximizing your money's potential over decades. Effective money management balances contributions to both emergency and retirement funds, securing your present needs and future stability.

How Much Should You Save in Each Fund?

You should aim to save at least three to six months' worth of living expenses in your emergency fund to cover unexpected costs like medical bills or job loss. Your retirement fund target depends on your desired retirement lifestyle, generally recommended as 10 to 12 times your annual income by retirement age, leveraging tax-advantaged accounts like 401(k)s or IRAs for growth. Effective money management balances contributions to both funds while maintaining daily budgeting and debt control, ensuring your financial stability in both short-term emergencies and long-term goals.

Accessibility: Emergency vs Retirement Savings

Emergency funds provide immediate access to cash, ensuring financial stability during unexpected events, while retirement savings are typically locked in until retirement age, limiting liquidity. The accessibility of emergency savings makes them essential for short-term crises, whereas retirement funds prioritize long-term growth through investments with restricted withdrawal options. Effective money management balances these accounts to maintain both readiness for emergencies and future financial security.

Investment Strategies for Each Fund

Emergency funds prioritize liquidity and capital preservation, typically held in high-yield savings accounts or money market funds to ensure immediate access without risk. Retirement funds focus on long-term growth through diversified investment portfolios, including stocks, bonds, and index funds, aiming to maximize compounding returns over decades. Effective money management balances allocation between emergency savings, retirement contributions, and other investments by assessing risk tolerance, time horizon, and financial goals to optimize overall asset growth and financial security.

Common Mistakes to Avoid

Many individuals make the mistake of neglecting an emergency fund while prioritizing retirement savings, leaving themselves vulnerable to unexpected expenses. Overcommitting to long-term investments without maintaining accessible funds can disrupt your financial stability during crises. Proper money management requires balancing immediate liquidity with future growth to avoid cash flow issues and ensure comprehensive financial security.

Balancing Priorities: Funding Both Accounts

Balancing priorities between emergency funds and retirement accounts requires strategic allocation of income to ensure financial security and long-term growth. Maintaining a minimum emergency fund covering three to six months of expenses provides liquidity for unexpected events, while consistent contributions to retirement accounts like 401(k)s or IRAs leverage compound interest for future wealth. Integrating budgeting tools and automatic transfers optimizes cash flow management, enabling simultaneous progress in both funds without compromising current financial stability.

Infographic: Emergency Fund vs Retirement Fund

relatioo.com

relatioo.com