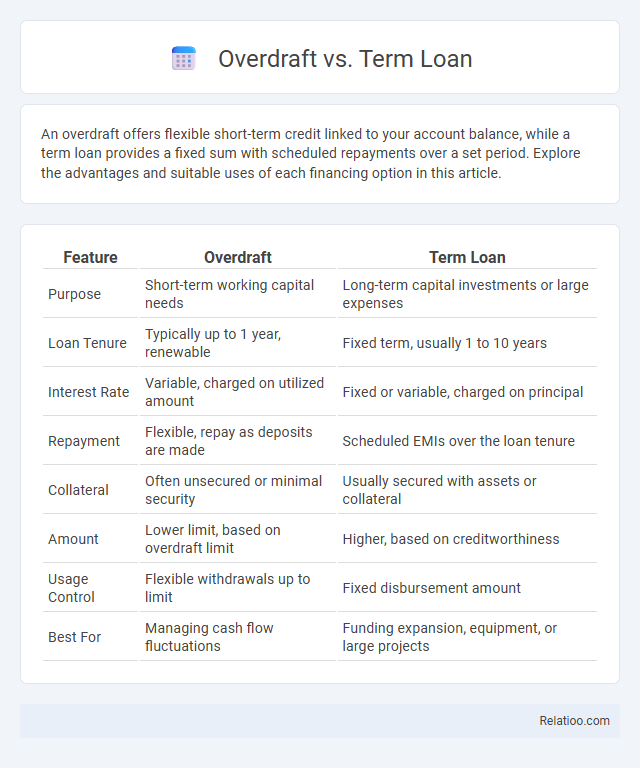

An overdraft offers flexible short-term credit linked to your account balance, while a term loan provides a fixed sum with scheduled repayments over a set period. Explore the advantages and suitable uses of each financing option in this article.

Table of Comparison

| Feature | Overdraft | Term Loan |

|---|---|---|

| Purpose | Short-term working capital needs | Long-term capital investments or large expenses |

| Loan Tenure | Typically up to 1 year, renewable | Fixed term, usually 1 to 10 years |

| Interest Rate | Variable, charged on utilized amount | Fixed or variable, charged on principal |

| Repayment | Flexible, repay as deposits are made | Scheduled EMIs over the loan tenure |

| Collateral | Often unsecured or minimal security | Usually secured with assets or collateral |

| Amount | Lower limit, based on overdraft limit | Higher, based on creditworthiness |

| Usage Control | Flexible withdrawals up to limit | Fixed disbursement amount |

| Best For | Managing cash flow fluctuations | Funding expansion, equipment, or large projects |

Introduction to Overdraft and Term Loan

Overdrafts provide short-term borrowing by allowing Your account to go negative up to an approved limit, useful for managing cash flow fluctuations with flexible repayment terms. Term loans offer a fixed amount disbursed upfront, repaid over a set period with regular installments and interest, ideal for financing specific long-term investments or projects. Understanding the differences helps You choose the right credit facility based on your financial needs and repayment capacity.

Key Differences Between Overdraft and Term Loan

Overdraft allows businesses to withdraw funds beyond their account balance up to a pre-approved limit, offering flexible short-term liquidity; Term Loans provide a fixed sum with a set repayment schedule and fixed or variable interest over a longer period. Overdraft interest is charged only on the withdrawn amount and can fluctuate, while Term Loans require regular principal and interest payments regardless of usage. Unlike Term Loans, Overdrafts do not typically involve collateral, making them ideal for managing working capital, whereas Term Loans suit financing capital expenditures or large investments.

What is an Overdraft?

An overdraft is a credit facility linked to a bank account that allows account holders to withdraw more money than their current balance, up to a predetermined limit, providing short-term liquidity. Unlike term loans, which are lump-sum amounts repaid over fixed installments with a set tenure, overdrafts offer flexible borrowing without a fixed repayment schedule. Overdrafts typically carry variable interest rates on the overdrawn amount and are ideal for managing temporary cash flow gaps.

What is a Term Loan?

A term loan is a fixed amount of money borrowed from a lender, repaid over a set period with a predetermined interest rate, typically used for financing specific investments or purchases. Unlike an overdraft that provides flexible, revolving credit access, a term loan requires structured monthly payments until the loan matures. Your choice between an overdraft and a term loan depends on your need for either cash flow flexibility or long-term financing stability.

Advantages of Overdraft Facility

An overdraft facility offers flexible borrowing by allowing You to withdraw funds beyond Your current account balance up to a specified limit without the need for formal loan approval processes. Unlike term loans, overdrafts provide immediate access to funds and interest is charged only on the utilized amount, enhancing cash flow management for short-term needs. Overdrafts also reduce the risk of cash shortfalls and offer unmatched convenience for businesses and individuals seeking quick, on-demand credit.

Benefits of Term Loans

Term loans offer predictable repayment schedules with fixed interest rates, helping you manage cash flow and plan long-term investments effectively. Unlike overdrafts that provide flexible but potentially costly short-term credit, term loans typically come with lower interest rates, making them more cost-efficient over time. Your business can leverage term loans to finance significant assets or expansion projects, ensuring stable funding without the risk of fluctuating interest expenses.

Eligibility Criteria for Overdraft vs Term Loan

Overdraft eligibility typically requires your current account to be active, a stable income source, and a good credit score, making it suitable for short-term working capital needs. Term loan eligibility demands a detailed assessment of your business financials, credit history, collateral, and repayment capacity, reflecting its longer-term repayment structure. Understanding these criteria helps you choose the right financing option aligned with your business requirements and creditworthiness.

Interest Rates Comparison: Overdraft vs Term Loan

Overdrafts typically feature variable interest rates that are higher than term loans, reflecting their flexible, short-term usage for managing cash flow gaps. Term loans usually have lower, fixed interest rates suited for long-term financing needs, providing predictable repayment schedules. Understanding the interest rate differences helps you choose the best option for your financing requirements.

Which Option is Best for Your Business?

Overdrafts provide flexible short-term working capital by allowing businesses to withdraw beyond their account balance, while term loans offer structured, fixed repayment schedules for long-term investments or large purchases. Overdrafts suit businesses needing quick access to cash flow without fixed installments, whereas term loans support planned expansions with predictable payments and potentially lower interest rates. Selecting the best option depends on your business's cash flow patterns, repayment capacity, and funding purpose, with overdrafts ideal for fluctuating expenses and term loans preferable for stable growth investments.

Conclusion: Choosing Between Overdraft and Term Loan

When deciding between an overdraft and a term loan, your choice depends on your business's cash flow needs and repayment capacity. An overdraft offers flexible, short-term access to funds with variable interest, ideal for managing day-to-day expenses, while a term loan provides a fixed amount with structured repayment over a set period, suited for larger, long-term investments. Understanding your financial situation ensures you select the option that best supports your liquidity and growth goals.

Infographic: Overdraft vs Term Loan

relatioo.com

relatioo.com