Term loans provide businesses with a fixed amount of capital repayable over a set period, ideal for long-term investments. Revolving credit offers flexible borrowing up to a limit, suitable for managing short-term cash flow needs. Learn more about choosing between term loans and revolving credit in this article.

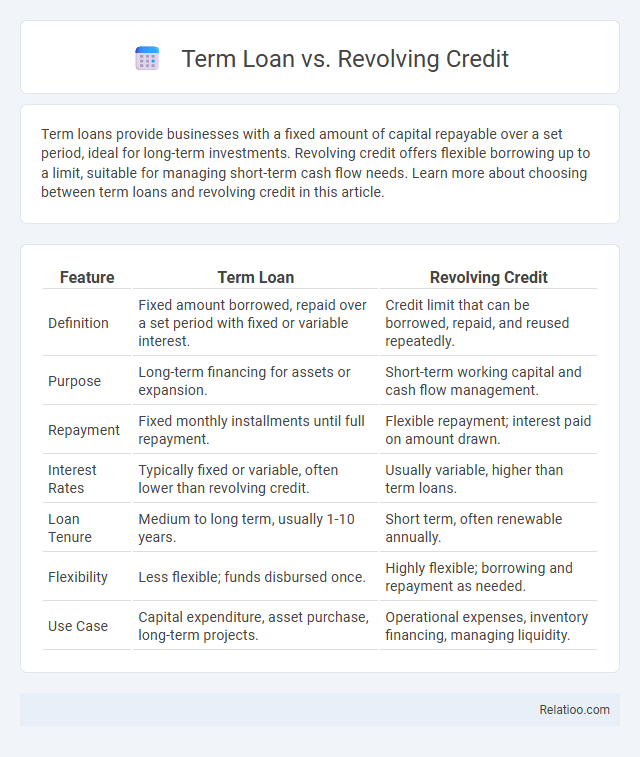

Table of Comparison

| Feature | Term Loan | Revolving Credit |

|---|---|---|

| Definition | Fixed amount borrowed, repaid over a set period with fixed or variable interest. | Credit limit that can be borrowed, repaid, and reused repeatedly. |

| Purpose | Long-term financing for assets or expansion. | Short-term working capital and cash flow management. |

| Repayment | Fixed monthly installments until full repayment. | Flexible repayment; interest paid on amount drawn. |

| Interest Rates | Typically fixed or variable, often lower than revolving credit. | Usually variable, higher than term loans. |

| Loan Tenure | Medium to long term, usually 1-10 years. | Short term, often renewable annually. |

| Flexibility | Less flexible; funds disbursed once. | Highly flexible; borrowing and repayment as needed. |

| Use Case | Capital expenditure, asset purchase, long-term projects. | Operational expenses, inventory financing, managing liquidity. |

Introduction to Business Financing Options

Term loans provide a fixed amount of capital with a predetermined repayment schedule, making them ideal for businesses seeking predictable financing for specific projects. Revolving credit offers a flexible borrowing option that allows you to draw funds up to a set limit, repay, and borrow again as needed, supporting ongoing cash flow management. Understanding these options helps your business choose the most suitable financing strategy aligned with your growth and operational needs.

Understanding Term Loans

Term loans provide a fixed amount of capital with a predetermined repayment schedule, ideal for financing long-term projects or asset purchases. Revolving credit offers flexible borrowing up to a credit limit, allowing repeated drawdowns and repayments without reapplying, making it suitable for managing cash flow fluctuations. Understanding term loans helps Your business plan structured repayments and ensures clear budgeting for specific financial goals.

What is Revolving Credit?

Revolving credit is a flexible financing option allowing you to borrow, repay, and borrow again up to a predetermined credit limit, making it ideal for managing ongoing cash flow needs. Unlike term loans, which provide a lump sum repaid over a fixed period, revolving credit adapts to your fluctuating borrowing requirements without the need to reapply. Your business benefits from increased liquidity and convenience, especially when short-term financing is necessary for operating expenses or inventory purchases.

Key Differences Between Term Loans and Revolving Credit

Term loans provide a lump sum amount repaid over a fixed period with a set interest rate, offering predictable monthly payments ideal for long-term investments. Revolving credit allows you to borrow, repay, and borrow again up to a credit limit, providing flexibility for short-term cash flow management with variable interest rates. Your choice depends on whether you need stability and fixed repayment (term loan) or ongoing access to funds for fluctuating expenses (revolving credit).

Pros and Cons of Term Loans

Term loans provide a fixed amount of capital with a predetermined repayment schedule, offering predictability and stability in financial planning. They often feature lower interest rates compared to revolving credit but lack the flexibility to borrow repeatedly without reapplying. While term loans suit long-term investments due to their structured terms, their rigidity can disadvantage businesses needing adaptable cash flow solutions.

Advantages and Disadvantages of Revolving Credit

Revolving credit offers flexibility by allowing borrowers to access funds repeatedly up to a predetermined credit limit, making it ideal for managing fluctuating cash flow needs. Its advantages include no need to reapply for credit with each draw and interest charged only on the outstanding balance, promoting cost efficiency. However, disadvantages involve higher interest rates compared to term loans, potential for over-borrowing due to easy access, and variable payment amounts that may complicate financial planning.

Suitability: When to Choose a Term Loan

Term loans are suitable for businesses needing a fixed amount of capital for a specific purpose, such as purchasing equipment or expanding operations, with predictable monthly payments over a set period. Revolving credit is ideal for managing short-term cash flow fluctuations, offering flexibility to borrow and repay repeatedly up to a credit limit. Choosing a term loan is beneficial when the funding need is one-time, sizable, and requires long-term financing with fixed interest rates and repayment timelines.

Suitability: When to Opt for Revolving Credit

Revolving credit is ideal for businesses with fluctuating cash flow needs, as it allows flexible borrowing and repayment without reapplying for funds. Term loans suit long-term investments with fixed repayment schedules, providing predictable expenses for capital projects. Opt for revolving credit when managing short-term working capital requirements or seasonal expenses that demand quick access to funds.

Costs and Interest Rate Comparison

Term loans generally have fixed interest rates and predictable monthly payments, making cost management straightforward, while revolving credit offers variable rates and flexible borrowing up to a set limit but can result in higher overall interest costs if balances are not paid promptly. Loans, in a broader sense, vary significantly in terms, with secured loans typically offering lower interest rates compared to unsecured loans due to reduced lender risk. Comparing these financing options, businesses often find term loans more cost-effective for long-term investments, whereas revolving credit is optimal for short-term cash flow needs despite potentially higher interest expenses.

Which Financing Option is Right for Your Business?

Choosing the right financing option depends on your business needs and cash flow patterns. Term loans provide a lump sum with fixed repayments, ideal for long-term investments or capital expenditures, while revolving credit offers flexible access to funds up to a set limit, perfect for managing short-term working capital or unexpected expenses. Understanding your financial goals, repayment capacity, and funding timeline ensures you select between term loans, revolving credit, or a traditional loan that best supports your business growth.

Infographic: Term Loan vs Revolving Credit

relatioo.com

relatioo.com