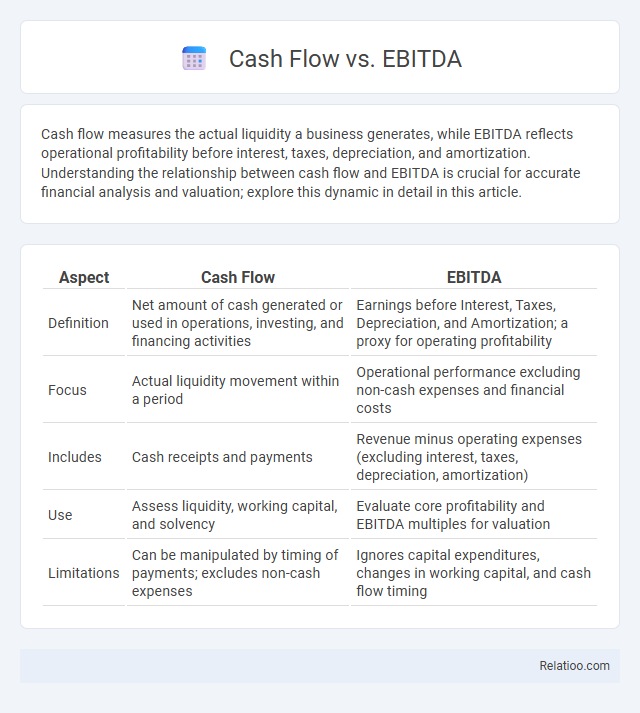

Cash flow measures the actual liquidity a business generates, while EBITDA reflects operational profitability before interest, taxes, depreciation, and amortization. Understanding the relationship between cash flow and EBITDA is crucial for accurate financial analysis and valuation; explore this dynamic in detail in this article.

Table of Comparison

| Aspect | Cash Flow | EBITDA |

|---|---|---|

| Definition | Net amount of cash generated or used in operations, investing, and financing activities | Earnings before Interest, Taxes, Depreciation, and Amortization; a proxy for operating profitability |

| Focus | Actual liquidity movement within a period | Operational performance excluding non-cash expenses and financial costs |

| Includes | Cash receipts and payments | Revenue minus operating expenses (excluding interest, taxes, depreciation, amortization) |

| Use | Assess liquidity, working capital, and solvency | Evaluate core profitability and EBITDA multiples for valuation |

| Limitations | Can be manipulated by timing of payments; excludes non-cash expenses | Ignores capital expenditures, changes in working capital, and cash flow timing |

Introduction: Understanding Cash Flow and EBITDA

Understanding your company's cash flow and EBITDA is essential for assessing financial health, as cash flow measures the actual liquidity available to fund operations, while EBITDA reflects earnings before interest, taxes, depreciation, and amortization, indicating operational profitability. Cash flow provides insight into the real-time cash generated or used, helping you manage expenses and investments effectively. EBITDA offers a clearer picture of core business performance by excluding non-cash expenses and financing effects, making it useful for comparing companies within the same industry.

Defining Cash Flow: What It Really Means

Cash flow represents the actual net amount of cash moving into and out of a business, reflecting liquidity and operational efficiency. Unlike EBITDA, which measures earnings before interest, taxes, depreciation, and amortization as an indicator of profitability, cash flow captures the tangible cash generated or consumed during a period. Understanding cash flow is crucial for assessing a company's ability to meet short-term obligations, invest in growth, and sustain daily operations.

EBITDA Explained: Key Concepts and Components

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, provides a clear picture of a company's operational profitability by excluding non-operational expenses and non-cash charges. Unlike cash flow, which measures the actual inflow and outflow of cash, EBITDA focuses on earnings generated from core business activities before accounting for financial and accounting decisions. Understanding EBITDA helps You evaluate a company's true operational efficiency and compare profitability across firms without the distortions from differing capital structures or tax environments.

Cash Flow vs EBITDA: Core Differences

Cash Flow represents the actual amount of cash generated and used by your business during a specific period, reflecting operational liquidity and cash availability. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures operational profitability by excluding non-cash expenses and financing costs, providing insight into your company's earnings potential without cash flow impact. Understanding the core differences between Cash Flow and EBITDA helps you assess both profitability and liquidity, ensuring a comprehensive financial analysis for better decision-making.

Importance of Cash Flow in Business Management

Cash flow represents the actual liquidity available to a business, enabling it to meet operational expenses, invest in growth, and service debt, making it a critical indicator of financial health compared to EBITDA, which excludes cash changes and non-cash expenses. Unlike EBITDA, cash flow provides a clear picture of real-time financial stability, highlighting the company's ability to sustain day-to-day operations and navigate short-term obligations. Effective business management relies heavily on positive cash flow to ensure solvency, maintain supplier and employee relationships, and fuel strategic decision-making.

Why EBITDA Matters for Financial Analysis

EBITDA matters for financial analysis because it provides a clear view of your company's operational profitability by excluding non-operational expenses like taxes, interest, depreciation, and amortization. Unlike cash flow, which reflects actual cash movement including financing and investment activities, EBITDA focuses strictly on core business performance, enabling better comparison across companies and industries. Your ability to assess EBITDA helps in evaluating operational efficiency and making informed investment or financing decisions.

Limitations of Using EBITDA as a Performance Metric

EBITDA often overlooks critical cash flow elements such as capital expenditures, debt repayments, and changes in working capital, leading to an incomplete picture of Your company's financial health. Unlike cash flow, EBITDA does not account for actual cash movements, which can mask liquidity issues and mislead stakeholders about operational performance. Relying solely on EBITDA may result in underestimating financial risks and overstating profitability.

Practical Examples: Calculating Cash Flow and EBITDA

EBITDA measures a company's operating performance by excluding interest, taxes, depreciation, and amortization, providing insight into profitability, while cash flow reveals actual cash generated or used during a period, indicating liquidity. For example, if your business reports $500,000 in net income, adds back $100,000 in depreciation and $50,000 in amortization, and ignores interest and taxes, EBITDA totals $650,000. Calculating cash flow involves adjusting net income for changes in working capital and non-cash expenses, such as subtracting a $30,000 increase in accounts receivable or adding $20,000 in depreciation, to show your real cash position.

Cash Flow or EBITDA: Which Metric Should You Use?

Cash flow and EBITDA offer different insights into a company's financial health, with cash flow representing actual liquidity and EBITDA highlighting operational profitability by excluding interest, taxes, depreciation, and amortization. Investors prioritize cash flow to assess a firm's ability to meet immediate obligations and fund growth, while EBITDA is favored for comparing operating performance across companies by filtering out non-operational expenses. Choosing between cash flow and EBITDA depends on the analysis goal: cash flow for assessing financial stability and cash generation, EBITDA for evaluating operational efficiency and profitability.

Conclusion: Choosing the Right Financial Metric for Decision-Making

Choosing the right financial metric depends on the specific decision context: cash flow provides a clear picture of actual liquidity, EBITDA highlights operational profitability excluding non-cash expenses, and net cash flow captures overall cash movement including financing and investing activities. For investment analysis, EBITDA can gauge core business performance, while cash flow metrics are crucial for assessing a company's ability to meet short-term obligations and sustain operations. Decision-makers should align metric selection with their financial objectives, ensuring a comprehensive evaluation of profitability, liquidity, and cash management.

Infographic: Cash Flow vs EBITDA

relatioo.com

relatioo.com