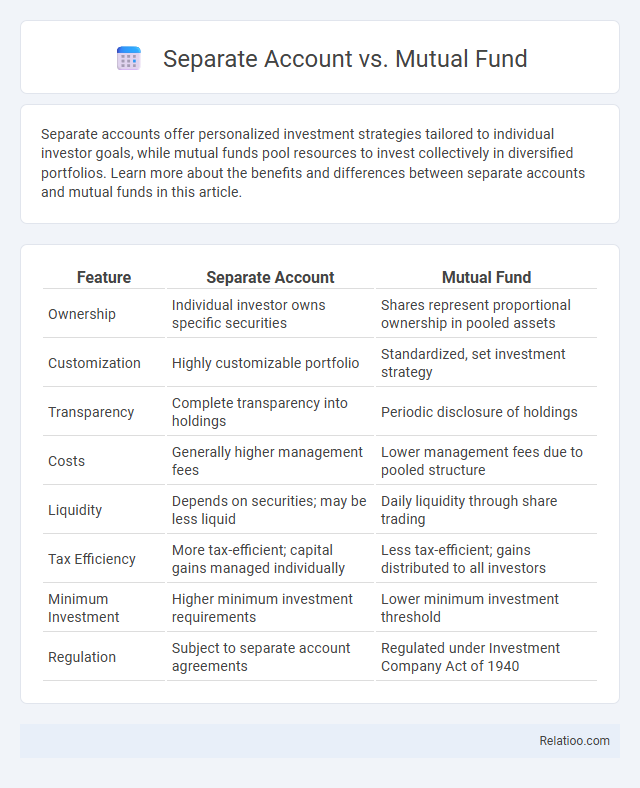

Separate accounts offer personalized investment strategies tailored to individual investor goals, while mutual funds pool resources to invest collectively in diversified portfolios. Learn more about the benefits and differences between separate accounts and mutual funds in this article.

Table of Comparison

| Feature | Separate Account | Mutual Fund |

|---|---|---|

| Ownership | Individual investor owns specific securities | Shares represent proportional ownership in pooled assets |

| Customization | Highly customizable portfolio | Standardized, set investment strategy |

| Transparency | Complete transparency into holdings | Periodic disclosure of holdings |

| Costs | Generally higher management fees | Lower management fees due to pooled structure |

| Liquidity | Depends on securities; may be less liquid | Daily liquidity through share trading |

| Tax Efficiency | More tax-efficient; capital gains managed individually | Less tax-efficient; gains distributed to all investors |

| Minimum Investment | Higher minimum investment requirements | Lower minimum investment threshold |

| Regulation | Subject to separate account agreements | Regulated under Investment Company Act of 1940 |

Understanding Separate Accounts and Mutual Funds

Separate accounts offer personalized investment portfolios managed on behalf of a single investor, providing tailored asset allocation and enhanced control compared to mutual funds, which pool assets from multiple investors into a diversified portfolio managed by professional fund managers. Mutual funds provide liquidity, diversification, and lower minimum investment thresholds, making them accessible to individual investors, whereas separate accounts cater to high-net-worth clients seeking customization and transparency in holdings. Understanding these differences is essential for investors aiming to balance personalized management with the benefits of pooled resources and cost efficiency.

Key Differences Between Separate Accounts and Mutual Funds

Separate accounts offer individualized investment portfolios tailored to Your specific financial goals, whereas mutual funds pool money from multiple investors to create a single diversified fund. Unlike mutual funds, separate accounts provide greater transparency and control over asset selection, allowing for customized risk management. Separate accounts often have higher minimum investment requirements and personalized fee structures compared to the standardized fees in mutual funds.

Structure and Management of Separate Accounts

Separate accounts are individually managed investment portfolios owned by a single investor, offering customization and direct ownership of securities compared to mutual funds, which pool assets from multiple investors for collective management. Unlike mutual funds that are managed by fund managers following a predefined strategy, separate accounts provide personalized investment strategies tailored to the investor's specific goals and risk tolerance. The structure of separate accounts allows for greater transparency and control, with direct ownership that can lead to tax advantages and the ability to exclude unwanted securities from the portfolio.

Portfolio Diversification: Separate Account vs Mutual Fund

Separate accounts offer personalized portfolio diversification tailored to your specific investment goals and risk tolerance, providing direct ownership of individual securities. Mutual funds pool resources from multiple investors to create a diversified portfolio managed by professional fund managers, but you share the fund's overall performance rather than specific assets. Your choice between a separate account and mutual fund depends on the level of customization and control you desire in achieving diversified investment exposure.

Cost and Fee Comparison

Separate accounts typically involve higher minimum investments but offer personalized portfolio management with fees ranging from 0.50% to 1.50%, while mutual funds generally have lower entry points with expense ratios averaging 0.50% to 1.00%. Separate accounts often provide tax advantages and greater transparency, but their advisory fees and administrative costs can exceed those of mutual funds. You should evaluate both cost structures carefully, considering management fees, load charges, and potential tax benefits to determine which investment vehicle aligns best with your financial goals.

Customization Options for Investors

Separate accounts offer personalized investment strategies tailored to individual investor goals, allowing greater customization compared to mutual funds, which pool assets into standardized portfolios. Unlike mutual funds, separate accounts provide direct ownership of securities, granting investors flexibility to select specific asset classes, sectors, or risk levels aligned with their preferences. In contrast, mutual funds prioritize broad diversification and professional management but limit customization due to their collective structure and regulatory constraints.

Performance and Transparency

Separate accounts typically offer higher performance potential through customized investment strategies tailored to individual goals, unlike mutual funds that pool assets and follow a standardized approach which can dilute returns. Transparency in separate accounts is superior as investors receive detailed reports on holdings, transactions, and fees, whereas mutual funds provide aggregated data with less frequent updates. Separate accounts also reduce the risk of hidden fees and enhance control over asset allocation, making them attractive for investors seeking clarity and performance optimization.

Suitability Based on Investor Profiles

Separate accounts offer personalized investment management tailored to your specific risk tolerance, financial goals, and tax considerations, making them suitable for high-net-worth investors seeking customization. Mutual funds provide diversified portfolios managed by professionals, ideal for investors preferring liquidity and lower minimum investments with moderate risk tolerance. Choosing the right option depends on your individual investor profile, with separate accounts favoring customization and control, while mutual funds offer accessibility and simplicity.

Tax Implications and Efficiency

Separate accounts offer personalized investment management with potential tax advantages by allowing You to control specific asset transactions, potentially minimizing capital gains taxes compared to mutual funds. Mutual funds provide diversification and professional management but may distribute taxable capital gains annually, reducing tax efficiency. Separate accounts generally deliver greater tax efficiency by enabling tailored strategies that align with Your individual tax situation and investment goals.

Choosing the Right Investment Vehicle

Selecting the right investment vehicle depends on your risk tolerance, liquidity needs, and investment goals. Separate accounts offer personalized portfolio management and transparency, ideal for investors seeking customization, while mutual funds provide diversification and professional management with lower minimum investments. Understanding the distinct features of each can help you align your portfolio with your financial objectives and achieve optimal returns.

Infographic: Separate Account vs Mutual Fund

relatioo.com

relatioo.com