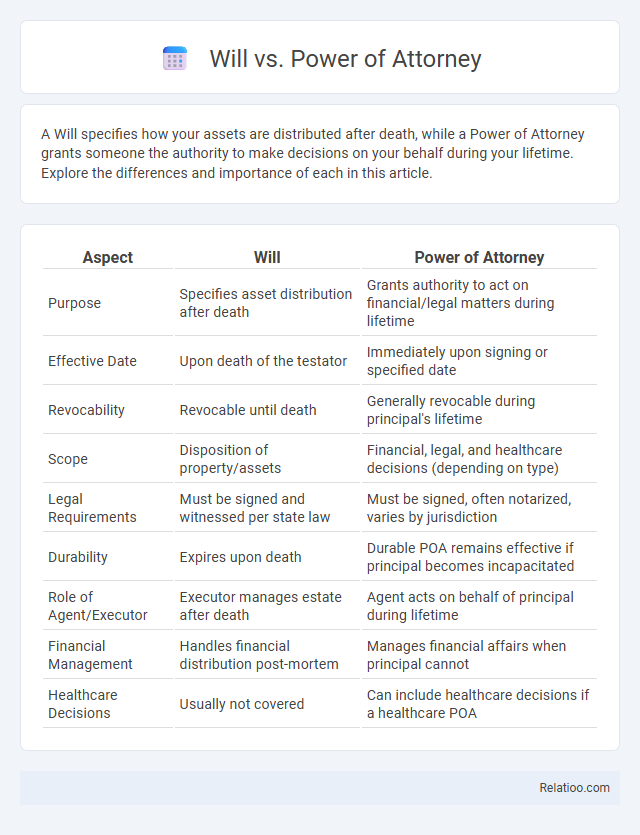

A Will specifies how your assets are distributed after death, while a Power of Attorney grants someone the authority to make decisions on your behalf during your lifetime. Explore the differences and importance of each in this article.

Table of Comparison

| Aspect | Will | Power of Attorney |

|---|---|---|

| Purpose | Specifies asset distribution after death | Grants authority to act on financial/legal matters during lifetime |

| Effective Date | Upon death of the testator | Immediately upon signing or specified date |

| Revocability | Revocable until death | Generally revocable during principal's lifetime |

| Scope | Disposition of property/assets | Financial, legal, and healthcare decisions (depending on type) |

| Legal Requirements | Must be signed and witnessed per state law | Must be signed, often notarized, varies by jurisdiction |

| Durability | Expires upon death | Durable POA remains effective if principal becomes incapacitated |

| Role of Agent/Executor | Executor manages estate after death | Agent acts on behalf of principal during lifetime |

| Financial Management | Handles financial distribution post-mortem | Manages financial affairs when principal cannot |

| Healthcare Decisions | Usually not covered | Can include healthcare decisions if a healthcare POA |

Understanding Wills: Definition and Purpose

A Will is a legal document that outlines how a person's assets and affairs should be handled after their death, ensuring their wishes are honored. Unlike a Power of Attorney, which grants authority to act on someone's behalf during their lifetime, a Will only takes effect after death. Understanding the purpose of a Will is essential for effective estate planning, as it clearly designates beneficiaries and can reduce legal conflicts.

What Is a Power of Attorney?

A Power of Attorney (POA) is a legal document that grants someone else the authority to make decisions and act on your behalf in financial, legal, or medical matters. Unlike a Will, which takes effect after your death to distribute assets and appoint executors, a POA is effective during your lifetime and can be tailored to specific powers and durations. Understanding the distinction between a Will and Power of Attorney is crucial for safeguarding your interests and ensuring your wishes are honored while you are alive.

Key Differences Between a Will and Power of Attorney

A Will outlines how your assets and estate will be distributed after your death, while a Power of Attorney grants someone the authority to make decisions on your behalf during your lifetime. The key difference lies in timing: a Will takes effect only after you pass away, whereas a Power of Attorney is active while you are alive but unable to manage your affairs. Your Will addresses estate distribution post-mortem; a Power of Attorney is about managing finances, healthcare, or legal matters while you are incapacitated.

Legal Requirements for Creating a Will

Creating a legally valid will requires meeting specific criteria such as being of sound mind, at least 18 years old, and voluntarily expressing clear intentions regarding asset distribution. The will must be written, signed by the testator, and witnessed by at least two impartial witnesses according to most jurisdictional laws. While a Power of Attorney grants authority to act on one's behalf during their lifetime, it does not substitute the legal formalities and requirements essential for a valid will.

How to Set Up a Power of Attorney

Setting up a Power of Attorney requires selecting a trusted agent who will have the legal authority to make decisions on your behalf in financial, medical, or legal matters if you become incapacitated. You must complete and sign a specific Power of Attorney form, which varies by state, often requiring notarization and witnesses to be valid. Your careful choice and clear instructions in the document ensure your agent acts according to your wishes when exercising the powers granted.

Roles and Responsibilities of Executors vs. Attorneys-in-Fact

Executors manage your estate by ensuring your will is executed according to legal requirements, handling debts, and distributing assets to beneficiaries after your death. Attorneys-in-fact hold the authority granted through a power of attorney to make financial or medical decisions on your behalf while you are alive but incapacitated or unavailable. Understanding the distinct responsibilities of these roles safeguards your interests during life and after death, ensuring seamless management of your affairs.

When Does a Will Take Effect?

A Will takes effect only after your death, ensuring your estate is distributed according to your wishes, while a Power of Attorney grants someone authority to act on your behalf during your lifetime. Your Power of Attorney ceases upon your incapacitation or death, whereas a Will activates once the probate process begins. Understanding these distinctions helps you plan both immediate decisions and your estate's future.

The Scope and Limitations of Power of Attorney

The scope of a Power of Attorney (POA) is limited to the specific powers granted by the principal, such as managing financial affairs or making healthcare decisions on your behalf, but it does not override or replace the directives established in your Will. A POA ceases to be effective upon your death, while a Will manages the distribution of assets and the settlement of your estate after death. Understanding the limitations and proper use of a POA ensures your designated agent acts within your intended authority without superseding your testamentary wishes.

Choosing Between a Will and Power of Attorney

Choosing between a will and a power of attorney depends on your specific needs for managing your estate and financial affairs. A will outlines how your assets are distributed after your death, while a power of attorney grants someone authority to make decisions on your behalf during your lifetime. Your choice should consider whether you want to control posthumous asset distribution or appoint a trusted person to handle your financial and medical decisions if you become incapacitated.

Common Mistakes to Avoid with Wills and Power of Attorney

Common mistakes to avoid with wills and power of attorney include failing to update documents regularly, which can lead to outdated instructions that don't reflect your current wishes. You should ensure both documents are clearly drafted and legally valid to prevent misunderstandings or challenges during enforcement. Neglecting to appoint alternate agents in your power of attorney can result in delays or complications if the primary agent becomes unavailable.

Infographic: Will vs Power of Attorney

relatioo.com

relatioo.com