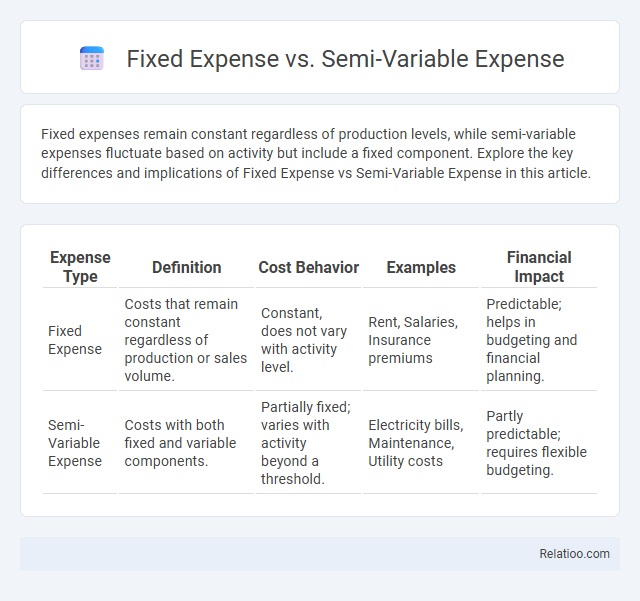

Fixed expenses remain constant regardless of production levels, while semi-variable expenses fluctuate based on activity but include a fixed component. Explore the key differences and implications of Fixed Expense vs Semi-Variable Expense in this article.

Table of Comparison

| Expense Type | Definition | Cost Behavior | Examples | Financial Impact |

|---|---|---|---|---|

| Fixed Expense | Costs that remain constant regardless of production or sales volume. | Constant, does not vary with activity level. | Rent, Salaries, Insurance premiums | Predictable; helps in budgeting and financial planning. |

| Semi-Variable Expense | Costs with both fixed and variable components. | Partially fixed; varies with activity beyond a threshold. | Electricity bills, Maintenance, Utility costs | Partly predictable; requires flexible budgeting. |

Understanding Fixed Expenses

Fixed expenses remain constant regardless of your business activity levels, such as rent, salaries, and insurance premiums, providing predictable financial commitments. In contrast, semi-variable expenses fluctuate with production volume or usage, including utility bills that have a fixed base rate plus a variable component. Understanding fixed expenses allows you to better manage your budget and forecast financial stability by separating them from variable costs that change with business operations.

Defining Semi-Variable Expenses

Semi-variable expenses combine fixed and variable cost components, changing in proportion to business activity while maintaining a baseline fixed charge. This category differs from fixed expenses, which remain constant regardless of production levels, and variable expenses, which fluctuate directly with output volume. Understanding semi-variable expenses helps you accurately forecast costs and manage budgeting efficiently.

Key Differences Between Fixed and Semi-Variable Expenses

Fixed expenses remain constant regardless of business activity levels, such as rent or salaries, providing predictable monthly costs. Semi-variable expenses fluctuate with production volume or sales but include a fixed base cost, like utility bills or maintenance fees, blending constant and variable components. Understanding these distinctions helps you manage cash flow effectively by anticipating which expenses stay steady and which vary with operational changes.

Common Examples of Fixed Expenses

Common examples of fixed expenses include rent, insurance premiums, loan payments, and salaried wages, which remain constant regardless of business activity levels. These predictable costs help in budgeting and financial planning by providing stable expense benchmarks. Understanding your fixed expenses allows for better cash flow management and more accurate profit forecasting.

Typical Examples of Semi-Variable Expenses

Semi-variable expenses, also known as mixed costs, include typical examples such as utility bills, where a fixed base charge is combined with a variable usage fee, and sales commissions that have a guaranteed minimum payment plus a percentage of sales. These expenses fluctuate with activity levels but maintain a consistent baseline cost, distinguishing them from purely fixed expenses like rent and purely variable expenses such as raw materials costs. Understanding the behavior of semi-variable expenses is crucial for accurate budgeting and cost control in financial management.

Importance in Business Budgeting

Understanding fixed expense, semi-variable expense, and variable expense is crucial for precise business budgeting. Fixed expenses, like rent and salaries, remain constant regardless of production levels, providing budget stability. Semi-variable expenses, such as utilities and maintenance costs, contain both fixed and variable components, requiring careful analysis to forecast accurately and optimize financial planning.

Impact on Cash Flow Management

Fixed expenses, such as rent and salaries, create predictable cash outflows that simplify budgeting but limit flexibility in cash flow management. Semi-variable expenses, combining fixed and variable components like utility bills, require more nuanced monitoring to adjust for fluctuating costs without disrupting cash reserves. Variable expenses, including raw materials and sales commissions, directly impact cash flow volatility, necessitating proactive forecasting to maintain liquidity and operational stability.

Strategies for Managing Fixed and Semi-Variable Expenses

Effective strategies for managing fixed and semi-variable expenses involve closely monitoring your fixed costs, such as rent and salaries, to ensure consistent budget adherence while identifying opportunities to renegotiate contracts or lease terms. For semi-variable expenses like utilities or sales commissions, implement usage tracking and performance-based adjustments to optimize spending without sacrificing operational efficiency. Utilizing detailed financial analysis and forecasting tools will help you balance predictability with flexibility, enabling better cash flow management and informed decision-making.

Fixed vs Semi-Variable Expenses: Pros and Cons

Fixed expenses remain constant regardless of production levels, providing predictability for your budgeting and financial planning. Semi-variable expenses fluctuate with activity but include a fixed component, offering flexibility but complicating cost control and forecasting. Understanding the pros and cons of fixed vs semi-variable expenses helps you optimize cost management and adapt to changing operational demands.

Conclusion: Choosing the Right Expense Strategy

Selecting the appropriate expense strategy depends on a company's cash flow stability and operational flexibility. Fixed expenses offer predictable costs ideal for stable revenue environments, while semi-variable expenses provide adaptability by combining constant and fluctuating elements. Variable expenses suit businesses with highly fluctuating sales, enabling cost alignment with revenue changes to optimize profitability.

Infographic: Fixed Expense vs Semi-Variable Expense

relatioo.com

relatioo.com